Key Takeaways:#

China’s slow growth has been changing its consumption patterns.

The aspirational class is increasingly choosing to trade down to middle-market brands and pre-owned luxury goods.

The silver lining of this economic downturn is that luxury brands could become even more digital-centric.

Many have widely reported that China is struggling to overcome its recent economic challenges. Additionally, its property market problems and current power crisis have made it more difficult for the country to boost consumer confidence and domestic consumption. As such, China’s slow growth is changing consumption patterns and delaying the government’s dream of transitioning the country away from an investment-driven growth model and towards a model focused on domestic consumption.

On top of that, government efforts to create jobs for China's youth have been less than stellar. Therefore, younger generations' vulnerability to debt and unemployment is causing additional stress for these young demographics.

As per Quartz, discussions on Douban have conveyed that “consumers are becoming more thrifty.” From conversations about saving money by switching to reusable menstrual cups to discussions about buying leftover cakes, these exchanges communicate how consumers have embraced frugality while becoming more price sensitive. In fact, a group named “Have you downgraded consumption today” has seen its user numbers jump to 300,000 over the year, according to Quartz.

Even the aspirational class is starting to trade down by opting for middle-market brands and pre-owned luxury goods. According to the National Bureau of Statistics, final consumption expenditure exceeded 8.6 trillion (55 trillion yuan) and accounted for 54.3 percent of total GDP in 2020. That is a significant drop from 85 percent in 1962. As such, luxury brands should consider a future in which Chinese consumers are seriously cutting back on spending. But what does this rise of the frugal economy mean for luxury brands?

Lesser known, standalone luxury brands might not survive in China#

While LVMH and Kering-owned brands will continue to enjoy the unique opportunities created by their conglomerates, independent labels that don’t have huge assets or didn’t develop strong brand positioning strategies will be among those to suffer most.

These labels will quickly see their unsold stocks pile up in stores and warehouses, and this dead inventory could sink their businesses. And the brands that don’t go bankrupt could reach record levels of debt.

Competitive pressure from mid-range brands#

“Amid the many worries and uncertainties, China’s middle class is abandoning its old habit of upgrading everything from cars to cosmetics,” says Quartz.

This sudden drop in middle-class spending could have dire consequences for luxury brands. Not only will they lose market share, but they might have to increase their advertising expenditures to promote their products, which will help erode their short-term profitability.

The only silver lining is that it could force luxury brands to become even more digital-centric as they will try to reduce business costs and find alternative sources of revenue. Chanel could finally abandon its offline strategy and embrace e-luxury.

High-end stores might kill luxury brand pricing strategies#

During the Great Recession, high-end department stores like Saks Fifth Avenue, Bergdorf Goodman, and Bloomingdale’s tried to boost sales by offering deals and steep discounts on luxury brands. But this price discounting strategy devalued luxury brands and altered their essence.

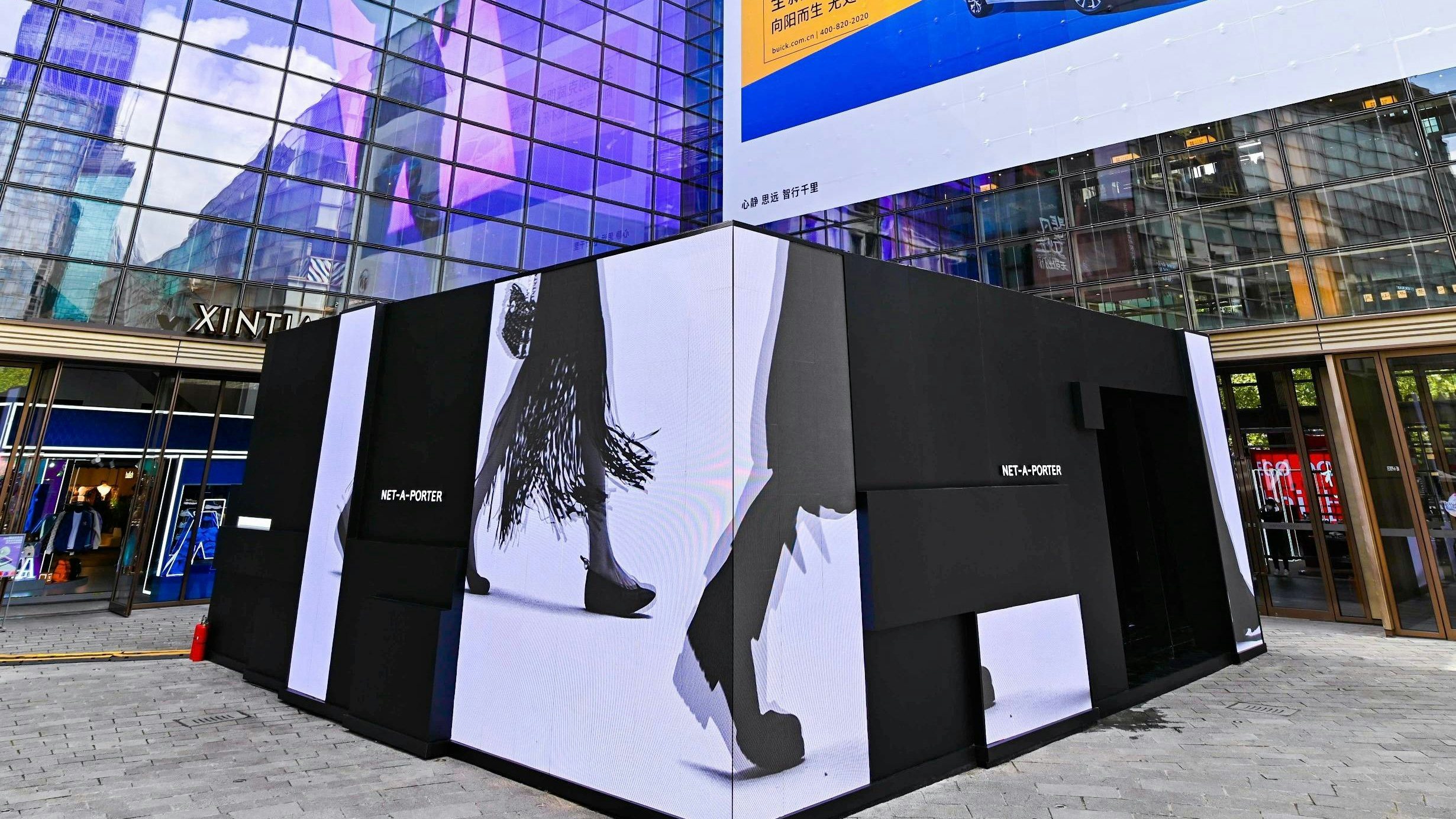

Nowadays, luxury brands have to battle a double risk. Not only do they have to pay attention to the pricing strategy of high-end stores, but they also have to keep an eye on online luxury fashion retailers like YOOX Net-a-Porter Group.

Luxury brands will go into retreat-mode#

After years of massive lower-tier city expansion, some luxury brands might decide to make cuts in underperforming markets. Recalibrating their strategies and focusing solely on outperforming markets might increase business performance and generate revenue growth. However, some abandoned customers might turn against these luxury labels while embracing their rivals.