One Chinese tech company has become an unexpected winner of COVID-19: Pinduoduo. Over the past month, the mobile-only marketplace has emerged as the top performer in the Nasdaq Golden Dragon China Index, with shares soaring 43 percent and outpacing larger e-commerce rivals Alibaba and JD.com.

With the mainland’s economy cooling, Pinduoduo is looking abroad to continue expanding. On September 1, the Shanghai-based platform launched an online shopping site in the US called Temu, offering fashion, jewelry, health, home supplies, and other categories. According to a press release, “Temu was created with the goal of empowering consumers by giving them access to a broad range of carefully curated products at ultra-competitive prices.”

Known for offering discounts on agricultural produce, Pinduoduo’s success points to the growing price sensitivity of Chinese consumers. Two-plus years of the pandemic have worn down revenge shopping urges; battered by lockdowns, travel restrictions, and high youth unemployment, locals have cut down on discretionary spending. Even the luxury resale market is seeing prices for Rolex watches and Hermès bags tumble as cash-strapped business owners offload their goods, underscoring weak consumer confidence.

Although Pinduoduo’s Chinese app also offers apparel, beauty, and even iPhones, it is best known for connecting farmers directly to consumers. Can it now find success outside of its farm-to-table business? And will the new Temu platform’s low prices be enough to ride high in the saturated North American market?

Pinduoduo’s pandemic success#

In 2020’s fiscal year, Pinduoduo’s revenues had surged 97 percent year-on-year to 9.1 billion (59 billion RMB) and the number of active users increased by 57 million to reach 788 million.

Established in 2015 — much later than other domestic e-commerce players — Pinduoduo has quickly developed into one of the country’s largest marketplaces. With JD and Alibaba dominating first-tier cities like Beijing and Shanghai, the e-tailer differentiated itself by catering to underserved shoppers in lower-tier cities. It also made the online shopping experience more interactive by introducing “group buying,” allowing customers to buy products in bulk with their friends and family members to receive steep discounts.

These features helped Pinduoduo post strong results even during lockdowns. In Q2 2022, after setting up a special section in the app to deliver food to trapped Shanghai residents, Pinduoduo was the only Chinese internet company to report a surge in profits (up 36 percent to 4.6 billion or 31.4 billion RMB), tripling its net income, while Alibaba and JD.com posted their slowest quarterly growth on record.

Pinduoduo’s success also comes down to its heavy investment in agriculture, one of its key priorities. “Agriculture products are great for user retention,” said Queenie Yao, a marketing and communication manager at China e-commerce enabler Azoya. “Fruits and vegetables are a daily necessity for almost all users — this is even more so as many of Pinduoduo’s customers live in rural areas.” Going a step further, “throughout last year, Pinduoduo initiated agriculture-focused shopping festivals with different regions to promote thousands of local specialties,” she added.

Entering the Amazon-dominated US market#

While Pinduoduo has found its niche in China, the US is a totally different playing field. Here, the social commerce platform must go up against the formidable Amazon for market share, which accounts for nearly 40 percent of all US retail e-commerce sales. A household name, Amazon draws 126 million mobile visitors in the US to its digital stores each month. Pinduoduo will have a huge ways to go to build up name recognition and site traffic.

“Chinese brands and platforms have notoriously been bad at branding, so much so they focus too much on sales volume over any longer-term benefits,” said Arnold Ma, founder and CEO of Chinese digital agency Qumin. “Quality should be the number one priority of the marketing team, focus on trust over recognition — [the latter] will come on its own in time.”

