Over the last five years, the Chinese fitness market has experienced exponential growth, thanks to growing attention towards wellbeing and a host of convenient ways to learn more about how to achieve better fitness, such as video tutorials, live streaming, and apps.

In 2021, China’s fitness industry was valued at 7.5 billion. Today, with an estimated 435 million people partaking in fitness activities, the sector shows no signs of slowing down. The government has also made promoting sports and exercise a priority in the 14th Five-Year Plan (2021-2025). Moreover, by the end of 2025, it is estimated that 38.5 percent of Chinese citizens will be regularly participating in some form of physical activity.

Yet, the ongoing pandemic has changed the way people partake in fitness. Today, instead of going to the gym, the gym has become part of their home, with a phone and an exercise mat the only equipment needed to workout.

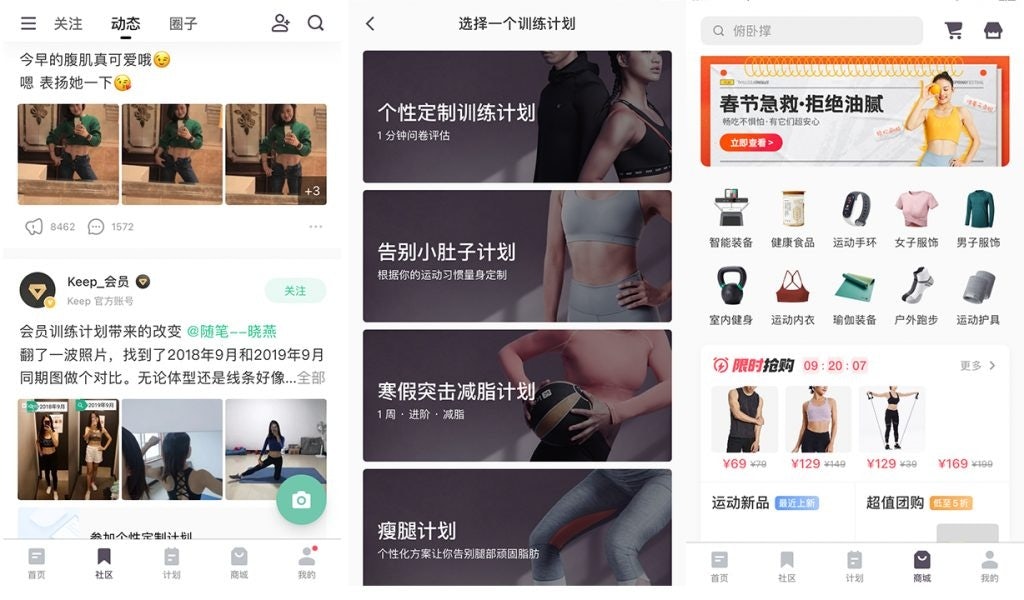

As home fitness increases in popularity, a number of local online fitness apps have taken root. One of the most popular of these, Keep — which provides users with exercise monitoring and guidance, Instagram-like social networking, and sports equipment sales — might also be a unique way for global luxury brands to reach this lucrative and largely untapped market.

To date, some brands have already jumped on the fitness bandwagon, launching sportswear lines (Fendi, Moncler, and Prada) or technological equipment (as in the case of Dior’s Technogym). Here, Jing Daily explores whether a fitness app like Keep can help luxury brands reach China’s growing fitness-crazed consumers.

Why Keep is dominating the sector#

Keep is a one-stop solution featuring all kinds of exercise activities, from short exercise videos to joining live, interactive classes (Zumba, anyone?) to personalized training via an extra membership fee. A unicorn in the field of online fitness, it has amassed an impressive 300 million users since its launch in 2014 and now dominates the fitness sector in China.

More interestingly, Keep also offers a community space, where "Keepers" [what the platform’s users are nicknamed] can share posts of their achievements, training sessions, or product recommendations. The platform has recently expanded and now e-tails mid-price sports-related goods itself — fitness equipment, athleisure wear, and healthy snacks.

By giving users the benefits of a yearly gym membership without the travel and expense, Keep’s popularity continues to expand. “People are constantly finding ways to make life easier, more convenient, and quicker, doing it at the comfort of their home,” Andrew Spalter, Founder & CEO of East Goes Global, explained. Subsequently, an extensive number of renowned fitness trainers, like the German influencer Pamela Reif have also spotted the consumer shift and joined the platform to share their courses online.

How can luxury leverage Keep?#

Still, fitness trainers are not the only ones making money on Keep. Access to the site’s 300 million users and its community space could be highly attractive to international sportswear brands as well. Lululemon, New Balance, and The North Face have already launched promotional campaigns on the platform.

In 2019, the Canadian brand Lululemon partnered with Keep, offering online yoga classes with top instructors; those who attended the course for 21 days in a row were gifted a professional yoga mat and had donations made on their behalf to charity projects. In the company’s Q3 2021 earnings report, the high-end yoga clothing brand achieved a compound growth rate of 70 percent in China in the previous two years — significantly exceeding the overall growth rate of the market outside the mainland.

Thus far, global luxury houses have yet to experiment with the app but, according to Spalter, this would be a smart business play for high-end brands that want to tap the growing fitness trend. “If you are taking time to workout and eat healthily, you would like all the other aspects of your life to meet that. Why not have the option to purchase Gucci or Dior sportswear?” In that case, Keep could help high-end brands unconnected to athleisure with an entry point to throngs of Chinese fitness fans.

However, given the exclusivity of luxury brands, positioning could be problematic. “The content must align with both the brand and the platform’s image and positioning,” Spalter added. Special sponsored courses with star instructors exclusive to VIP members, unique nutrition guides, and limited edition merchandise are just a few options for high-end names. Besides simply offering “luxury,” the initiatives have to resonate well with Keep’s users to create meaningful connections.

Increase appeal to non-traditional luxury consumers#

The beauty of Keep is that it has a low entry point. Anyone can download the app and access most of its courses without starting fees. Those who want a customized training plan can have one for as little as 1 (9¥) per month.

“Brands such as Gucci, Burberry, and Balenciaga wouldn’t mind collaborating with everyday brands. This is because they are not attracting the top, elite clients,” said Laura Pan, Professor of International Business at SDA Bocconi School of Management. “Gucci has collaborated with The North Face, Balenciaga with Gap. They are probably looking to increase market share, so advertising to non-luxury consumers could benefit them.”

Having said that, brands may risk diluting their image when partnering with the platform. “This is not the same as brands such as Chanel, Hermès, and Dior, which has a reputation for its high barriers of entry,” says Pan. “If a luxury brand were to work with a third party that it’s not in the same luxury positioning, it can be seen as a brand trading down.”

On top of this, there is an ownership factor. Brands would be unable to gather their own consumer data via the Keep app, as fitness fanatics would likely remain on the app instead of being directed to the brands’ own channels — another entry hurdle. But China’s vast fitness segment has been noticed by global luxury brands. Even Hermès has been tempted; it launched a fitness class on its WeChat Mini Program.

Given the popularity of Keep, and the overall fitness market in China — especially now, as China comes off the heels of the Beijing Winter Olympics — global luxury brands would be wise to explore what’s possible, if they haven’t already. Let the games begin.