PricewaterhouseCoopers Report Also Notes Opportunity Of Second-, Third-Tier Chinese Cities.#

Underlining the importance of Asia to the global luxury market, and the role that emerging economies like China, Vietnam and India are playing in buoying major brands, a new PricewaterhouseCoopers report highlights some of the key trends currently taking shape in this fast-growing region. With Europe facing a protracted economic and financial crisis, and the US economy expected to remain sluggish in 2012, luxury brands are expected to keep their broader focus on the Asia-Pacific region in the year ahead. However, mixed economic data coming out of new regional powerhouse China could dent the rampant growth we've seen there over the past five years. Still, as the PwC report notes, new opportunities in segments like e-commerce and in smaller, second- and third-tier cities (particularly in China) should see luxury sales continue to climb in Asia.

Though the report covers a wide range of consumer segments, from food and general retail to luxury and electronics, our interest lies in findings about the Asian luxury market. Considering the massive demand they've seen in the region, led by emerging economies and the newly wealthy in China, India and now Vietnam, luxury brands are expected to continue pinning their hopes on Asia in the year ahead. As Bain & Co pointed out earlier this year, luxury sales worldwide are expected to have grown by eight percent to US$249.3 billion this year, three to five percent higher than previously expected due to higher demand and consumer confidence in the US, Europe and China. Through 2014, Bain expects global luxury sales to continue growing by five to six percent annually, led by emerging markets.

Though PwC believes the US "will remain the world’s largest luxury market" in 2011, with luxury sales rising eight percent to US$70.1 billion, its newest study notes that "China will be the top contributor to growth in luxury sales worldwide through 2014."

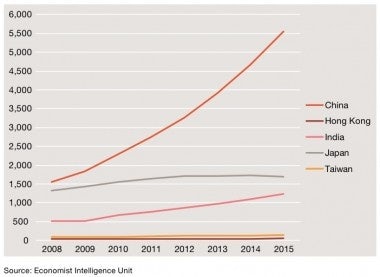

According to the study, luxury sales in mainland China rose 30 percent in 2010 and are expected to grow an additional 25 percent in 2011 to US$15.5 billion. However, when one takes into account the entire Greater China region (mainland China, Hong Kong, Macau and Taiwan), this year sales are expected to surpass Japan for the first time. While this news isn't as shocking as it would be if mainland China luxury sales outpaced Japan for the first time -- though this is expected to happen by 2015 -- it still marks an important shift in the balance of (luxury) power in the region.

Looking more closely at the mainland China market in particular, the PwC study adds one caveat that Jing Daily has noted several times in the past: second- and third-tier cities will likely remain the main drivers of sustained luxury sales growth in the year ahead. Another key trend called out in the study is the critical importance of mainland Chinese tourist-shoppers in places like Hong Kong and Taiwan. In Hong Kong, the report points out, "certain categories of goods, such as jewelry, watches and gifts, where tourists are a main driver of consumption, will see rapid sales growth in 2011-15. This trend will also play out in Taiwan, where mainland Chinese tourists are equally important consumers."

However, the emergence of a significant outbound Chinese tourist-shopper demographic will become equally noticeable in nearby retail hubs like Singapore and Macau. Considering Chinese consumers still make more than half of their luxury purchases outside of the Mainland -- owing to high luxury taxes at home, a rising yuan, better selection and customer service, and a lingering consumer trust gap -- this is not entirely surprising. Recently, a survey by China’s International Tourism Development Institute found that a whopping 76 percent of the money spent by mainland Chinese tourists in Hong Kong went towards shopping, while that figure came to 63 percent in Macau and 50 percent in Taiwan.

All in all, the findings in the new PwC report do more to validate observations from over the course of the year, rather than break new ground. However, many of the points raised in the report's luxury section are crucial for marketers and retailers to keep in mind, particularly in places like Hong Kong. For one thing, consumers from emerging markets like mainland China expect better service and better selection, and are willing to go further afield to get these things if need be. Whereas many, if not most, mainland Chinese tourist-shoppers have traditionally been content to stand in long lines to shop in Hong Kong, the greater focus that retailers in places like Singapore, Macau and Taiwan are placing on this demographic -- and the greater ease of travel for mainland Chinese -- means Hong Kong will see greater competition for the outbound tourist yuan.