The growth of independent travel from China's lower-tier cities is outpacing that in Shanghai, Beijing, and other first-tier cities, according to a report jointly conducted by Tianxun, Skyscanner’s Chinese entity, and UnionPay’s big data subsidiary, UnionPay Smart. Among other topics, the report also looks into the seasonality, gender ratios, shopping behavior, and popular airlines among Chinese independent travelers between January and October 2016. While most of the findings are consistent with what travel patterns China's jetsetters are already known to have, the data produces a few surprises.

City of residence#

- Shanghai (-25.0 percent)

- Beijing (-20.0 percent)

- Guangzhou (-5.6 percent)

- Chengdu (+19.0 percent)

- Hangzhou (+36.9 percent)

- Chongqing (+44.9 percent)

- Kunming (+69.1 percent)

- Shenzhen (+50.6 percent)

- Tianjin (+44.2 percent)

- Xiamen (+69.0 percent)

While the first-tier cities of Beijing, Guangzhou, and Shanghai remain the most important source markets of Chinese independent travelers, the report finds that lower-tier cities are quickly catching up—with growth rates far beyond all first-tier cities except Shenzhen, which is still catching up with its peers. The fast-growing affluent middle class throughout China’s lower-tier cities has undoubtedly not only started having an appetite for international travel, but also for independent international travel, which until recently, has been heavily concentrated in China’s more developed first-tier cities. An ever-increasing number of direct flights to international destinations from lower-tier cities, as well as easing visa restrictions have all made independent travel from China more convenient than ever, and it seems like people across China are taking note.

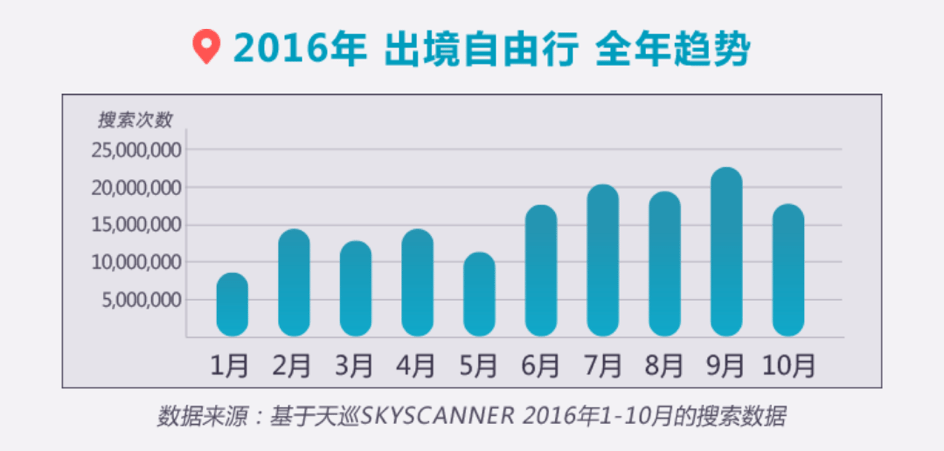

Seasonality#

The report shows that the interest in overseas travel among China’s free independent travelers (FITs) peaks in September. While the data is consistent with the higher frequency of travel during the summer in comparison to during the winter and spring, it would appear as if interest in overseas travel peaks later than actual trips abroad. In comparison, overall Chinese travel to the United States has peaked in August during the last five years—with September coming in at third place.

