Japanese Luxury Cosmetic Brand Launching New "DQ" Line Throughout Mainland To Reach Emerging Urban Areas#

Over the past few years, the luxury market in China has fragmented in interesting ways, with companies of all sizes trying new ways to transform China's expanding middle class from uninformed buyers who mainly choose their purchases on price alone into discriminating (and loyal) customers. For some luxury brands, getting into the Chinese market and gaining a foothold there depends almost completely on media and advertising saturation and the construction of trophy showrooms in top-tier cities. Though these showrooms draw relatively few paying customers, they're considered by many brands to be an essential means of brand education, and rent or tax subsidies help offset the relatively low revenue most of these stores pull in.

For some other luxury brands, the best way to build a strong base of loyal buyers is to take a two-tiered approach: by catering to the "ideal" luxury buyers (brand loyal, free-spending, exclusivity-seeking) with the high-priced products available in Tokyo, Paris, and New York through traditional branding and outreach, while simultaneously catering to as many potential (mostly middle-class) buyers with less exclusive, affordable sub-brands.

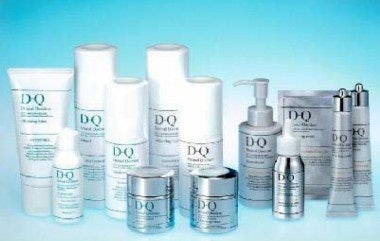

Although this approach has the potential to put the prestige of some brands at peril, major luxury brands like Hermes have begun to roll out "China-only" sub-brands. This week, Japanese cosmetic brand Shiseido -- which has operated in mainland China since 1981 -- joined the growing list of luxury brands taking the two-tiered, exclusive/accessible approach, as the company announced that it will launch its sub-brand "DQ" in China in 2010. Shiseido's move follows a similar "China only" approach employed by its rival Kanebo earlier this year.

According to Shiseido, DQ will be available in drugstores throughout China beginning in March 2010. Currently, the majority of Shiseido's sales in China are from department stores and specialty cosmetic shops, so the company has designated the new drugstore channel as a "third pillar" to reach customers. In addition to Shanghai, Beijing and Guangzhou, the DQ cosmetic line will be available in other "major cities in coastal and inland areas," meaning -- presumably --first- and large second-tier cities that should include Hangzhou, Tianjin and possibly Ningbo, though details have not yet been released. Shiseido has announced that the company plans to introduce the DQ line into upwards of 600 stores in that region in the first year alone.

While "Shang Xia" handbags and "DQ" cosmetics are quite different, the thinking behind these non-Chinese luxury brands' new mainland strategy is pretty much the same. While some Chinese luxury consumers might be turned off by the idea of their favorite luxury brand branching off into the not-quite-luxury market, creating sub-brands that don't directly compete, and aren't sold in the same stores, others won't care. In less developed inland areas where brand recognition is almost nonexistent, they'll care even less. For companies like Hermes, however, the risk is far greater than it is for Shiseido.

Hermes, as a fashion brand, has built its entire identity around conspicuousness -- when you've spent thousands on a handbag, you want others to notice it, and -- in China -- know it's real. Shiseido, however, has positioned itself as a high-quality luxury cosmetic company and not much else. Outside of some of their advertisements, perhaps, Shiseido isn't actively promoting a "Shiseido lifestyle." As a result, launching a cheaper sub-brand probably will do little to dent Shiseido's huge popularity among China's key demographics, who consistently name Shiseido "favorite skincare product" virtually every year, according to Hurun Report "best of the best" lists.