What happened

Southeast Asia and India are poised to be the next “gold rush” markets for luxury beauty; they are expected to almost triple in size in 10 years.

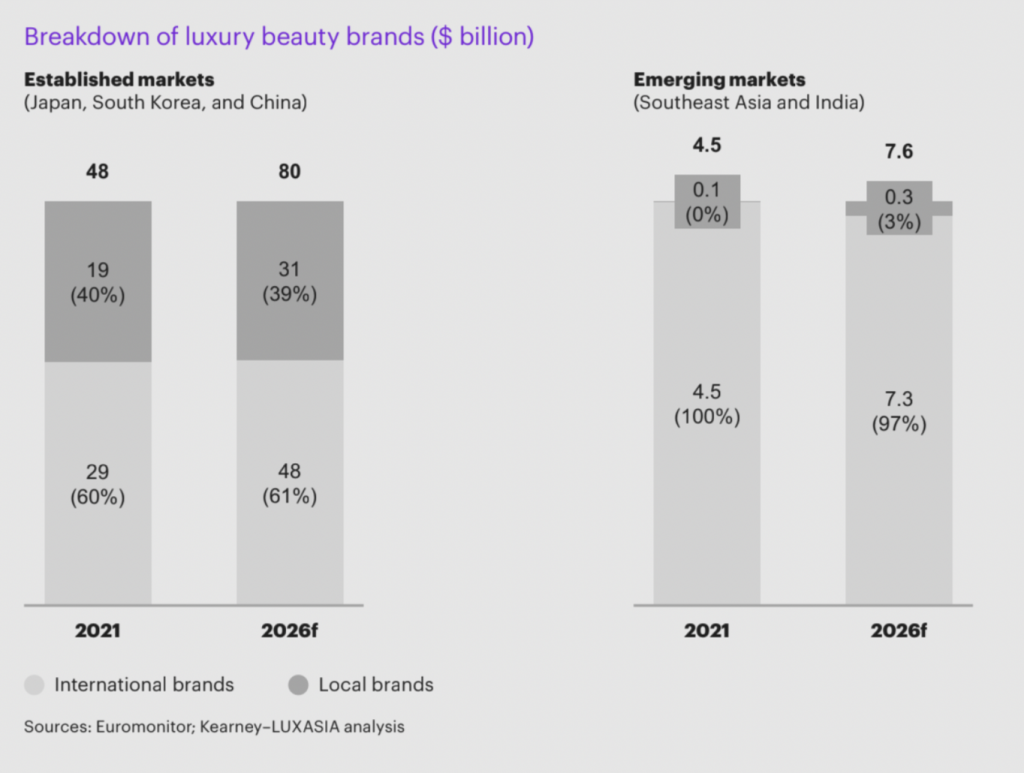

According to a report released by global consultancy Kearney and beauty e-commerce platform Luxasia earlier this month, the two regions together will grow in size from 4.5 billion in 2021 to 12.7 billion in 2031 at a CAGR of 11 percent, compared to the estimated global luxury beauty industry growth rate of 4 percent to 6 percent.

“Southeast Asia and India should be on the agenda of every global luxury beauty CEO,” said Siddharth Pathak, Senior Partner, Head of Consumer Industries and Retail for Asia Pacific at Kearney, in a release. “To emerge successful in a competitive landscape, brands should have a cohesive strategy to cut through the noise and tap on the power of digitalization, data analytics, and ecosystem support to improve their offerings and overall resilience.”

The Jing Take

While China is still a huge market for luxury beauty, new entrants may struggle to find their footing there. On top of the intense competition from international brands like Chanel and Dior, which entered early and now have deep relationships with consumers, domestic players like Florasis and Chando have bolstered their in-house R&D and distribution networks to carve out market share for themselves. It’s a crowded landscape.

In contrast to China and other North Asian markets like Japan, Southeast Asia and India are relatively unsaturated, with a limited presence of luxury beauty brands and compelling local ones, the report states. Specifically, Kearney names India, Thailand, Vietnam, Indonesia, and the Philippines as the most promising luxury beauty growth markets; in fact, a separate report by BMI predicts that a quarter of Indian households will reach 10,000 in annual disposable income by 2027.

But expanding to Southeast Asia and India isn’t straightforward. There is significant demographic diversity in terms of product preferences and consumption habits. Consumers in the Philippines, for example, favor American brands like Calvin Klein and Ralph Lauren and tend to purchase in small basket sizes due to their lower average purchasing power.

Those in Vietnam, unlike the rest of the region, prefer eau de parfum formulations over eau de toilette, and to a large extent buy based on KOL reviews and user-generated content.

But every market has its challenges. As Wolfgang Baier, Group CEO, Luxasia, puts it: “This golden window to capture accelerated growth cannot be missed.”

“Existing market brands ought to rejuvenate their omnichannel presence, adding greater operational agility, to better navigate market developments,” Baier said. The report also noted that Southeast Asia “has traditionally been an online marketplace economy and not a brand.com play,” meaning that e-commerce marketplaces and social commerce are essential, despite seeming like the antithesis of luxury beauty.

Given the advantage for early movers, new entrants must act swiftly to strike gold or risk striking out.

The Jing Take reports on a piece of the leading news and presents our editorial team’s analysis of the key implications for the luxury industry. In the recurring column, we analyze everything from product drops and mergers to heated debate sprouting on Chinese social media.