Multi-brand boutiques such as Glossy, which features labels such as Raf Simons and Rick Owens, are on the rise as Chinese consumers develop a taste for niche brands.

While foreign and Hong Kong multi-brand luxury stores such as Lane Crawford, Galeries Lafayette, and I.T make strides in mainland China, homegrown multi-brand stores have been sprouting quietly to reach a surprising number of 25, occupying a large share of the market. The impossible-to-ignore trend spurred the recent publication of a report on multi-brand stores in China by Chinese commercial real estate research firm RET and Chinese-language fashion news website Fashion Trend Digest.

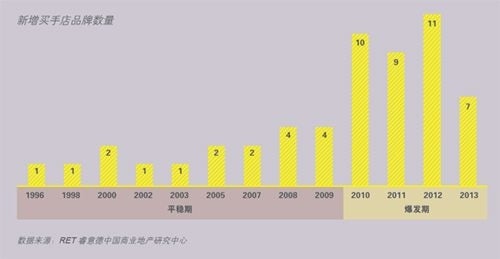

According to the research report, multi-brand stores in China experienced an extended phase of slow growth from 1996—when the first store opened in Shanghai—to 2009. In 2010, multi-brand stores entered a phase of furious growth and have been gradually expanding to the second- and third-tier cities. The number of new multi-brand stores opened between 2010 and 2013 is four times the sum of the past 14 years.

A chart showing new multi-brand stores in China each year from 1996 through 2013. (RET)

In respect to this trend, Ye Qizheng, the editor-in-chief of Fashion Trend Digest, points out that as Chinese middle class gain more purchasing power, the consumer market is now undergoing tremendous restructuring. A portion of these strong consumers has started to pursue individualistic and distinctive labels, with their interest gradually shifting from popular mainstream luxury brands to those that express unique personalities. The trend has led multi-brand stores to rapidly crop up in China.

Homegrown multi-brand stores are the rising stars#

The research report shows that on the mainland, homegrown multi-brand stores now account for 55.6 percent of all multi-brand stores. Different from foreign-invested stores, which operate as large corporations, homegrown stores are primarily small-scale and independent ones that are geographically concentrated in Beijing, Shanghai, Guangzhou, Hangzhou, and Hong Kong. Presently, there are a total of 183 locations, covering 829 luxury brands. Some of the homegrown stores have begun chain expansion and to seek a presence in second- and third-tier cities. P-Plus, one of the leading homegrown stores, now has a total of 28 locations nationally in both first-tier cities and second-tier locales such as Guiyang, Qingdao, and Wuxi. A portion of them chooses to stay in the local market; a case in point is Glossy, one of the oldest homegrown multi-brand stores that was founded in Shanghai.

However, multi-brand stores do not evenly distribute among first-tier cities. The number of stores in Shanghai is 65 percent higher than that of Beijing, and is nearly six times more than the total count of stores in Guangzhou or Shenzhen. Significantly, the number of stores in Chengdu comes in third place after Shanghai and Beijing, reflecting an increasing and accelerating demand in second- and third-tier cities.

Geographic distribution of multi-brand stores in China. (RET)

Online-to-offline is the new black

As indicated in the research report, two-thirds of the homegrown multi-brand stores have established an e-commerce platform, and many from the additional third are planning to do so. With lower operating cost and increased visibility as O2O’s main advantages, some of the leading stores in Beijing and Shanghai have been using WeChat for customer service and sales. Online sales reportedly account for 10 percent of total sales.

The current e-commerce status among homegrown multi-brand stores. The left circle shows stores with O2O; the right shows online and offline sales: online 10 percent, offline 90 percent. (RET)

The report points out that the next phase of competition will be focused on how to select and introduce new brands to consumers. In the next three to five years, the market—now facing homogenous competition—will be dominated by international luxury brands and local designer brands that feature distinctive qualities.

The brand positioning and market mapping in the report uses two dimensions—price and trendiness—to position foreign and homegrown multi-brand stores in China. Most multi-brand stores carry trendy, edgy products and fall on the mid- to low-priced sides, as their main consumer groups are usually younger and more expressive.

Each of the stores that specialize in Chinese designer brands focuses on different markets independent from each other. Dong Liang, The Fashion Door, and Seven Days attract different consumer groups based on different product characteristics.

Brand positioning and market mapping of foreign and homegrown multi-brand stores in China. (RET)