Key Takeaways:#

Chinese consumers have gravitated towards J-beauty as they’ve become more skincare educated, seeking sustainable results over trendy gimmicks. In 2020, imports of Japanese cosmetics to China grew more than 30 percent to 4.3 billion, surpassing major suppliers like South Korea, France, and the US.

Shiseido’s sales in China jumped to 600 million in Q1 2021 — trailing just behind the 687 million made in Japan — signaling a closing gap between the two markets.

Forty years after entering China, Shiseido continues to grow by focusing on prestige skincare, cutting-edge technology, and personalized services.

Shiseido sure knows how to party. On March 9, the Japanese beauty giant set off 300 drones to dance across Shanghai’s night sky, spelling out “40th Shiseido China” in honor of its corporate anniversary. On the ground, it delighted guests with an exhibition charting its accomplishments in the country since 1981.

But the big 4-0 isn’t the only thing Shiseido has to celebrate. Over the past year, China has quickly become one of its top markets, helping the skincare pioneer bounce back from the pandemic. Although Japan defended first place with sales of 687 million in the quarter ending March 31, China trailed closely behind at just under 600 million — a stark contrast from last year, when sales were nearly half that of Japan’s.

With Chinese consumers demanding more high quality beauty products, J-beauty imports to China jumped over 30 percent to 4.3 billion in 2020, overtaking South Korea and other major suppliers. Below, Jing Daily breaks down why J-beauty has surged in the country and how Shiseido stands at the forefront of these changes.

Staying out of trouble#

But first, some context: J-beauty’s lead over competitors such as K-beauty isn’t solely based on its own merits. There are political issues to consider too: In 2016, South Korea’s decision to allow the deployment of a US missile defense system on its soil sparked notable outrage from China, spurring sanctions on cultural imports that continue to be felt today. In fact, it was only in mid-2019 that Beijing eased its economic grudge against retail giant Lotte, as other Korean conglomerates like Samsung and Hyundai dramatically scaled back operations in the country.

Andrew Atkinson, senior marketing manager at China Skinny, explained that these political complications helped J-beauty gain some separation from K-beauty. “The [THAAD missile] stoush, ensuing crackdown in 2019 on Daigou traveling back from Seoul specifically — there were viral posts at the time of travelers being met on arrival and handed out 20,000 RMB tax bills for what was in their suitcase — and COVID-19 obviously have all impacted Korea more than Japan,” he said.

However, with K-beauty exports to China up 24.5 percent to 3.81 billion in 2020, the sector still offers stiff competition. “Overall, Korea is still incredibly strong compared with most other origins, Japan has just surged more without these issues,” Atkinson added.

Doubling down on strengths#

In this uneven playing field, Shiseido has clawed its way ahead of K-beauty and J-beauty rivals alike by restructuring around its core strengths. In February, the company unveiled a new strategy to achieve full recovery by 2023 — and, ambitiously, become the “world’s No. 1 skin beauty company by 2030” — by making prestige skincare its driving force. Not only does this move align with post-pandemic trends (which favors skincare over color cosmetics), but it also caters to Chinese consumers who have become increasingly skincare educated and, as a result, hungrier for high-end items.

“The skincare high-end segment is much more promising than the middle or low-end,” Steffi Noël, a project leader at Daxue Consulting, told Jing Daily. “Chinese consumers, including Gen Z, increasingly perceive skincare as a long-term investment and are willing to spend more money on highly functional products.”

So far, the pivot is paying off. The parent company of Tory Burch and Nars saw group sales rise 6 percent to 2.2 billion in Q1 2021, while net sales in China surged 41 percent compared to 2020 and 24 percent versus 2019, surpassing pre-COVID levels. Building off this momentum, Shiseido recently debuted two prestige skincare lines in China, the Ginza and Baum, in addition to revamping its men’s skincare category.

Harnessing data and technology#

However, Shiseido isn’t just riding the skincare wave — it’s helming the ship. Living up to its motto of “beauty innovations for a better world,” the 149-year-old company has become one of the most active names in the beauty device market, which is expected to be worth 80.7 million by 2031. Carol Zhou, head of the China business innovation and investment team at Shiseido, said that advancing technology has been key to providing more personalized services and gaining a competitive edge in China.

For starters, months before L'Oréal launched Perso, Shiseido had already released its own smart skincare device, Optune, which uses AI to detect a user’s skin condition from an image. The group later partnered with beauty device company Ya-Man to debut EFFECTIM, a new anti-ageing skincare brand that employs cutting-edge technology to enable long-term, customized care. And most recently, it joined forces with tech firm Accenture to create “unprecedented beauty experiences” online and in stores, including skin diagnostic tests and virtual makeup try-ons.

