Chinese Ski Slopes Marketing Aggressively And Investing Heavily; But Is The Domestic Interest High Enough?#

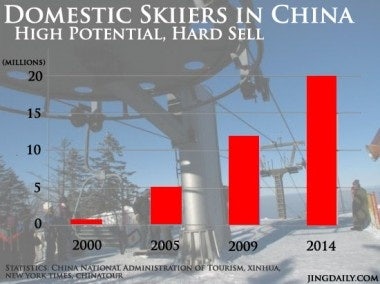

In recent years, the nascent ski industry in China has had well-publicized difficulties convincing foreign and native skiers to take to the slopes. According to recent data, however, resort operators have reason to be cautiously optimistic. (Emphasis on the word cautiously.) Between 2000 and 2005, the China Ski Association says, the number of skiers in China rose from only 200,000 per year to more than 5 million, and the association predicts that number will rise to around 20 million skiers within the next 4-5 years. That may sound like a lot of people, but as a portion of China's growing domestic tourist market, this (admittedly lofty) number equates to around the number of Chinese tourists who traveled to Sichuan province alone last year.

Recently, a CNN article looked into the difficulties faced by China's ski industry, a high-potential but struggling segment of the country's booming tourism market, and noted the particular cultural, geographical and financial obstacles that resorts even at the highest-end are coming up against. From the article:

"[Although the number of skiers in China is rising,] 80 percent will probably never do it again, because the experience is so bad," says Graham Kwan, CEO of Melco China Resorts the developers of Sun Mountain, Yabuli.

It's a factor that has held back the momentum of the Chinese ski industry, where the image is still one of bumpy nursery slopes crowded with first-time skiers snow-ploughing into one another.

"The industry isn't developing as fast as it should," says Justin Downes, president of Axis Leisure, a Beijing-based resort industry consultancy.

"Ninety percent of skiers are still considered beginners and rent their equipment. The quality of the product and safety has often been questionable, service has been poor."

Heilongjiang province's Yabuli Sun Mountain -- which is aiming to be China's own Whistler, Aspen or Chamonix -- announced in 2008 that it would invest around $100 million to upgrade its facilities to international standards. The following year, the resort received another $400 million from the Chinese government to further update facilities and improve transport links to nearby cities.

Also in 2009, Yabuli was chosen as the base for China's national ski team, and was named Asia's "Best Resort Make-Over" by TIME magazine. However, as a recent article in Britain's Telegraph pointed out, despite all the money that has poured into Yabuli over the past two years, one important thing is lagging behind the upgraded "hardware" -- the level of service seasoned skiers expect from a high-end, "international" ski resort. From that article:

Although you couldn’t compare the skiing with what’s on offer in the French Alps or the US, there was definitely enough to keep a decent skier occupied for a weekend, as well as some good child-centred activities including an Alpine slide and a purpose-built run for ‘tubing’ which, as the names suggests, involves sitting in a rubber tube rather than on a sledge. Kids too young to ski love it.

The let-down comes not with the spanking $150m facilities, but with the way they are managed. The old adage that the “customer is king” hasn’t quite penetrated Chinese service industries, even at the higher end like Yabuli, which is billed as an “international standard” resort.

I’m talking about superficially small things, but ones that are guaranteed to irritate customers paying top-dollar prices for a weekend away.

If these kinds of experiences are indeed common, and poor service and perks -- rather than the slopes, ski lifts or equipment -- is what is keeping people away or discouraging them from coming back, we would assume those in the Chinese ski industry are in the right to be cautiously optimistic. While building the "hardware" of a world-class ski resort is deceptively easy, at least in today's China-on-steroids, developing the service side, the "software" as it is called in the Telegraph article, is obviously much harder.

This is a problem faced by the Chinese tourism industry as a whole, and one whose kinks will likely take several years to work out. In terms of skiing, changing attitudes about what tourism means among China's middle class will require something of a cultural shift, and mean that resorts like Yabuli will need to heavily tailor their services to meet Chinese demands. As the CNN article concludes, however, much of the future success of China's high-end ski slopes will rest on the popularity of skiing among the younger generation:

A few gold medals by Chinese skiers at the Winter Olympics could help create a buzz around the sport itself, but for Kwan and Downes, presenting a gold-standard lifestyle is just as important.

"All their gear is high-end, because of course it represents their status. And that's why we've chosen to go higher end, because those kinds of customers want to be with us," says Kwan, who plans to add VIP gondolas with heated seats and sound system at Sun Mountain, as well as slope-side tea service.

"You can't just pick up a Whistler or Three Valleys pop it into China and expect it to be successful," adds Downes. "Because while Chinese skiers want all the positive trapping they also want something that is theirs -- food and cultural elements, but delivered at a much higher level.

"The younger generation is getting money, traveling and getting more adventurous, they're the ones who are going to define the industry."