It is no secret that the popularity of overseas travel is on the rise in China. All of the indicators, such as the growing number of passports and travel visas issued for Chinese tourists, have been in the green for some time. With increasing demand for experiences, wealthy Chinese and the growing middle class are spending more and more on international trips.

Fully aware of this trend, the travel and retail industries have been developing a whole range of strategies tapping into this growing interest. From honeymoon tours to graduation holidays, from intensive sightseeing programs to personalized shopping trips, most of the destinations are now competing in order to influence both the travel and the purchase intentions of their target audience.

The Chinese National Day holiday period that started on October 1 and runs until October 7, also known as Golden Week, represents the most important milestone after Chinese New Year in terms of number of Chinese travelers. With this in mind, Digital Luxury Group partnered with simplyBrand to analyze the online buzz on Sina Weibo, WeChat, and leading travel sites such as Ctrip, Qunar, and Tuniu to uncover what Chinese travelers are discussing. Based on an analysis of over 83,721 spontaneous messages posted online, we found some noteworthy insights:

South Korea and Japan In; Hong Kong Out#

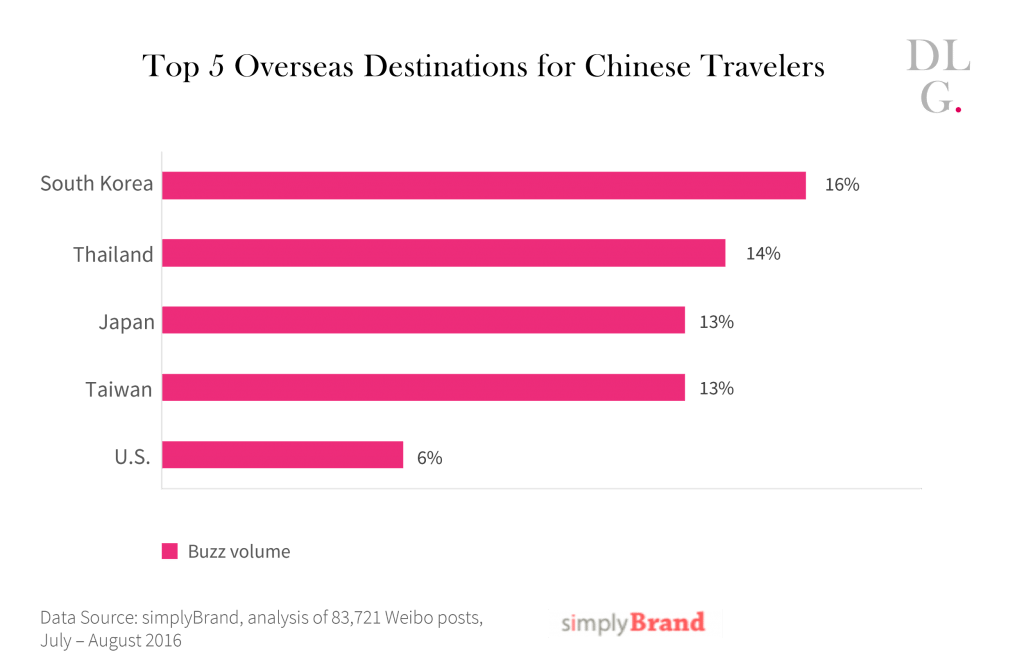

The trend that has been observed for some time is also confirmed by social media comments. Hong Kong didn’t even make it in the top five list of the most-discussed destinations:

South Korea and Japan are the big winners for short trips and remain favored destinations. It clearly appears that popular destinations are now winning over Hong Kong because they can offer more than just attractive retail prices. Japan with its rich history and culture, South Korea a go-to trendsetter for China when it comes to entertainment, beauty, and more, Thailand with its stunning beaches and temples, and Taiwan with its nature and notable street food are all close destinations that have a lot to offer. Hong Kong’s reputation as a travel destination has become more associated with “outlet shopping” for Chinese consumers, a concern for Hong Kong’s tourist board if it wishes to keep affluent Chinese travelers in search of luxury coming back.

