Brands want to see results when they embark on working with KOLs, which is why it can be disheartening when expensive marketing efforts result in low sales generation—at least, at first glance.

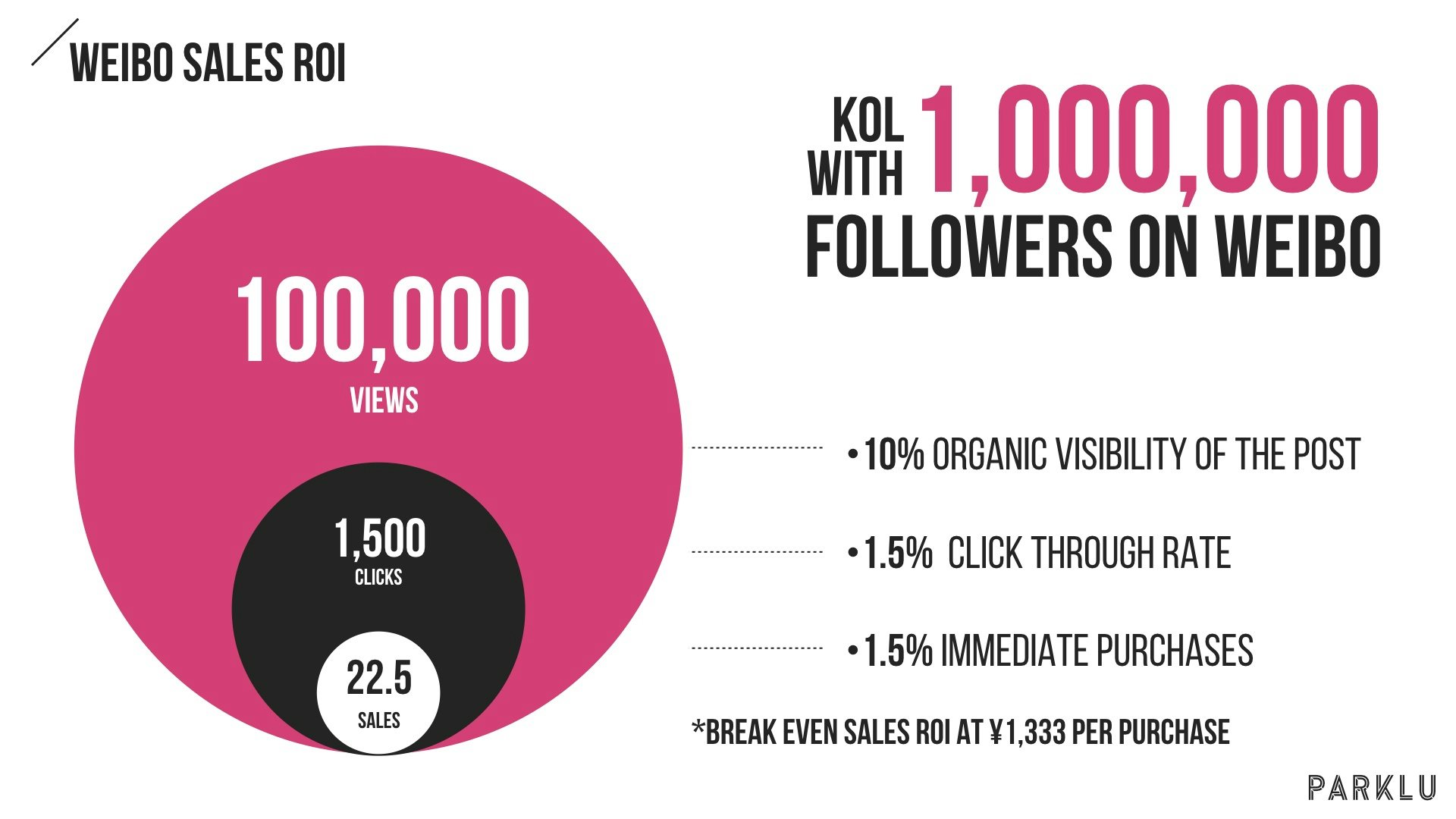

The statistics are gloomy: when a KOL with 1 million followers on Weibo posts about a product, they, on average, are going to gain organic views from about 10 percent of their followers. About 1.5 percent of them will click through, and out of this group, only 1.5 will make a purchase right away, resulting in just 22.5 immediate sales. For a brand to achieve break-even ROI from immediate sales, the items sold must be priced at roughly $192 (RMB1,333).