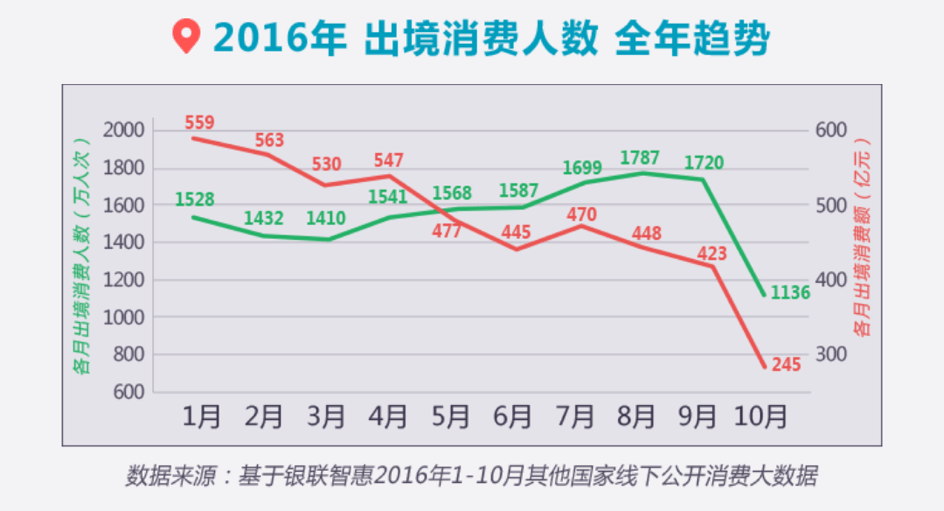

UnionPay’s data remains in line with the greater trends in Chinese travel, with August representing the peak of Chinese overseas travel. Interestingly, UnionPay put the number of overseas trips and the volume of travel spending next to each other and found that while fewer Chinese travel during the winter months, they outspend summer holidaymakers by a substantial margin. A higher proportion of more profitable market segments, such as business travelers and independent travelers during the winter, could be one explanation for the discrepancy in travel spending that UnionPay has found.

Demographics#

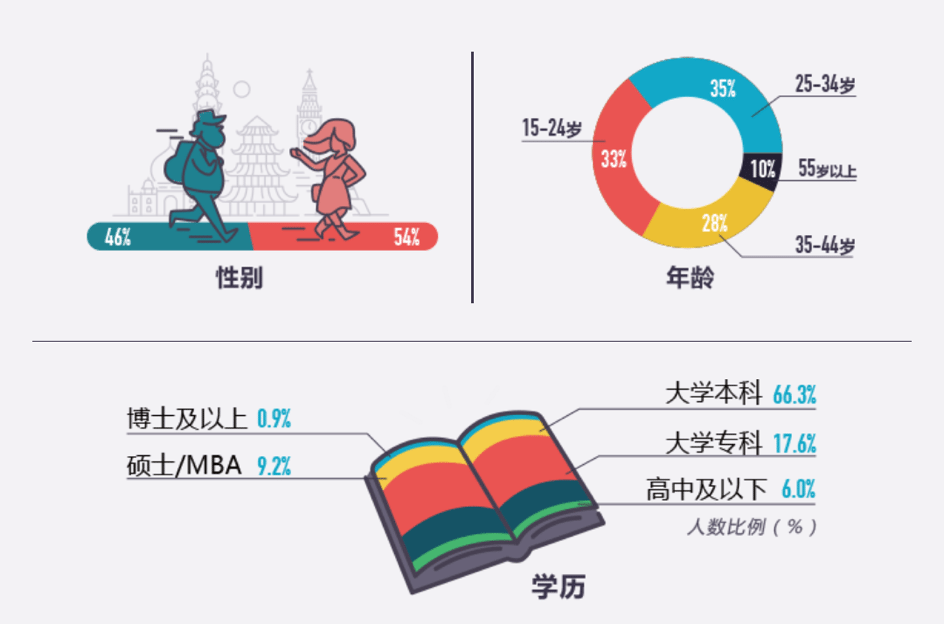

So, who are China’s independent travelers? According to the data presented by Skyscanner and UnionPay, female independent travelers outnumber men by four percentage points. The lion’s share of all Chinese independent travelers are part of the millennial generation—68 percent of independent travelers are between 15 and 34 years old. As conventional wisdom would have it, travelers older than 55 years only represent a small share of all independent travel and are much more likely to join group tours for their overseas visits.

The report also reaffirms that a majority of China’s independent travelers are educated—94 percent of independent travelers hold degrees equivalent to or higher than college/vocational school. Master’s degree holders and travelers with Ph.D. degrees or higher represent 9.2 percent and 0.9 percent of Chinese independent travelers respectively.

Shopping#

While the data shows that female independent travelers slightly outnumber men in terms of overseas journeys, the different travel behaviors between these two genders become much more prominent when shopping is taken into account. According to UnionPay’s data, a whopping 84 percent of overseas shopping is accounted for by China’s female travelers. As for the preferred method of payment, UnionPay debit cards hold a slight edge over credit cards, and the growth of payments made with debit cards more than doubled between 2016 and 2015. The proportion of mobile payments is not represented in the report.

Preferred airlines#

Something that may come as a surprise is that the report found that the most-preferred airline among Chinese independent travelers is the relatively unknown Chinese low-cost carrier Spring Airlines, which is servicing a growing number of international destinations throughout Asia. Asia’s largest low-cost carrier, AirAsia, also ranks among the top choices for independent travelers. Booking tickets independently of tour agencies appears to be giving both low-cost carriers and overseas carriers from Hong Kong and South Korea a boost in traveler preference.