Luxury Shopping Remains at the Center of Travel Activities#

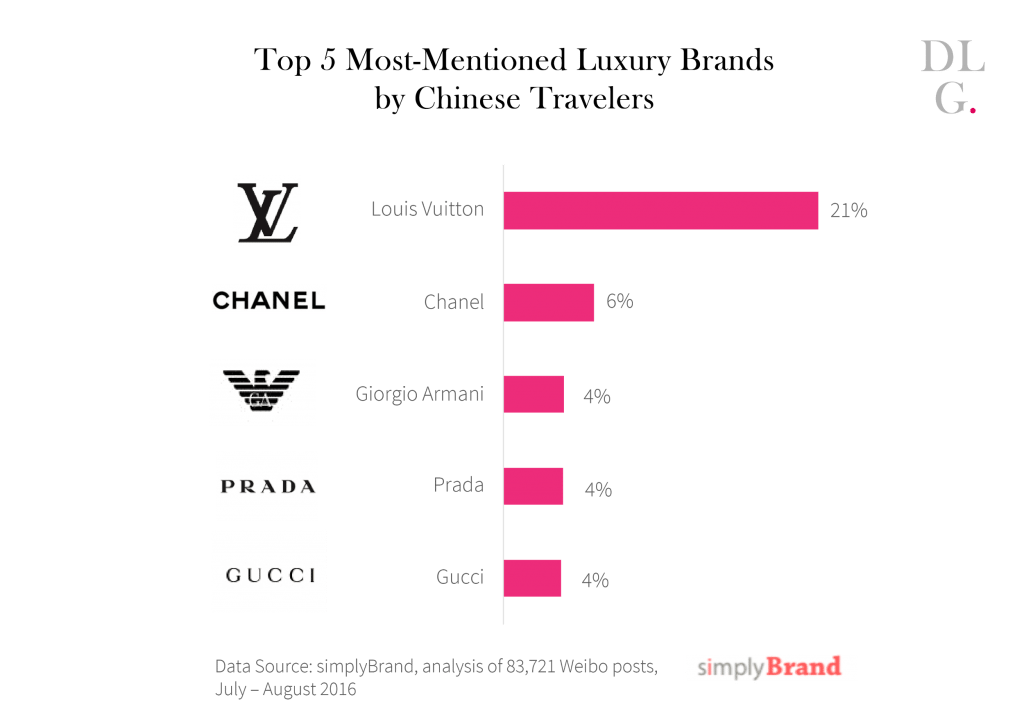

While the demand for experiential travel is growing, shopping remains a key draw, as evidenced by the monitoring of various travel discussions. In fact, 8 percent of the total buzz analyzed directly mentioned specific luxury brands. The most-discussed brands are the grand “maisons” with Louis Vuitton (21 percent) coming first, followed by Chanel (6 percent), Giorgio Armani, Prada, and Gucci.

Analyzing in more detail the activity of these brands within that period of time, it appears that the winners were highly active during the summer months, even if that period is often considered as a “slow period” for retailers.

As an example, Louis Vuitton collaborated with a few highly popular celebrities (like Fan Bingbing and Jing Boran) to promote the LV travel suitcase, which in turn generated an enormous amount of social buzz.