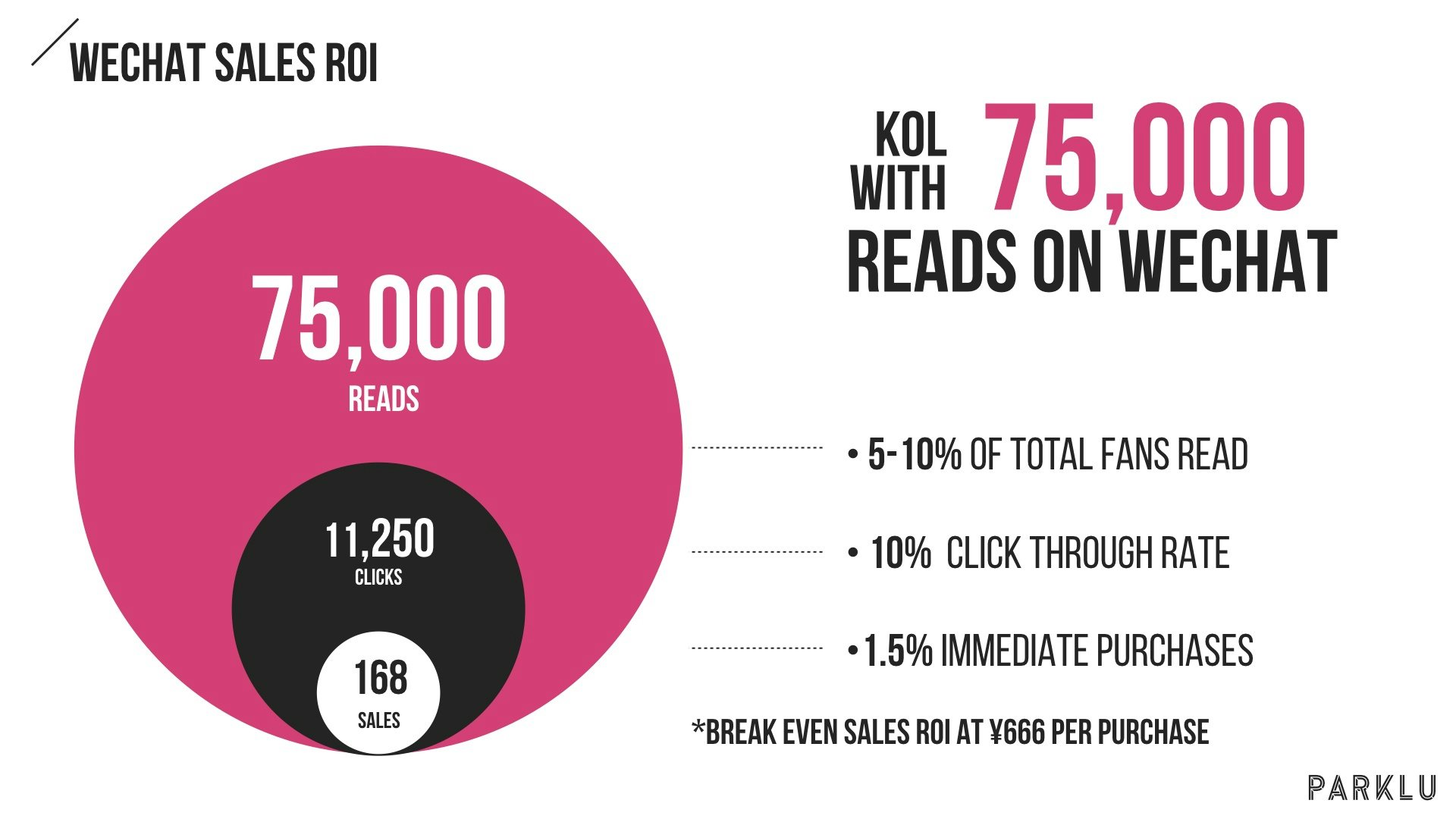

When a KOL with 75,000 average reads on WeChat posts about a product, about 10 percent of them will click through, and out of this group, only 1.5 will make a purchase right away, resulting in just 168 immediate sales. For a brand to achieve break-even ROI from immediate sales, the items sold must be priced at ¥666 RMB.

