Once a taboo topic for luxury houses, the second-hand market is witnessing a surging number of fashion brands embracing and incorporating the concept into their business models. From Gucci to Coach, luxury brands are foraying into the second-hand market to cater to the shifting demands of young shoppers. In China, Gen Z in first and second-tier cities are driving growth. They account for over 65 percent of preloved goods buyers.

Compared to seasoned markets like the US and Japan, where second-hand luxury makes up 31 and 28 percent of luxury consumption, respectively, China’s preloved market accounts for only 5 percent. Although it is still a nascent field, it has enormous room for growth.

The number of Chinese consumers putting up their used goods for sale soared 40 percent in 2022, according to CPP luxury, expanding the range of luxury goods circulating in the local second-hand market.

“The trend has been driven largely by the economic squeeze of the pandemic, with more people looking to sell their luxury goods for cash and luxury shoppers tightening their belts. Moreover, travel restrictions prevented Chinese luxury shoppers from going overseas to bypass the significant price gap for luxury goods between China and other markets like Europe,” explains Jacob Cooke, co-founder and CEO of WPIC Marketing + Technologies.

Jing Daily looks at the state of China’s resale ecosystem and the opportunities it presents for brands and retailers.

Analyzing China’s second-hand shoppers#

There’s significant room for second-hand market growth in China. According to a recent iResearch report, the domestic resale market was valued at $8 billion (51 billion RMB) in 2020, and will expand to exceed $32 billion (208 billion RMB) by 2025.

Thanks to celebrities, KOLs’ promotion, and the popularization of second-hand consumption among younger shoppers, purchasing preloved goods has gradually become mainstream in China. “In our quarterly index, we can see that consumers’ searches for second-hand fashion have increased month by month,” says Liang Chen, co-founder of Shanghai-based resale platform dejaWooo.

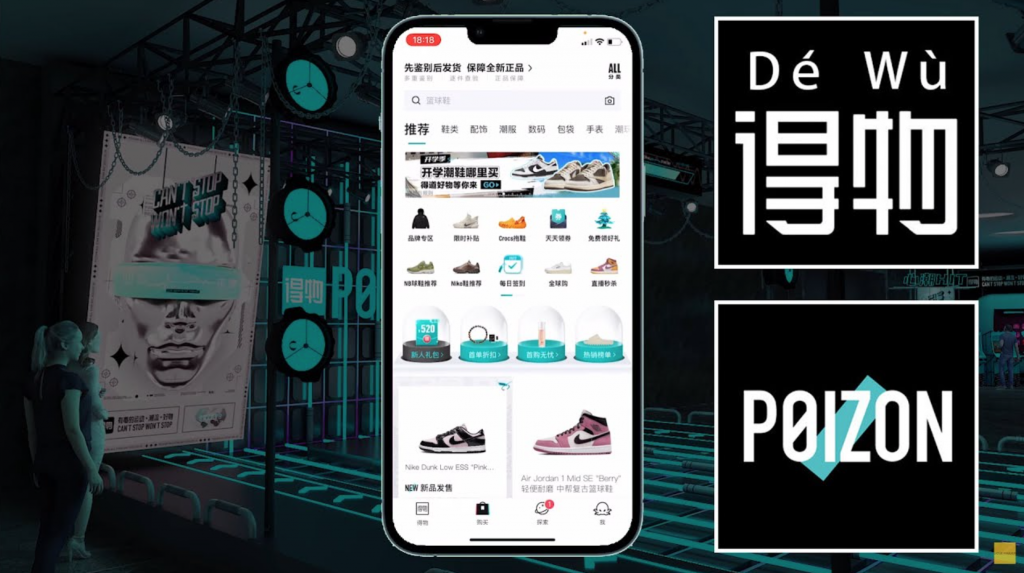

Female Gen Z buyers largely lead their counterparts in second-hand purchases, accounting for 65 percent of second-hand consumption in China. Yet, brands should not neglect male consumers. Their appetite for sneakers and limited edition collaboration pieces provides a lucrative opportunity for streetwear-oriented resale platforms like Poizon.

“The categories of interest have expanded from handbags to ready-to-wear for different occasions, including wedding dresses, suits, and ties,” adds Liang.

Currently, domestic second-hand luxury market consumption is mainly concentrated in first, new first, and second-tier cities, which account for about 70 percent. However, as luxury spending power in third-tier cities continues to increase, demand for second-hand luxury goods is also growing, as reported by Zhanqian Research. Given that, resellers should not overlook these areas.

Online vs. offline#

Investors and businesses have already spotted the preloved luxury opportunity. In 2020, second-hand e-commerce platforms like Seecoo, Plum, and Poizon received tens of millions of dollars in funding.

But, despite consumers’ rising interest, these first-movers are now embroiled in a whirlpool of operational difficulties. Their high commissions, low transparency, slow logistics, and counterfeit issues have blighted the consumer experience and damaged their reputation. Over 20,000 posts criticizing these apps have been published on Xiaohongshu.

Consumer trust is a pain point for China’s resale market. The proliferation of counterfeits is creating barriers to growth. “Authenticity continues to be the primary concern for buyers,” says Cooke. Data shows that in 2019, only 33.6 percent of luxury products in China verified by luxury goods appraisal were genuine.

Although online sites offer the convenience of product searches and price comparisons, offline stores are the preferred destination for consumers purchasing preloved luxury goods. Research from resale platform Plum shows that the three primary reasons for shoppers to purchase in-store are immediate product availability, the reliability of the source, and the ability to view items. “Chinese shoppers are more inclined to touch the product on the spot,” says Liang.

In response to this demand, second-hand luxury stores are opening in residential areas in China. They will likely become a crucial channel for second-hand market expansion. Close to both sellers and buyers, they offer more competitive price points, have a deeper understanding of consumers’ demands, and accurately connect their clientele with suitable products.

“Community stores have an advantage in building trust between the buyer and seller,” concludes Cooke.

A glimpse into the future#

Many factors are accelerating the development of China’s second-hand luxury ecosystem.

Compared to baby boomers and Gen X, younger generations are less reluctant to accept the idea of preloved luxury. With this demographic becoming the main consumption force in China, the preloved goods market will likely grow rapidly.

Additionally, this cohort is more attune to climate change issues. Thus, sustainability plays a vital role in their decision-making process. “Young consumers are inclined to make choices that contribute to the environment, such as buying second-hand fashion,” comments Liang.

The popular vintage goods trend is also boosting demand for preloved and collection-worthy pieces in the second-hand market. “We can see that in the sought-after watches and handbags categories,” says Liang.

For instance, 720 preloved units of the Chanel Classic Flap and Hermès Lindy handbags, each priced over $7,500 (50,000 RMB), were sold via second-hand platform Poizon in 2022, according to a report by data and AI platform Re-Hub. Meanwhile, two preloved units of Hermès’ alligator skin Birkin were sold at $53,800 (370,000 RMB) the same year, and five second-hand Louis Vuitton Courrier Lozine trunks were sold at an average price of around $32,700 (225,000 RMB) each.

Fueled by a range of factors, the rise of second-hand luxury looks unstoppable, which explains why luxury brands are entering the sector to shape it to their preferences.