Whether it’s innovative gadgets or serums, Shiseido’s digital transformation has ultimately reinforced J-beauty’s perception as highly functional. And according to Noël, this focus on utility is another reason the sector has grown more popular than K-beauty in China. “Japanese brands will communicate much more on ease of use, the texture, the ‘long-lasting’ side or pure efficiency of the products rather than on the colors or fancy packaging.”

Localizing e-commerce efforts#

This digital transformation doesn’t just stop at Ramp;D; it also applies to how products are marketed and sold. Rather than simply participating in China’s e-commerce activities, Shiseido localizes its efforts to better resonate with consumers. On the first day of Tmall’s 618 presale, the eponymous Shiseido label saw sales exceed 33 million by leveraging livestreaming. Meanwhile, its parent managed to boost first quarter sales by dressing some of its best-selling items in festive, limited-edition packaging to ring in the Lunar New Year and International Women’s Day.

One word of caution before relying too heavily on shopping holidays: “It is a lot harder to build a brand that means something to a Chinese consumer than simply targeting Singles’ Day and getting action via discounting,” Atkinson said. “The China marketing game is tough, and you need to be active, consistent, and well-resourced to keep up or you'll get forgotten about quickly.”

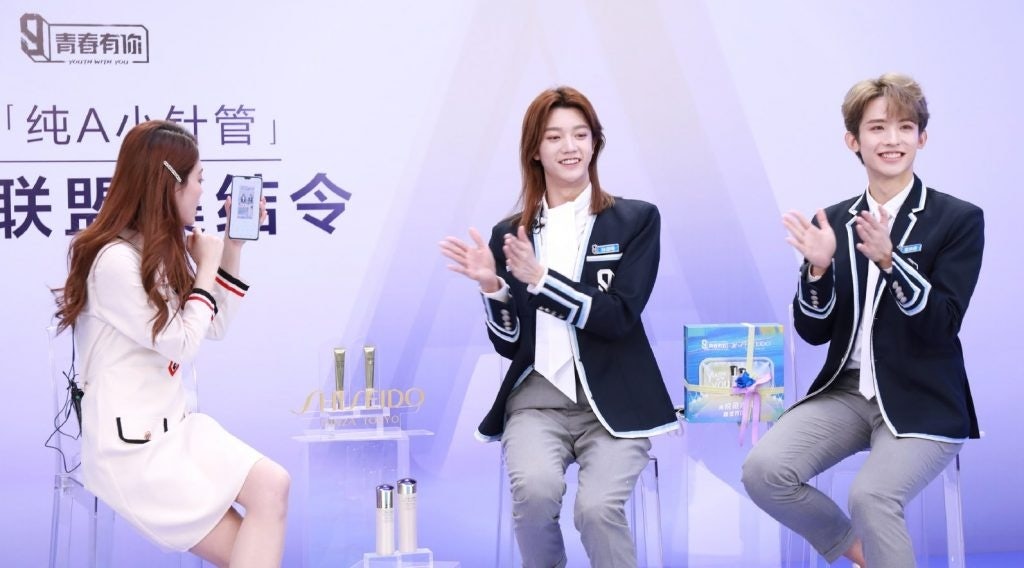

That’s why Shisiedo has built an extensive network of Chinese influencers to maintain engagement. Not only does the industry heavyweight rely on top-tier celebrities, such as Zhang Ziyi, Liu Yifei, and Huang Xuan, but it also engages with smaller KOLs to reach more niche demographics. The Shiseido brand, for example, has tapped the idol trainees of variety show Youth With You 3— capitalizing on China’s fan economy — and even used its own beauty consultants as micro-influencers. As Noël advises, “Don’t go just to giant KOLs or celebrities, think twice!”

Chasing big beauty dreams#

These are just a few of the tactics Shiseido has used to gain steam in China. Looking ahead, Zhou expects the country to become “a global innovation hub” and continue driving growth for the company. “China has a very unique ecosystem, with a booming consumer and capital market combined with an insatiable taste for anything new, [making it] the perfect place for new innovations.” And as Shiseido rises through the ranks via tech advancements, localization, and craftsmanship, the “Made in Japan” label will similarly be elevated alongside it.

That said, whether Shiseido can become the world’s top skin beauty company remains to be seen. Though it leads in the J-beauty sphere, it’ll still have to beat out the likes of L'Oréal, Unilever, and Procter and Gamble to take first place. But perhaps if the Tokyo-based titan can take on China for 40 years, it can take on anything.