This post originally appeared on Content Commerce Insider, our sister publication on branded entertainment.

In this weekly series, How Chinese Tech Builds Trust, CCI aims to demystify the fundamentals that drive Chinese e-commerce, explaining why critical practices have evolved the way they have and helping brands predict what comes next. From the triggers behind Baidu’s downfall to the rise of social commerce, we’ve got you covered. And if you missed the first installment last week, give it a read here.

Digital Department Stores#

In most of the world, your

Nike#

s and your

H&M#

s sell through their own websites. They own the entire process — the branding, the user experience, the funnel, the data — and email you birthday discounts. Let's say you’re shopping on Nike’s site: it lives and breathes its brand identity. If you turn the volume up, you’re likely to hear Michael Jordan whispering Just Do It. Fairly effective. Other direct-to-consumer brands might use

Shopify#

. The

Casper#

s,

Allbirds#

, and

Warby Parker#

s of the world rake up millions with it.

But D2C looks different in China.

Close to 60% of all e-commerce sales in China take place within the

Alibaba#

ecosystem, while

JD.com#

and

Pinduoduo#

have a combined 25% market share. America's closest counterpart to

Taobao#

and

Tmall#

,

Amazon#

, commands 37% market share, and Shopify has just around 6%.

Asking whether or not this matters is akin to asking whether you want your customers shopping at a department store or your own store. Tip: it's the latter.

Content Feeds#

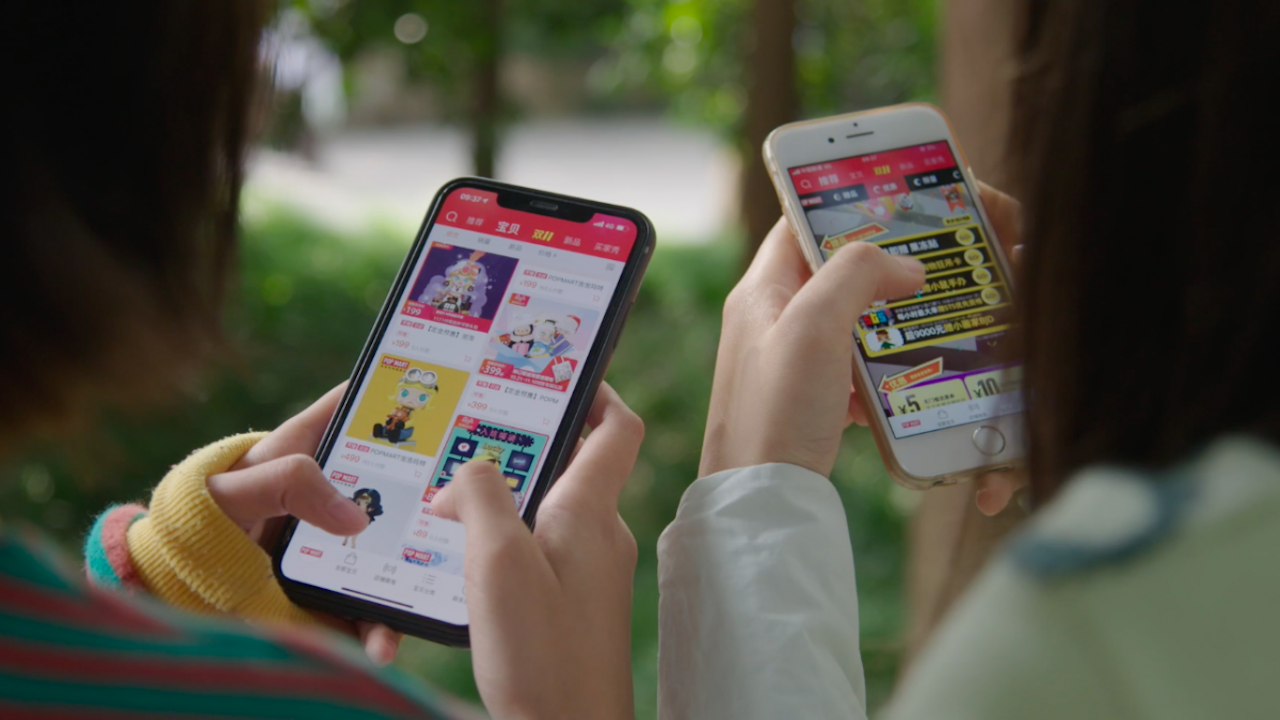

Most mobile web browsing experiences are terrible. I'd rather invest all my money in bitcoin (HODL) than use a mobile browser. So smart people developed apps. Americans spend 150% more time on mobile devices than on desktops, but in China, it’s 2.3x. Non-professional desktop usage is actually so low that it dropped from 2014 to 2015, while mobile leapfrogged, hard.

Taobao#

reinvented shopping entirely by taking a page from social networks, namely, content feeds. None of that static web stuff — Chinese feeds bring together product listings, reviews, and livestreams. Mine, for example, contains many cheese videos (high conversion rates). Existing as a mere sidebar, Amazon's "feed" is years behind, like its mobile experience generally. But I'm guessing Jeff Bezos doesn't need the money.

Taobao, JD.com and Amazon function as automated department stores. And while department stores are great for product discovery, they aren’t always so great for brands. Especially in China, where far less time is spent on brand-owned pages. As a result, brands are relegated to consumer data that platforms give them access to, which is not not nearly the same as owning your own channel.

Consumers become loyal to the department store, and less so to the brand. As Nielsen puts it: "With the overwhelming majority of consumers actively or passively open to unfaithful actions, the risks for brands have never been greater.” It’s a digital Temptation Island over here, and Taobao and JD.com are more like Tinder for brands than anything else.

Competitors are just a swipe away. So how can any single brand stand out?

Brand Differentiation#

Establishing a distinct visual identity is fundamental and you probably already do it. When a customer asks, "why should I buy your product?” be sure you know the answer. According to one study, 89% of Chinese survey respondents reported that loyalty programs make them want to spend more.

Highly engaged gated communities work too. Think status-as-a-service. For example, video streamer

Bilibili#

(previously on CCI) requires users to pass a geeky 100-question test (with questions such as, "where is Ultraman's homeworld?") in order to gain full membership privileges. It's not a bug — it's a feature and part of the platform’s appeal.

Content production, engagement, and storytelling are key elements when brand communication is taking place largely through feeds. Taobao has its own media ecosystem, its own user-generated rich media, its own livestreamers, and thousands of brands competing for eyeballs on its platform.

It's 2020, and all brands are media companies.

Bottom Line#

Anytime we talk about Chinese platforms (Taobao, WeChat, Pinduoduo, Xiaohongshu, etc. ) we are talking about mobile experiences. Even if some of these platforms offer a desktop experience, it tends to be lacking.

Another thing mobile platforms do great is seamless integration. No pop-up windows, no new pages loading. Everything is horizontally integrated, from payments to sales to every digital service imaginable. It’s as if

Mastercard#

,

Shopify#

, and

Facebook#

were all bundled into one product (that would be one hell of a congressional hearing).

What Do You Think?#

Amazon probably doesn’t have as much incentive to innovate.#

Alibaba is in a continuous arms race with JD.com, Pinduoduo, and other innovative contenders. Who is Amazon up against?

As a consumer, why are you loyal to brands?#

As a brand, why are consumers loyal to you? Visual identity? Loyalty programs? What else?