While China’s government abruptly changed its tax policy toward cross-border e-commerce in 2016, Alibaba’s Tmall says growth remains high for everything from clothing and cosmetics to baby formula and supplements.

According to the recently released Chinese-language “Annual Report on Tmall Global Data 2016” by Tmall Global and CBNData (第一财经商业数据中心), Tmall saw a 30 percent increase in the sales value of items ordered abroad from China in 2016.

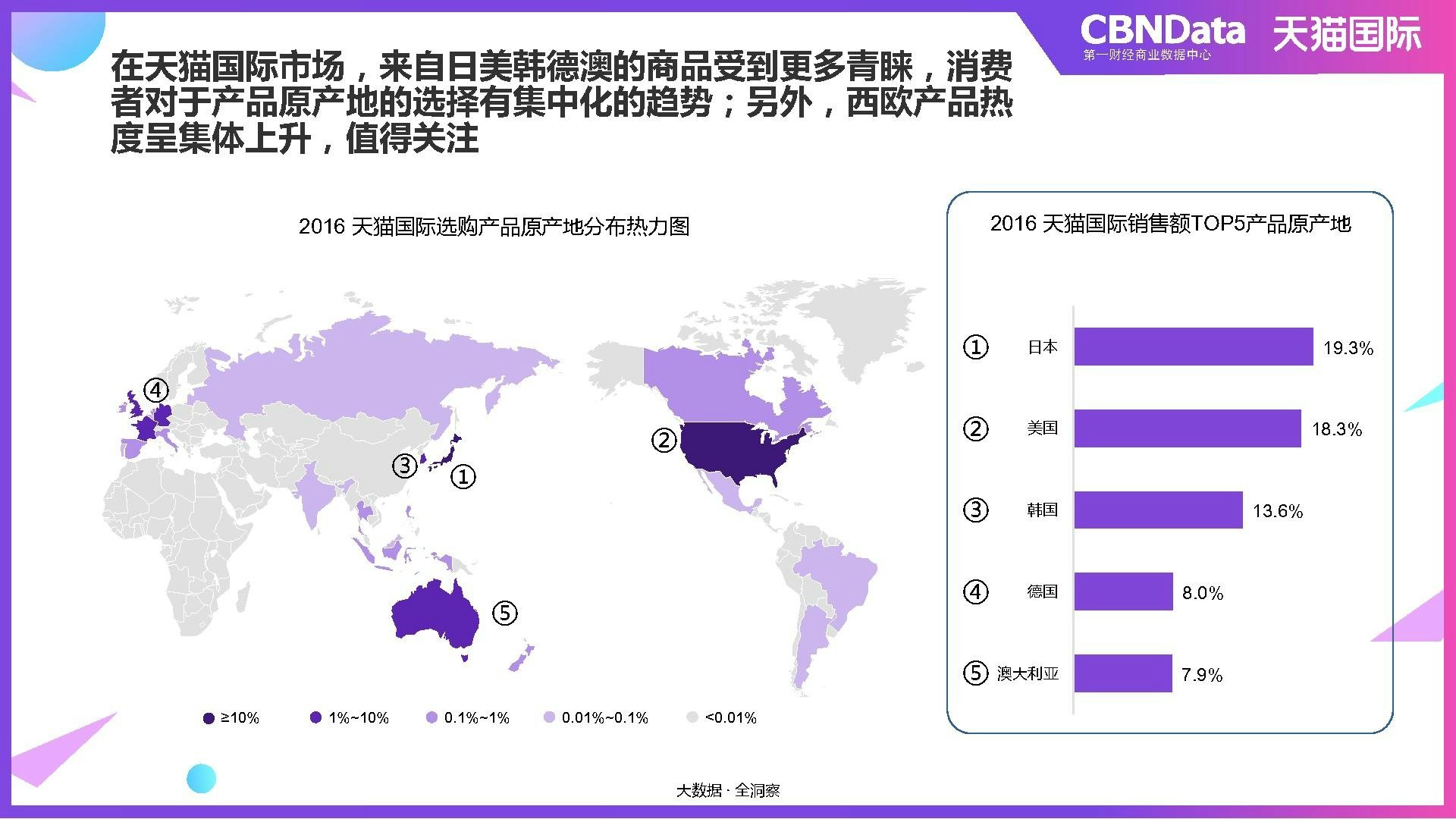

The top country for imports was Japan, followed by the United States, South Korea, Germany, and Australia, respectively. Cosmetics, baby formula, and dietary supplements were among the most popular items ordered. China’s obsession with Japanese and Korean beauty products remained high, while the United States, Germany, and Australia were the go-to for food products, supplements, and milk powder—which Chinese consumers generally consider to be less safe when produced by Chinese brands. According to the report, quality consciousness was one of the top three reasons for buying items from abroad, along with a change in personal circumstances and demand to experience new things.

Here’s the list of the top five countries and their most popular products provided by the report:

Beauty products and serums

Diapers, strollers, and baby products

Personal care products

Japan#

United States

#

Health foods and supplements

Baby formula and snacks

Bags and luggage

South Korea

#

Beauty products and serums

Cosmetics and perfume

Women’s apparel

Germany

#

Milk powder, dietary supplements, and snacks

Kitchenware

Health and nutrition supplements

Australia

#

Health and nutrition supplements

Milk powder, dietary supplements, and snacks

Coffee, oatmeal, and instant beverages

The top five cities for cross-border imports were Shanghai, Beijing, Hangzhou, Guangzhou, and Shenzhen, respectively. Lower-tier cities saw significant growth, however, with 31 percent of new customers hailing from third- or fourth-tier cities. Meanwhile, 24 percent of the previously existing customer base was comprised of the same.

Cross-border e-commerce is especially popular among younger online shoppers born after 1988, who accounted for over half of Tmall Global’s new customers this year. Of these young people, many were new parents—hence the demand for baby formula.

While the UK didn’t make the top five list, it experienced significant growth last year thanks to the Brexit-driven currency slump, says the report. This wasn’t only felt by Alibaba: around the time of the Brexit vote last year, competitor JD.com opened its “British Mall” on its own cross-border platform JD Worldwide, a competitor to Tmall Global. Meanwhile, the pound's plunge also meant that the UK saw a surge of Chinese tourists scooping up cheaper goods.

The most popular category overall was beauty products, followed by food and baby products. In another wholly unsurprising development, foreign air filter brands sold especially well thanks to the air quality in Beijing and other major Chinese cities over the past year.