The following is one of 11 online resale platform profiles included in Jing Daily’s latest market report,#

Leveraging China’s Online Luxury Resale Boom#

. Packed with case studies, revenue-generating best practices, spotlight interviews, and in-depth profiles of domestic Chinese resale platforms, the 68-page report is crucial for anyone looking to understand the huge potential of secondhand luxury demand in China.#

Secondhand Luxury Resale Platform Profile: Idle Fish (闲鱼)#

Alibaba launched its resale platform Idle Fish (originally “Taobao Secondhand”) in mid-2014, and it was the first e-commerce channel focused exclusively on resale. Leveraging Alibaba’s vast user base and well-developed ecosystem for transactions, Idle Fish was founded on the concept of providing a convenient way for users to resell any unused (i.e. “idle”) goods, especially Taobao purchases that they may have come to regret (the platform’s competitive pricing and frequent discounts have tended to encourage excess consumption).

Idle Fish allows secondhand items to be listed for sale online (for Taobao purchases, this can be done with one click), and incorporates Alibaba’s Alipay to streamline the payment process.

Users#

Idle Fish has become the dominant force in the secondhand market, with around 300 million registered users. As of January 2021, Idle Fish held a 70.7 percent share of China’s total resale market. Idle Fish’s 72.9 percent market penetration rate is more than double that of its nearest competitor, Zhuan Zhuan (33.1 percent).

Sales#

Idle Fish expects to hit RMB 500 billion ($77.2 billion) in GMV in 2021, a significant increase from RMB 200 billion ($30.8 billion) in 2020 and RMB 100 billion ($15.4 billion) in 2019. In 2020, Idle Fish sold more than 10 million luxury items worth approximately RMB 4.5 billion ($702 million).

Strengths#

Idle Fish has yet to make a strong move into luxury resale, but this could change given parent Alibaba’s vast resources. As Tmall Luxury Pavilion, the leading platform for designer fashion e-commerce in China, continues to expand and consumers become more concerned about sustainability, Idle Fish could potentially become a major player in China’s luxury resale market, perhaps even spinning off a premium goods division following the Luxury Pavilion model.

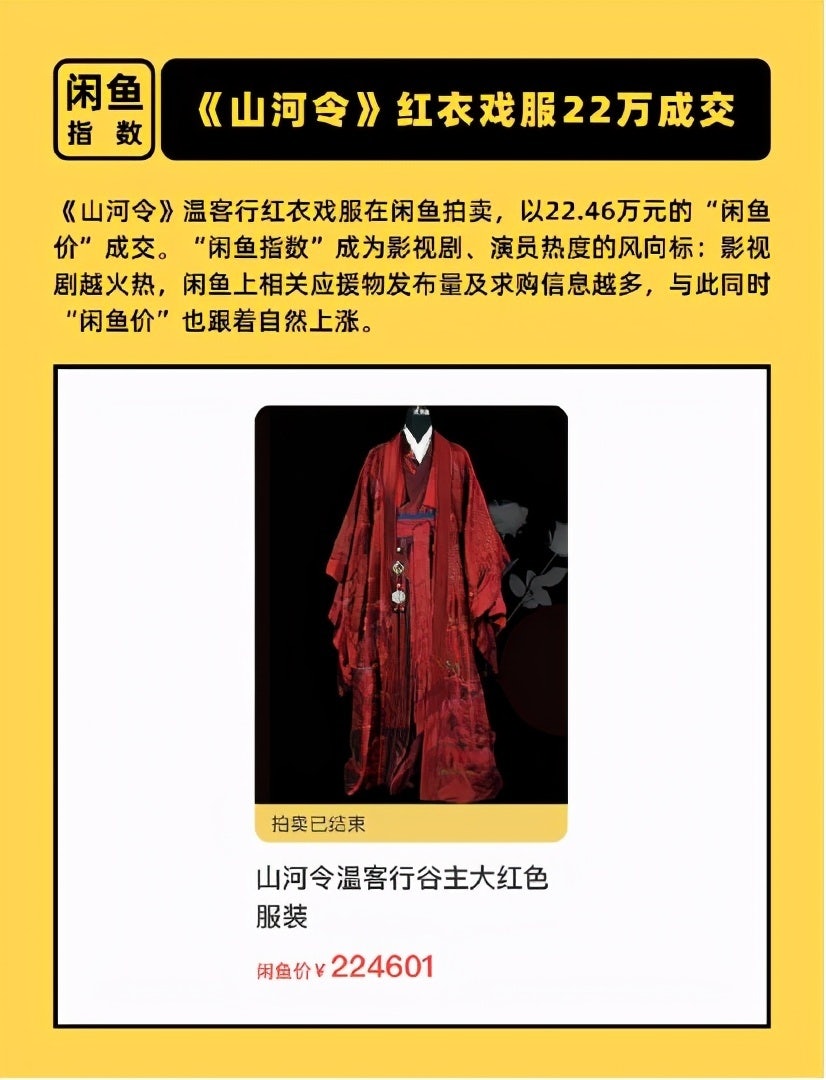

Idle Fish has also established a strong connection with celebrities and influencers, launching a dedicated sales channel for them to part with their unused items and PR gifts that has proven popular among fans as well as shoppers who may be intrigued by secondhand luxury but concerned with authenticity and provenance. And as Chinese consumers show greater willingness to shell out for big-ticket purchases online, luxury resale can stand to benefit. In April 2021, Idle Fish hosted a charity auction of costumes and other items from the hit fantasy drama Word of Honor that raised nearly RMB 1 million ($154,000), with an elaborate robe worn by one of the stars going for more than RMB 220,000 ($34,000).

Idle Fish has also emphasized boosting trust for its users. In December 2020, the platform introduced a “worry-free purchase” (无忧购) service, contracting with professional examiners to provide certificates of authenticity and offering seven-day returns with free shipping, with triple refunds guaranteed if a counterfeit product is delivered. Idle Fish has also been developing online community-based and offline authenticity services, and while it is not alone in prioritizing consumer trust, Alibaba’s experience in quality control via Tmall and Taobao and the integration of Alibaba’s “Sesame Credit” system, which uses consumer data and transaction history to assess trustworthiness, could offer consumers greater assurance than other platforms are capable of.

In July 2021, Idle Fish doubled down on initiatives to appeal to Gen Z consumers by emphasizing trendy shopping categories, which could serve as a gateway for sales of more premium goods. The “Idle Fish Trend Community” (闲鱼潮社) channel targets young consumer passions for sneakers, streetwear, and collectible designer toys. At the same time, Idle Fish launched a campaign inviting well-known collectors, brand managers, and sellers to participate in the new community. Idle Fish’s large user base and name recognition create the potential for it to outpace its rivals as a streetwear community, and it can draw on the experiences of Tmall, for example, in leveraging Alibaba’s vast trove of consumer data to capitalize on the latest trends among fans of popular product categories. Already, one collector of the trendy Be@rbrick figurines has noted that almost half of China’s Be@rbrick collectors are active on Idle Fish.

Weaknesses#

While Idle Fish is pivoting towards encouraging users to buy and sell more high-end items, its origins as a sort of online “flea market” give it a distinctly non-luxury sheen, potentially making it a harder sell for the platform to enlist luxury brands to get on board.