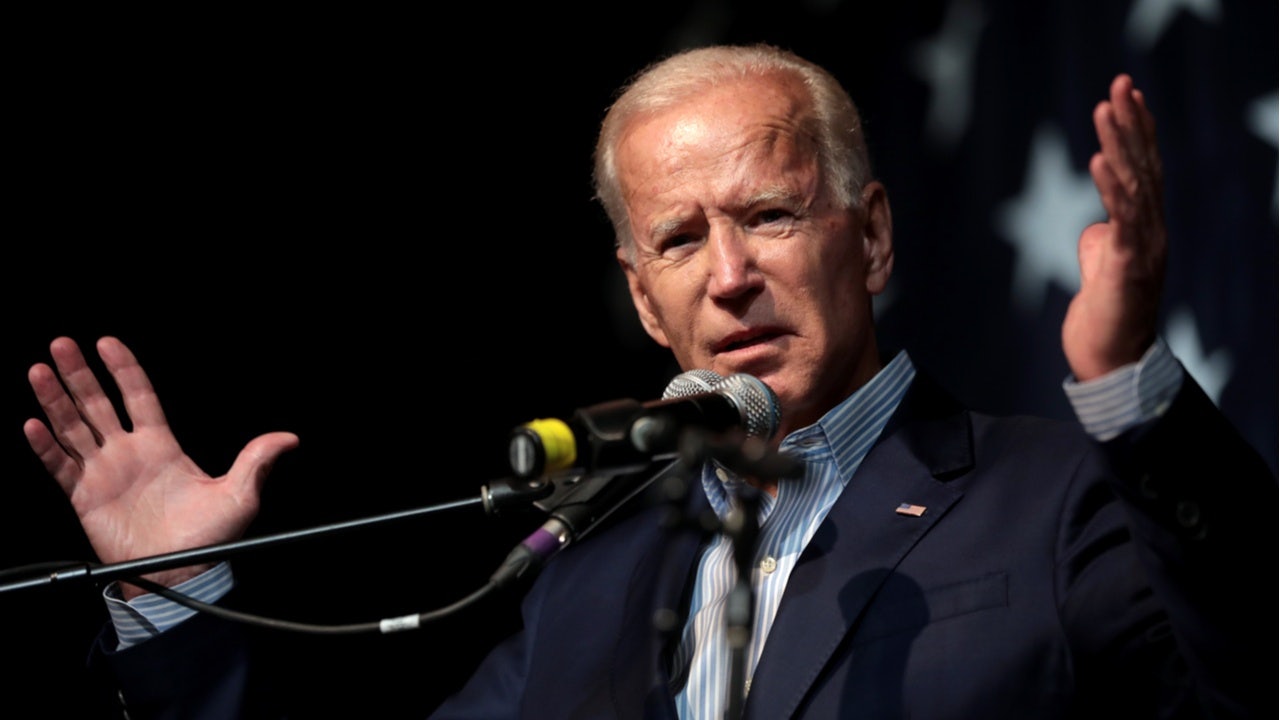

Update published November 7, 2020:#

Joe Biden has been elected the 46th president of the United States. Kamala Harris will be the next vice president of the United States, marking history as the first woman and woman of color as vice president.

Read below for our analysis of what the Joe Biden and Kamala Harris win will mean for luxury and US-China relations.

Original article published October 31, 2020:#

Key Takeaways:#

- A survey by Glossy/Modern Retail found that 46.8 percent of those polled agreed that the US economy would improve with a Biden win. Only 12.9 percent expressed the same confidence for Trump.

- While Biden has not indicated any sharp improvement in the US China relationship, commentators agree his tone and approach would stabilize what has been in recent years a negative trajectory.

- Biden’s tax plan might result in some stock market volatility. This will likely have some impact on the propensity and capacity to spend on discretionary items too — that includes luxury which is not a necessity.

2020 can’t end fast enough. But before it does, we still need to plough through a COVID-19 winter and the results of the US presidential election. Nothing is ever certain, but the early voting numbers already exceed 2016’s levels, indicating that President Trump’s challenger, Democratic nominee Joe Biden is leading. However, don’t hold your breath; the US has a long history of controversial election results.