But these numbers are misleading. At PARKLU, statistical evidence suggests that brands should be looking at the bigger picture. Data shows there is indeed a correlation between successful KOL campaigns and sales generation, but it depends on a number of variables and requires a patient effort to tweak them over a series of collaborations with multiple KOLs.

Measuring KOLs’ Impact#

Measuring the success of an influencer campaign isn’t easy, especially when those immediate sales numbers look bleak. But brands should keep a number of factors in mind when considering their sales targets in a KOL partnership:

Chinese consumers require eight touchpoints before they buy.#

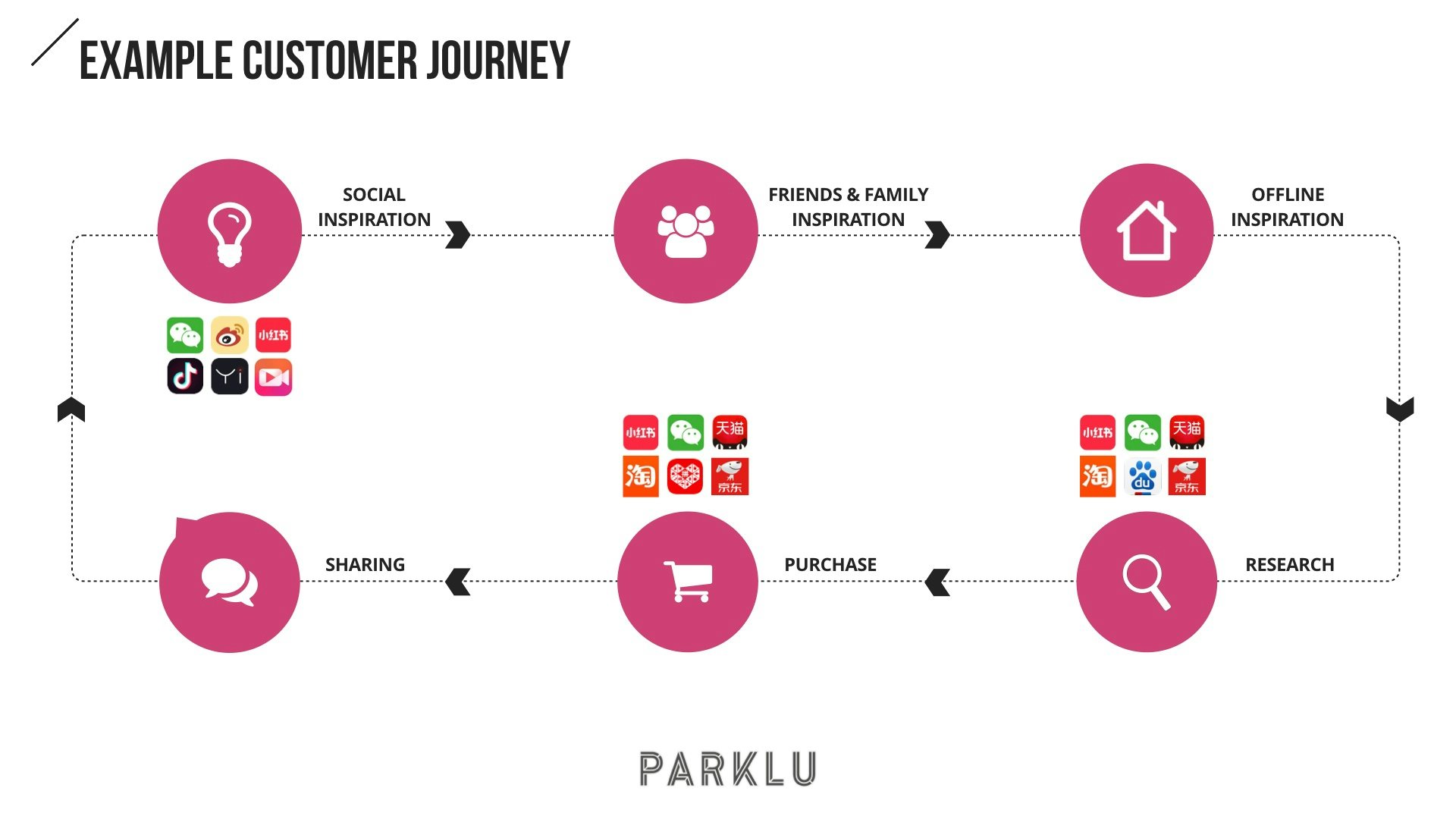

This is compared to just four for Western shoppers, according to McKinsey China. Ultimately, it means there is an extremely low chance of a Chinese consumer making a purchase after a single point of exposure. For most followers, a WeChat, Weibo, Douyin, or similar post serves as the source of inspiration, after which they might embark on a journey to discover more about the product. The typical customer journey in China can include seeking additional social proof from family and friend, search on e-commerce platforms—if the brand is wellknown—or Baidu, if they’ve never heard of the brand before. Xiaohongshu is quickly becoming China’s Social Search Engine, playing an increasingly important role in many consumer goods categories for women between the ages of 18 and 35. And still in China, only 18 percent of consumer goods products are purchased online, so the vast majority of purchases ultimately happen offline. Offline purchases make drawing a direct correlation between KOL exposure and the final purchase impossible in most case.

Thus,

a brand’s status matters#

when it comes to sales generation. “If you’re a well-established brand and no one needs to research you, you can expect a higher conversion rate as long as the product you’re selling is accessible,” says PARKLU CEO Kim Leitzes. Brands can’t expect an immediate effect on sales if consumers are going to need seven more touchpoints along the shopping journey.

Not all products lend themselves to immediate sales generation.#