First-Tier Cities Key, But the Market Becomes More Fragmented#

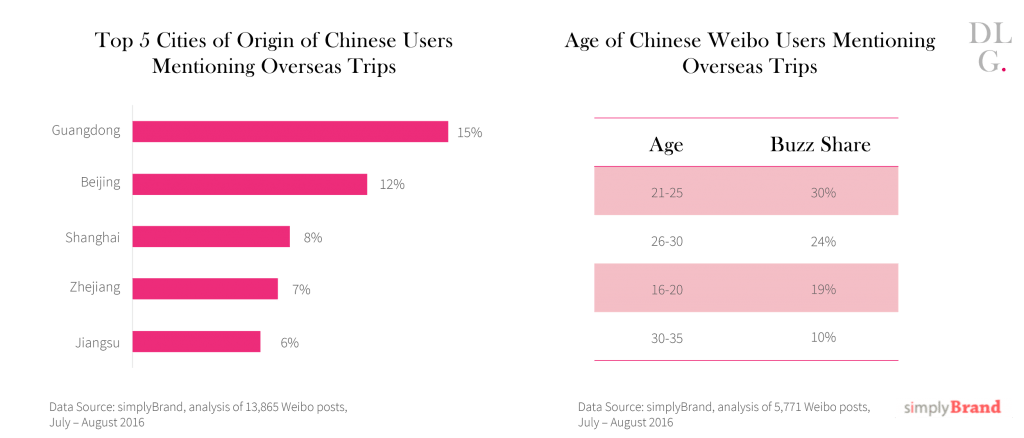

Fifteen percent of the audience mentioning overseas trips were from Guangdong, which topped the city ranking, followed by Beijing, Shanghai, Zhejiang, and Jiangsu. Additionally, more than half of the online users sharing online about their summer trips were between 21 and 30 years old. While it is not a surprise to see that active social media users are young, it also shows that overseas trips are not limited to a mature audience and that the spending power is already there.

Provinces like Zhejiang and Jiangsu represent a share close to their neighbor Shanghai, which clearly illustrates the fact that provinces that have long been considered secondary are now playing a more important role.

Soft Luxury Over Hard Luxury#

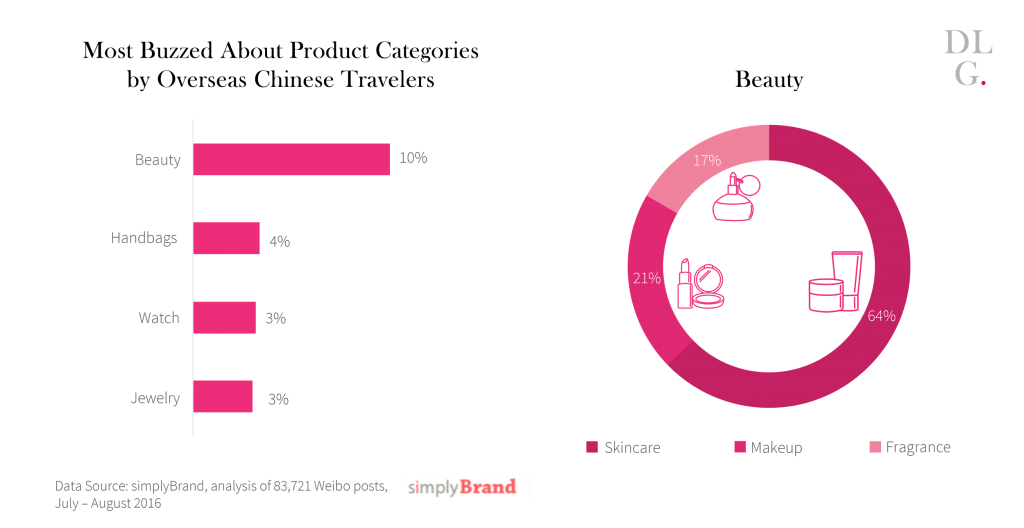

Beauty products were mentioned most, followed by handbags, watches, and then jewelry. Within the beauty category, 17 percent of discussions were about perfume, a segment that in the past did not particularly resonate in the Chinese market, illustrating clearly the growing “internationalization” of Chinese consumers but also the positive correlation with beauty brands communication.

Indicators are confirming the growing similarities between the habits of Chinese travelers and those of their European and U.S. peers, and this can be observed beyond the first-tier cities. Travelers are now considering more destinations than in the past and their expectations have changed.

In a context where a brand’s marketing calendars are focused on supporting local retail, it clearly shows that the top places will be taken by the ones that are not afraid to invest in China to support their travel retail performance.