Much of the electorate (and wider world) would presumably have hoped to see a democratic nominee bring some diversity to the White House. To his credit though, Biden has chosen his running mate cleverly: Kamala Harris is the first woman of color on a major party ticket and more than two decades younger than him— given Biden’s age many might see her as the real candidate.

For the many voters tired of the theatrics of politics, Biden is a welcome return to the centrist, status quo. An experienced career politician: 36 years in the Senate plus eight years as Vice President under President Obama.

This is not Biden’s first stab at the Presidency: a plagiarized speech (from the UK Labor leader Neil Kinnock) put heed to his 1988 run. In 2008 he failed to secure the Iowa caucus. And, no stranger to tragedy, another attempt in 2016 was derailed by the tragic and untimely death of his son, Beau. Now he is back, but are his policies any better than Trump’s?

So far, Biden’s legacy is mixed. It includes 1990s Violence Against Women Act seen as a win, yet he spearheaded the heavily criticized Crime Bill of 1994. He endorsed the Iraq war in 2002 — an act he claims he immediately regretted. Yet, President Obama’s administration was as war-mongering as Bush: in 2016 alone, it dropped over 26,000 bombs — approximately three bombs every hour per day for the entire year. Given this, we can only hope he is now as anti-war as he claims to be.

Furthermore, during the Great Recession (between 2007-2009), Biden helped lead the slowest economic recovery since World War II. 93 percent of the counties in America failed fully to recover. Despite this, 2020’s campaign sees him basking somewhat in that government's achievements, and Biden was credited with turning around Obama’s second run in 2012 in his face-off against Paul Ryan.

When it comes to health care, played a large part in Obama’s controversial Affordable Care Act. He now wants to prop this up with a public option but is against Sanders’ Medicare For All. Still, overall, Biden is considered to be the more progressive of the two: he supported gay marriage, condemned racism and promised to rejoin the Paris Climate Accord if elected. In fact, his green policies are more than good news for the environment.

This neoteric outlook sits well with the fashion sector. Numerous industry leaders supported Trump’s 2016 campaign rival, Democrat Hilary Clinton: Ralph Lauren and Calvin Klein among them. The sector is even more politicized now; companies and influencers around the country are urging the electorate to vote, taking to the likes of Instagram to voice their support.

Julie Gilhart, President of Tomorrow Projects and Chief Development Officer of Tomorrow Ltd., stated that Biden is “engaging with top brands on many fronts. This includes the clothing and accessories collection titled 'Believe in Better' from the Biden Victory Fund that enlisted some of the most celebrated designers like Thom Browne, Tory Burch, and many others.”

Almost twenty high profile designers from Jason Wu to Vera Wang supported the campaign. Donna Karan, Michael Kors and Anna Wintour have all joined Biden's ranks too. Supermodel, Karlie Kloss, the sister in-law to White House adviser, Jared Kushner, joined team Biden in September. Biden is no stranger to the industry himself; his daughter Ashley has a conscious hoodie brand called Livelihood.

A survey by Glossy/Modern Retail found that 46.8 percent of those polled agreed that the US economy would improve with a Biden win (only 12.9 percent expressed the same confidence for Trump). And, with only days to go, but potentially weeks until a clear result, Jing Daily looks at what impact a Biden win would have on luxury and US-China relations.

Could Biden Quell US-China Tensions?#

The US is deeply divided. Much of Biden’s immediate focus will be on internal domestic affairs, and in the run-up to this election, he is equally as lack-luster as Trump when it comes to international trade. Frank Lavin, Founder and Chairman, Export Now (China E-Commerce and Market Entry), noted that “little would change” in this area should he take office.

“A Biden victory would not resolve the complicated geopolitical issues in the relationship,” he explained. “But, it would improve the tone and public discourse. It might be difficult to see a sharp improvement in the relationship, but at least we would stabilize what has been in recent years a negative trajectory."

Trump’s anti-China rhetoric can be viewed through the prism of the legacy of the Obama and Clinton administrations. Obama expanded global trade, including with China. Under these presidencies, in particular, China’s economic star rose. Subsequently, and in no uncertain terms, Trump has branded China’s growth under these leaders as a threat to the world.

