What happened

Luxury company share prices plunged today after LVMH Group, the world's largest luxury goods company, yesterday reported slowing sales growth.

LVMH shares dipped to a year-to-date low, while Kering and Richemont also declined.

The Bernard Arnault-owned conglomerate’s sales growth came in at 9 percent in Q3 2023, down from 17 percent the previous quarter.

In the first nine months of the year, the entire group, which includes lifestyle, beauty and jewelry brands such as The Belmond Group, Fenty Beauty, Moet & Chandon and Tiffany & Co., posted revenue of €62.2 billion, up 9.1 percent year on year when currency fluctuations and non-core revenue are accounted for.

A bright spot was the conglomerate’s fashion and leather goods business (a stable of 14 brands), its biggest component, which generated revenue of 32.8 billion (€30.9 billion) in the same period, up 10 percent year on year.

Expansion was attributed to "remarkable growth in all product categories" at Christian Dior, which has reportedly tripled in size in the past seven years, as well as the popularity of Loewe’s new leather goods designs, particularly under the aegis of Jonathan Anderson. Rimowa, Marc Jacobs, Berluti, and Fendi also performed well, according to LVMH.

However, in Q3 2023, LVMH’s wines and spirits business saw revenue decline 26 percent year on year.

The Jing Take

With a multitude of high-caliber brands operating under its umbrella, LVMH’s strategy has produced a broad, yet select portfolio of elite labels, each with its own unique identity and consumer market. This diversification cushions the business during challenging economic times.

However, the financial markets took a dim view of LVMH’s results, with its stock price falling up to 8.5 percent in early Paris trading today. Other luxury stocks like Hermès, Richemont and Kering also tumbled with it.

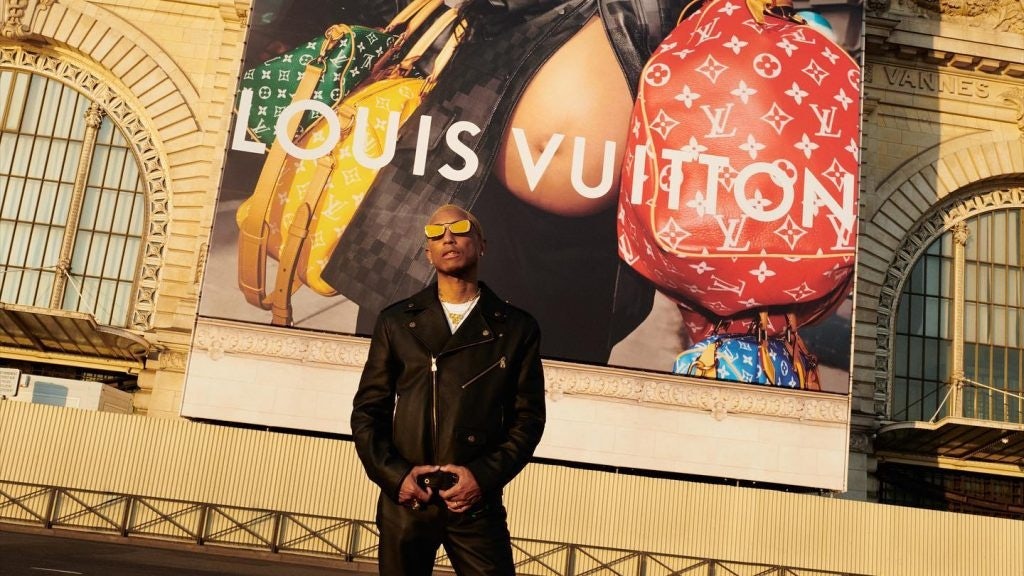

While the whole LVMH Group comprises over 75 brands, the fashion and leather goods arm is the largest division and includes coveted labels like Dior, Loewe, Fendi, Celine, Kenzo, Givenchy, and popular quiet luxury brands Berluti, Loro Piana and Rimowa. Bulgari, Tiffany & Co. top LVMH’s jewelry division. Then of course there is Louis Vuitton, the jewel in the group’s luxury crown.

With the much hyped debut of Pharrell Williams helming LV’s menswear line this year, the brand again hit headlines when it announced a pre-fall mens collection show in Hong Kong for November 30, its first ever show in the city.

Yesterday, the brand launched its first-ever Chinese-language podcast series, "Louis Vuitton [Extended]," which invites listeners to listen to creatives from different industries, including writers, actors and directors. The inaugural season will kick off with a fresh perspective on Shanghai, exploring the city's past, present, and future. This is all indicative of LV’s investment in the China market, its largest driver of revenue in Asia.

And while stock investors are getting skittish amid a luxury slowdown, people working in the industry will see new consumption patterns emerge. Perhaps some of the most significant will be in rapidly evolving markets, such as Greater China, Singapore, South Korea and Thailand. Many of the labels in their stable still enjoy high brand equity here compared to the rest of the world. With this in mind, perhaps it's no surprise that the LVMH Group is going long on investing in its relationship with Asian consumers.

The Jing Take reports on a piece of the leading news and presents our editorial team’s analysis of the key implications for the luxury industry. In the recurring column, we analyze everything from product drops and mergers to heated debate sprouting on Chinese social media.