More affordable products that are not necessities, yet consumers use constantly (such as cosmetics or fragrances), are going to lend themselves to a sales conversion that’s easier to track. FMCG products, on the other hand, are more difficult to track because they’re daily use products—for example, it’s not likely that a consumer would immediately purchase a bottle of Coke just because they saw a KOL post about it, but they might remember that KOL post when they head to the grocery store later that week and they see the bottle of Coke on the shelf.

A pricey pair of shoes or a handbag can be even more difficult as these are often investments that take more careful consideration from the consumer.

Brands might mistake the now famous accomplishments by fashion KOLs like Mr. Bags as an example of direct sales conversion; after all, the handbag guru has is known for selling an entire Tod’s capsule collection of 200 pieces in just a few hours. But it’s important to note that the sales generated by his posts are not really a measure of sales generated by the brand if one considers the actual percentage of flash sales on WeChat compared to the brand’s entire sales target in the market. Instead, these types of collaborations go towards building awareness to drive other sales—and their successes raise the media value of the KOL. More on that below.

Tracking sales conversion isn’t always straightforward.#

“There are a number of reasons why it’s hard to track conversion,” Leitzes says. “Let’s say someone talks about a product in a WeChat article and then the natural behavior of consumers is to go on Tmall or Taobao. So as a brand, how do you know that article drove the activity on Tmall? You don’t.”

Tmall has no digital connection to WeChat—most social commerce sales on the app are links to JD.com or run through WeChat mini-programs. “So that’s why if brands only look at direct sales, the challenge is obviously if they’re running multiple methods then they need to isolate that KOL’s specific activity,” Leitzes explains. “Hence, we use the idea of media value as a way to benchmark what was my KOL activation today versus next month or last year and then looking at your relative impact on sales over a period of time.”