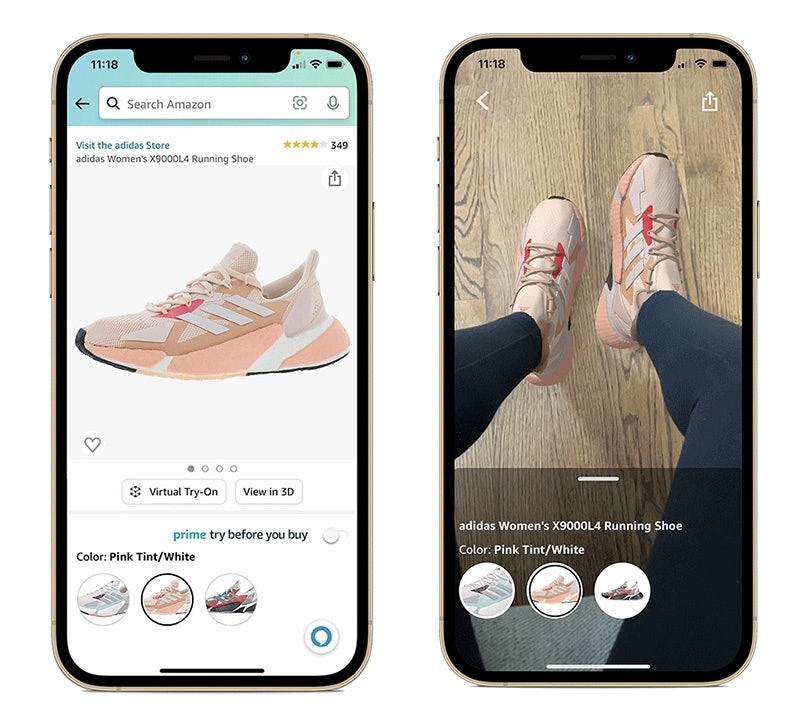

When it comes to quality of goods and services, Amazon currently has the upper hand. In 2020, the platform rolled out a “Luxury Stores” section in the US, offering established and emerging high-end names such as Elie Saab, Rodarte, and Oscar De La Renta. This summer, it launched an innovative shopping feature called Virtual Try-On for Shoes, where shoppers can test thousands of sneaker styles on their phones.

“Amazon focuses on providing brands and designers with innovative resources including motion graphics and enhanced autoplay imagery, to further share their stories and connect to a fashion-engaged customer base,” stated Vice President of Amazon Seller Services, Xavier Flamand in a press release about Luxury Stores' recent expansion to Europe.

In contrast, Temu lacks these elite renowned labels, advanced features, and sheer volume of goods. However, Ma notes that it could be more appealing to some given the lower barriers to entry: “On the business side the platform is to provide ‘zero entry and commission fee’ policies for merchants. This sharply contrasts with the high service fees charged by Amazon, which can be as much as 30 percent of total sales income, so it might naturally add to Pinduoduo’s appeal to business users.”

Learning from Shein#

In that vein, another way Temu could compete with Amazon is on price. Scrolling through the website — where there is currently a 30 percent site-wide sale to celebrate its opening — prices are dirt cheap: 2 bucket hats, 0.99 cargo print boyfriend jeans, 4.22 running shoes. But banking on “ultra-competitive prices” also draws comparisons to another e-tail titan: fellow Chinese company Shein.

The fast-fashion apparel maker has already conquered the US market; in fact, in May 2022, Shein became the most-downloaded app in the US, surpassing TikTok, Instagram, and Amazon.

“Shein disrupted the fast fashion industry with a bottom-up model (led by insights and data collected from what consumers prefer), compared to the traditional top-down model (led by high fashion and designers),” explains Ma. “They also had a huge focus on creator led social media over the traditional super-polished and over-produced branded accounts. Two things that Temu would do well to take notes from.”

But Temu is not completely at a disadvantage. Despite being one of the newest online marketplaces in the world, “Temu has access to one of the most sophisticated supply chain networks in the world right from the start,” the platform stated. Like Shein, Temu can leverage Pinduoduo’s global network of suppliers and fulfillment partners, which managed to handle a whopping 61 billion orders in 2021 alone.

But being able to handle orders is one thing; and attracting them is another. Pinduoduo made its name in China by providing fresh products and popularizing group buying, giving customers what it calls the “Costco + Disney” experience (i.e. more savings, more fun). Without these distinguishing features, Temu will need to carve a new niche in North America and learn from its predecessors if it wants to succeed long-term.