A desire for civility in politics is now back in fashion. Gilhart thinks Biden would come to the table with “a much more level approach to balancing domestic and international trade.” She cited one of Biden’s Senior Economic Advisors, Ben Harris, as part of that reasoning. In the past, Harris commented, “Biden is not blindly pro-trade, but he doesn’t want to shrink from the world as President Trump has.”

Moreover, despite calling Trump’s trade war as “self-destructive,” Biden has so far has not pledged to remove tariffs. China poses “an existential threat” for him, though Lavin was equally optimistic regarding discourse. Regardless of whether tariffs are cut or not and virus permitting, he said Chinese tourists may be tempted back to the US under Biden’s more restrained discourse.

“Any steps that lower the rhetorical temperature in the bilateral relationship will provide a modest boost to travel and tourism. Biden, in terms of personality and demeanor is less likely to engage in public criticism of other nations,” he offered.

What ‘Build Back Better’ Means for US Fashion#

Biden’s ‘Build Back Better’ campaign and America-focused policies argue for American-made goods, bought in the US — but in a less bullish way than Trump’s MAGA. Gilhart, who lives in New York, suggested that his proposals show he aims to: “encourage American companies to develop US-based jobs and build up industries at home.”

She continued: “Gabriela Hearst recently spoke about the fact that more than 400,000 small businesses across the country have collapsed in the wake of Trump’s management of the current crisis. Many of these businesses are a part of the fashion industry. Having domestic production would greatly decrease difficulties caused by the coronavirus.”

Indeed, remunerative plans under a Biden administration should have a strong boost to the US domestic economy. This comes by holding wealthy Americans and corporations to account for their appropriate share of tax. According to Tommy Wu, Lead Economist at Oxford Economics, this should make American households better off in general, “including the consumers of luxury goods.”

Under a Biden government, Wu predicted, “the US will likely form a “common front” with its traditional allies on China-related issues,” though he didn’t expect “significant decoupling” would happen. If it did though, it could well have unintended negative consequences on luxury.

“More decoupling could still give a boost to China’s homegrown brands as China will turn to more self-reliant companies and there could be a rise in nationalistic sentiment to some degree. This will lead to increasing competition for luxury brands from the West,” Wu added.

Post-election, the Chinese consumer remains key#

Luxury goods analysts have been keen to argue China’s dominant role going forward in luxury. In 2019, China’s consumers generated 35 percent of global luxury spending - American consumers generated 22 percent. This was even before COVID-19 and China’s economic recovery. Western brands have accepted the importance of the luxury Chinese consumer but more recently, they have been battling nimble local brands on home territory.

Luxury analyst, Flavio Cereda-Parini, Managing Director at Jefferies International Limited, went so far as to say: “In order to perform (niche brands are the exception), they need to resonate well in China. We are seeing this already in 2020. If you were lagging behind pre-COVID, now it’s a disaster — the gap is so big that it is opening up.”

Furthermore, if a brand is reliant on consumers but its government has a negative policy against their country, this may well hamper businesses clearly reliant on China. “The personal luxury goods sector is entirely about Asia. The US is holding up, Europe will bounce back, but these markets haven’t been growing for years. Any expansion is simply coming from Chinese travelers,” Cereda-Parini explained.

He also pointed to a potential boost for resellers but was adamant that all the market share gains from brands are coming from Asia — or more specifically China. “In luxury malls, the top 10 brands were getting 45 percent of revenue, but now it's 65 or 70 percent and that’s reflected in the revenues. It would have happened anyway eventually but due to the virus we got there in six to eight months.”

His finaly issue was stock market volatility. “In the US there’s a lot more wealth tied up with the stock market compared to Europe, where tax is high already. There will be some impact on the propensity and capacity to spend on discretionary items and that includes luxury which is not a necessity,” he summarized.

On and off the record, reports paint an ugly picture if Trump is re-elected: much social unrest is anticipated; retailers are stocking up in preparation, and brands have crisis plans in the pipeline.

Four years ago, Hilary Clinton won the popular vote but lost the Electoral College. Before that, Al Gore had his election result stolen in a contested Florida. This is likely the most eagerly anticipated election in US history and the world is watching.

Will Biden’s positive poll numbers hold and usher in a new presidency or will more chaos reign? The world awaits.