On June 18, JD.com celebrated a milestone of 17 years in business with its Grand Promotion sales event. According to the e-commerce giant, the occasion represents a “pulse check on consumption in China” over the first six months of 2020. Since the first half of the year was defined by unexpected turbulence, investors and retailers are turning to JD.com to help them understand the direction of the market for these upcoming months. Considering the significance of the date, JD.com organized a media event on June 12, where the company’s top executives discussed future market trends and current outcomes post-COVID-19.

JD’s consumer knowledge reinforced the belief that shoppers now have different needs within their distinct consumption phases. For instance, a report by JD Big Data (a market research body of JD.com), shows that during the lockdown in January of this year, sales of fresh food increased by 215 percent, vegetables by 450 percent, and pork/beef/poultry/eggs by 400 percent year-over-year.

During February, consumers turned toward baking supplies, investing in baking tools (up 332 percent year-over-year), food containers (332 percent year-over-year), and chopping blocks (139 percent year-over-year). And during China’s work-from-home phase, sales of audio/video-related equipment increased nearly 20 times over the same period during 2019.

But the month of March brought new changes in consumption patterns because of the nationwide resumption of work (the demand for office supplies increased by 57 percent, month-on-month, for instance.)

With a national holiday and the cancelation of the country’s strictest travel-controls, May started on a positive note, offering ideal conditions for retail spending. These favorable conditions supported a domestic consumption boom, and online consumption increased by 45 percent year-over-year. Some sectors registered stellar records for this period. For example, sales of outdoor items grew by 210 percent, home devices by 140 percent, and appliances by 100 percent month-over-month.

Meanwhile, it’s worth noting that the “consumption upgrade” trend that emerged a couple of years ago is still going strong. But the COVID-19 pandemic has forced shoppers to transition more quickly to online buying, and e-commerce has further improved its dominant position. Now, China’s “return to work” phase has propelled this sustained consumption recovery. But can Western businesses take advantage of these changes — and how?

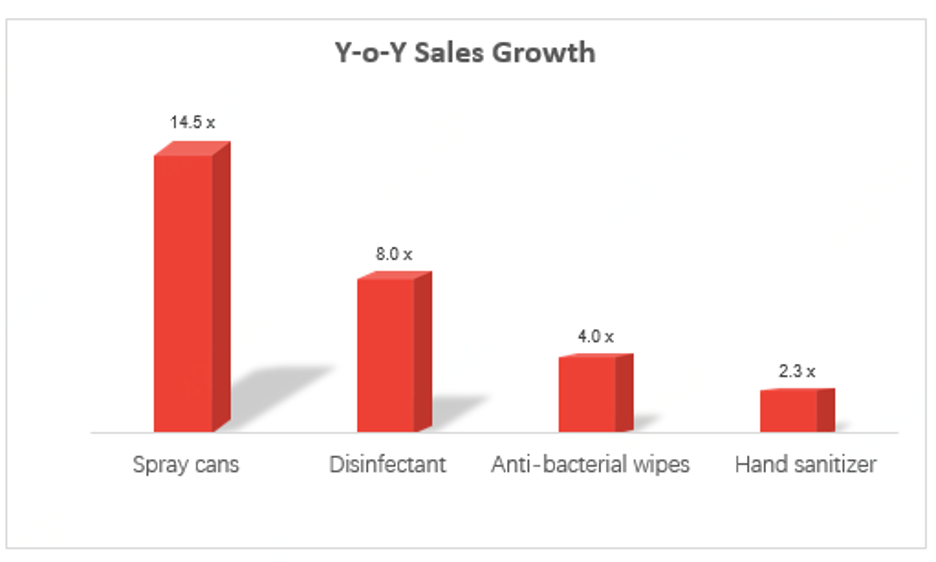

Western brands that want to extend their footprints in China need to pay attention to these trends and develop products and services that the market is demanding. For example, JD.com's Yuchuan Wang highlighted how sales of disinfection and sterilization products surged during China’s “return to work” phase. Sales of hand sanitizers and disinfectants grew by 112 percent year-over-year and 254 percent month-over-month. And because of the COVID-19 epidemic, hand sanitizer sales increased 2.3 times, and disinfectant sales increased over 8 times year-over-year.

Some brands will understand the shopper’s fear of contamination, so they’ll propose unique solutions to safeguard the wellbeing of the consumer. In the US, fashion brands manufactured face masks from cloth textiles for healthcare workers. In the European Union, LVMH and Bulgari produced hand sanitizer, and Kering announced a donation of 1 million to the Centers for Disease Control and Prevention (CDC) Foundation to support healthcare workers in America.

Many other industry players have also engaged in COVID-19 relief campaigns. These initiatives humanize the brand image and boost positive customer engagement, but they can also turn into a lucrative business model that offers a surprising revenue stream. “The economic benefit this has brought to brands has helped weather the very uncertain storm that has been this pandemic, providing some with uninterrupted cash flow,” said Forbes contributor Rebecca Suhrawardi.

The pandemic fears have also helped industry leaders that boast products and services with minimal human-to-human contact. For instance, JD.com reported that sales of electric bikes increased by 638 percent year-on-year, and sales of adult hoverboard scooters increased 147 percent in that same period.

The acceleration of online education is another byproduct of this pandemic. Students were isolated at home for months since most educational institutions closed their doors. The transition to online wasn’t a smooth process, but China was better equipped to deal with it than the rest of the world. With the rise of online learning, brands had a unique opportunity to build meaningful relationships with consumers and create new and more relevant identities.

Lastly, the “consumption upgrade” trend can be seen in growing sales for products such as high-end home gym equipment, luxury items, and large home appliances. The JD Big Data Research Institute highlights how the transaction volume of large exercise machines like rowers, elliptical trainers, and treadmills increased more than 133, 91, and 96 percent, respectively, between April 1-6 year-over-year.

No longer content having only small and portable exercise equipment like pullers, dumbbells, yoga gear, and jump ropes, “consumers are gradually tending towards buying more professional, large-scale fitness equipment with unit prices of several thousand yuan, and even as high as nearly 10,000 yuan,” according to JD.com's Ella Kidron.

And during the period between April 13-18, the transaction volume of large home appliances increased to over 200 percent as compared to 2019.

The COVID-19 pandemic has disrupted consumption by shifting consumer priorities toward new product lines and services. However, some industries have moved fast to overcome the negative shock and have transformed this disruption into a unique opportunity. With consumer confidence running high, the “return to work” phase is recalibrating the demand for various products. But businesses shouldn’t look at this pent-up demand as their full-blown market salvation. Yes, consumers are returning to spending, but they are only buying products that fit into their current reality. And that, unfortunately, means some products just aren’t going to be viable in the post-COVID-19 era.