As the 2022 China-Italy Year of Culture and Tourism passes, Italian food producers saw their exports to China drop almost 30 percent from the previous year. This should come as no surprise. The pandemic has meant few opportunities for travel between the two countries, and import costs have been hit hard over the past three years.

But there is one category of Italian food brands that have managed to weather China’s COVID-19 storm (at least, better than others): luxury. What will 2023 bring for this sector?

Storied Italian names such as winemaker Marchesi Antinori, LVMH-owned pastry chain Cova, and fine chocolate brand Amedei all have a presence in the country, and industry insiders say they’re likely to have done better than most. After all, this is the decade that Moët Hennessy’s CEO called the new “Roaring '20s.”

“The market for luxury Italian foods hasn’t really been impacted. Things like truffles and wine see constant demand, and actually, even with rising prices, we’ve seen increased demand,” says Francesco Ye, founder of iTaste, an agency that promotes Italian enogastronomy.

But these brands understand that with movement restricted until very recently, it has been difficult for the Chinese consumer to be immersed in Italian culture — an essential prerequisite for firms trading on history, pedigree, and tradition.

This led to a change in operations. Many saw the potential of the mainland's vibrant online ecosystem. The idea was that digital initiatives could lay the foundations for profit come Beijing’s relaxation of the rules. In this process — more connected and interactive than conservative approaches — these labels witnessed firsthand how a nation’s changing tastes could inform both branding and campaigns.

A playbook for navigating COVID#

Even as food establishments shut down across China, the country’s extensive e-commerce penetration and world-class logistics infrastructure threw a lifeline to food brands of all kinds during COVID-induced lockdowns. Italy’s high-end food makers were no exception.

“The development of the presence of Italian products on e-commerce platforms in China [...] has allowed many Italian producers to grow in China even without being able to travel and to deliver their products directly,” explains Massimiliano Tremiterra, trade commissioner at the Italian Trade Agency’s Guangzhou office.

But unlike mass-market brands, many exclusive Italian food producers also worked with specialized importers, who were vital to industry leaders in navigating COVID’s uncharted waters.

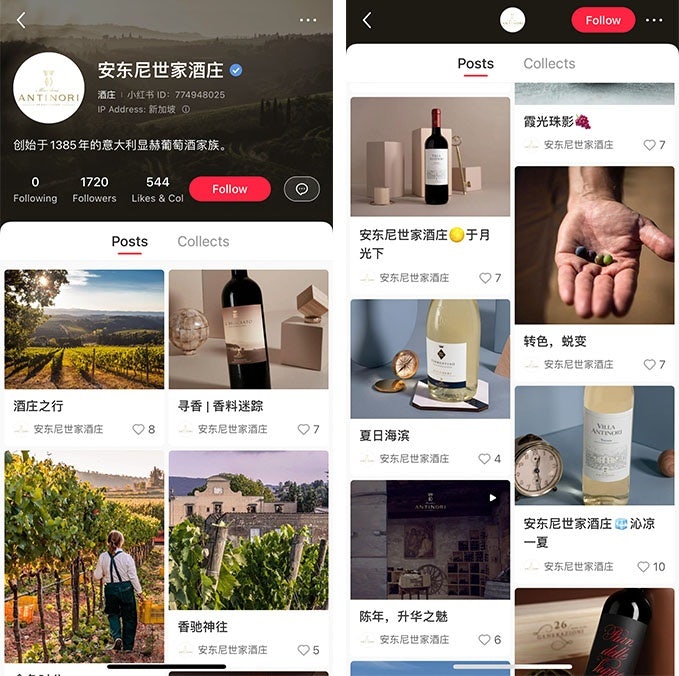

“These professionals have allowed us to maintain a constant presence on both public channels [such as restaurants] and private ones, like events and dinner parties,” affirms Albiera Antinori, president of wine company Marchesi Antinori. She adds that a social media presence on channels like WeChat and Xiaohongshu also played a key role in keeping business communication activities alive during lockdown.

Is the Chinese palate changing?#

For many Chinese gourmands, their experience of fine Italian food comes from restaurants. COVID hit these hard. “Before the epidemic I would often take my family to Italian restaurants in Sanlitun [a neighborhood in Beijing],” Li Manman, a Beijing-based architect, remembers. “But in the three years of the epidemic we have only been there once.”

One might expect that, cut off from both the country itself and its representative establishments, public taste might have changed. Antinori disagrees: If anything, absence makes the heart grow fonder. “Exactly because people haven’t been able to travel, I think there has been an increased desire for Italian food and gastronomy.”

Indeed, of China’s six Michelin-starred Italian restaurants, three have received stars in the last two years, showing that demand here might only be getting started. “It is a way to experience a bit of Italy without traveling. Some luxury restaurants such as Da Vittorio or 8 1/2 Otto e Mezzo offer a range of beautiful products and dishes, and a great atmosphere as well,” remarks Richard Krystkowiak, managing director of Sopexa China, a communication agency focused on food and beverage brands. This fondness for quality — borne from years of isolation — is good news.

And it isn’t the only unexpected upside. The increased scrutiny for food safety that followed the outbreak has benefitted purveyors of fine Italian products. “The Chinese consumer is increasingly attentive to the quality of the product. And they are better able to recognize products that enjoy quality certificates such as PDO and PGI marks,” observes Tremiterra. He notes that Italy’s trade agency has been active throughout COVID with information campaigns aimed at educating the Chinese public on the finer aspects of Italian gastronomy. Plainly, it’s worked.

Adapting to a China ever hungrier for fine Italian food#

Three years of largely online-only interactions meant that brands had to learn and adapt. Their relationships with clients were transformed. And Beijing’s recent relaxation of restrictions signals a new era, one where the deployment of this knowledge will be crucial. The next few months of reopening will possibly be the most competitive for luxury food producers around the world. They will have to fight to remind China exactly what it’s been missing.

“Adopting a strong digital strategy involving Chinese KOLs and educating Chinese consumers about Italian food would be an effective way to widen their reach in China. Storied Italian food producers cannot just rely on their brand heritage. They need to tell their story to local consumers and enhance their brand awareness,” argues Antonello Germano, marketing manager at Daxue Consulting, a research firm focused on China.

Several high-end Italian food groups have been preparing for his moment expectantly. Acquerello, a firm selling Italy’s famed risotto rice, had already been making the arrangements with importers. “We are getting ready to present our products and brand to China’s luxury market,” enthuses founder Piero Rondolino.

COVID offered an opportunity for brands to reset their go-to-market strategies in China, Tremiterra believes. His advice is that businesses should develop better structured on-the-ground operations: opening their own offices, production sites, or sales outlets managed directly by the Italian company with a Chinese partner.

However, Sopexa’s Krystkowiak holds that a love for Italian gastronomy can only truly be developed on a trip to the Bel Paese. “We are in a digital era, and it’s important to relay all that information through social media and influencers. But food is about tasting, experiencing,” he maintains. “While the amplification is necessary, the ultimate goal remains living it.” With international travel finally opening for the Chinese market, these opportunities may come sooner than later.