What is Media Value?#

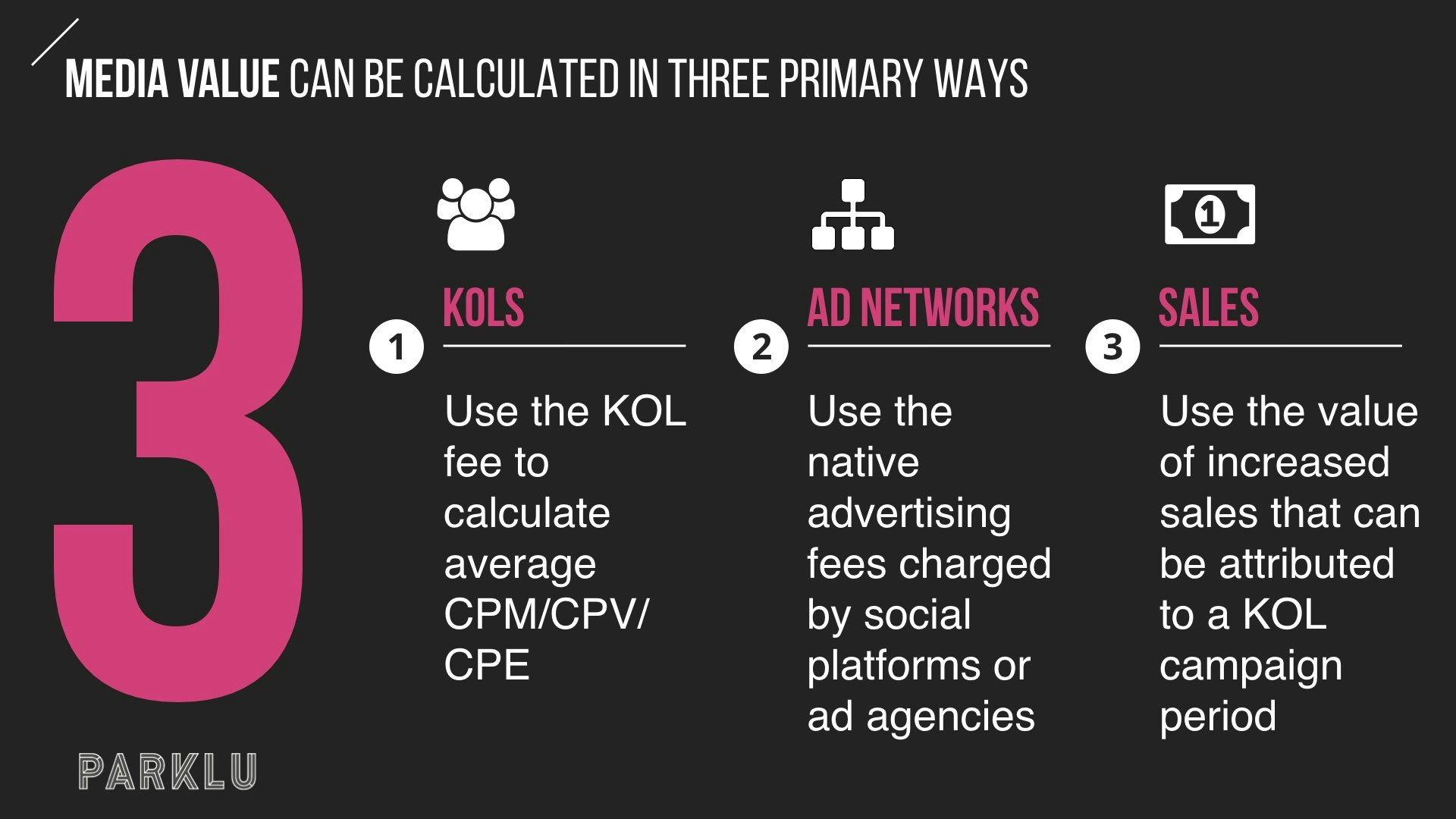

When a brand assess how a KOL collaboration might impact their ROI, it’s important to remember that the value of a KOL is one that is measured not simply by their reach, but by their ability to interact with a potential shopper at all points of their customer journey. Obviously, most hope that Media Value will be underpinned by sales generation value. And it can be, but, sales generation value can only be assessed on a case by case basis as every business will have different sales revenue. Because the supply and demand economics active in ad networks dictate the value of an impression, we can trust the average accepted impression value is a fair valuation as it is based on sales generation metrics. The average impression value for any given social platform is what PARKLU uses to determine the Media Value generated by KOLs.

So what does media value mean for sales generation?

The Takeaway for Brands#

If a brand can understand the unique value of a KOL impression, they can refine predictive metrics that will lead to KOL initiatives which guarantee ROI.

“I don’t tell brands that if you spend $1,440 (RMB 10,000), you’ll make these many sales—it’s just not that simple,” Leitzes says. “Ultimately, brands are working with KOLs not just for the sale, but they may want branded content or community growth, or there might be multiple objectives to what they’re trying to achieve. Obviously, marketing is aimed at eventually leading to sales, so it takes consistency through working with KOLs every month, looking at the data to see what works and then understanding the context.”

This post originally appeared on ParkLu, our content partner.