Historically, luxury beauty brands have based their identity on exclusivity, prestige, and impeccable service. And while they've prided themselves on being tastemakers and experts, this position has kept them from fully hearing their customers’ needs.

Luxury beauty today needs to engage directly with consumers to gain insights into changing behavior, define new trends, and enable advocacy. The challenge for luxury beauty will be how to embrace omnichannel outreach without compromising their brand values or expression — in other words, retaining their exclusivity and desirability.

Below, we’ve applied three "Beauty Barometers" to rapidly-evolving luxury beauty brands working in the APAC region:

E-commerce collaborations#

— From TMall's Luxury Pavilion to Farfetch's JD.com alliance, we look at high-ranking VIP brands as well as interesting newcomers.

Privilege programs#

– Once just for big spenders, membership programs now drive differentiation and marketing integrity. We monitor newly established programs and how they're implemented.

New Wave Brick & Mortar#

– There’s a slew of new-era beauty roadshows and luxury pop-ups happening all across Asia. We benchmark the most important breakthroughs that retain brand authenticity.

These barometers bring a wealth of insights into changing consumer behavior (everything from how to best introduce new products to trends in adjusting ingredients), helping brands understand where new spheres of influence are coming from, and allowing them to keep pace with this rapidly shifting landscape.

E-commerce collaborations#

Farfetch's recent merger with JD.com, which was meant to provide the "Premier Luxury Gateway to China" for luxury brands, illustrates a step-change within luxury beauty in Asia. This means Chinese customers will get 700 luxury brands with JD's same-day delivery speeds and highly professional service, and luxury brands with a local retail presence (Saint Laurent, Balenciaga) will have access to world-class omnichannel capabilities (i.e. ‘click & collect’ and in-store returns) that connect those brands' physical retail stores to consumers in China.

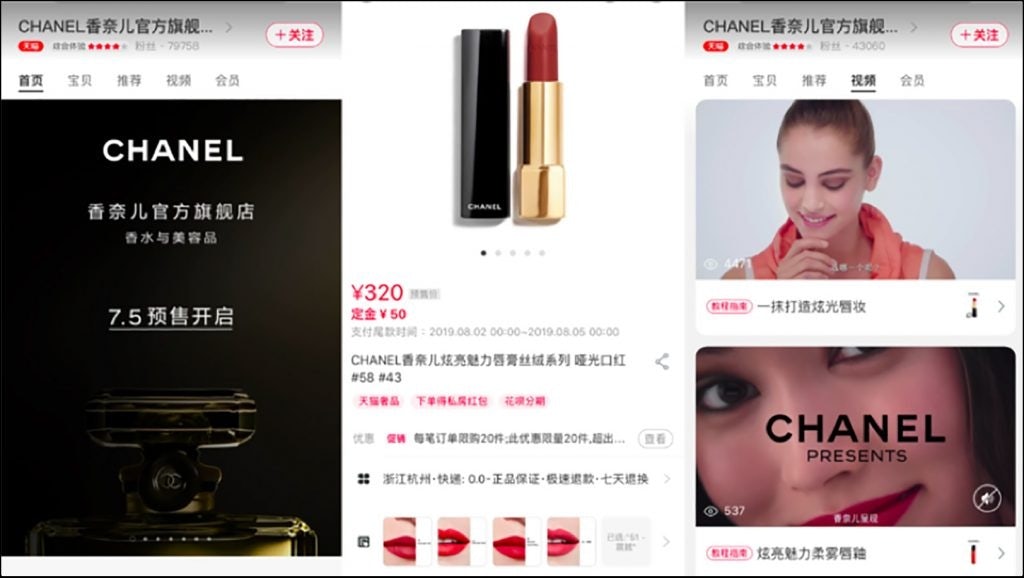

Alibaba’s Tmall Luxury Pavilion aims to bring the same brand exclusivity and tailored shopping to the world of e-commerce. In 2018, they invited iconic global beauty brands to participate, such as Burberry, Giorgio Armani, and La Mer. In 2019, it added Chanel, which was previously only sold offline and via its own online store.

Importantly, this year’s Pavilion introduced the South Korean brands Sulwhasoo and the History of Whoo, which reinforced that brands from South Korea can compete with European luxury powerhouses. Sulwhasoo is shifting from the hype of K-beauty to a more natural branding by slathering its website with mentions of “Asian wisdom” and “natural harmony.” This shows that they’re still trying to appeal to its biggest Asian market: China.

Tmall said the brands on this platform would be able to access the same tools to engage consumers that many of the brands selling through Tmall have used over the past year, such as virtual reality and augmented reality. They will also have omnichannel solutions that integrate online and offline commerce at their disposal.

Privilege programs#

After Chanel's online expansion, it can now offer real-time consultations from online beauty advisors and a membership program that provides members with exclusive new product samples and invites to offline events. The brand’s continuous integration of online and offline marketing builds a stronger network for members to experience first-hand offerings, which, in turn, improves brand loyalty.

As brands continue to adopt exclusivity programs to grow brand loyalty, their innovative products are strengthening the bond between members and brands while also appealing to a wider group of customers. Shiseido's recent launch of their personalized skincare subscription service, Optune, takes personal care to the next level by combining technology with the customer’s daily regime. The paid subscription model, which is exclusive to Japan, offers a new customized daily skincare practice with a personalized formula for twice-a-day use. This illustrates how Shiseido's innovation has built a unique program that has drawn a niche community of personal care specialists.

The future of membership programs is tapping into technological advances in the beauty industry to further forge a close-knit membership program that provides best-in-class specials for members. J&J offers one such example: the J&J 3D-printed personalized face mask, due to launch in Asia in 2020 and beginning with China. The product, MaskiD, is a tool that meets the needs of customers who want products that go beyond the one-size-fits-all category. This individualized solution then creates a sophisticated community on the lookout for privileged offers.

New Wave Bricks & Mortar#

We're seeing beauty luxury brands unleash their creativity in Asia by pushing their products in fresh, new ways that help drive social media exposure, thanks to popups and new takes on bricks & mortar. What we’ve seen across Asia is a movement toward making the exclusive truly available to everyday consumers.

Following the success of Clarins' Ice Cream Bar, we've seen similar success with Clarins' Garden. Customers can play an augmented mobile reality game where they 'catch' the plant extract ingredients that go into Clarins' Double Serum and explore 'washing machines' with materials hidden within for you to touch and experience that depict the different textures of their cleansers.

The Coco Game Center (by Chanel) kicked off in Tokyo and generated so much social media buzz, reservations were fully booked a week before it arrived in Shanghai. The game-themed pop-up stimulated fans to record their experiences and post them on social media, creating authentic branded content without the need for paid promotion. This helps to reach out to the younger consumers and expands the brand's customer base while improving sales.

Kathryn Sloane is the APAC Director of Growth Director, SGK. Kathryn sits on the APAC’s leadership team, helping drive growth in APAC, through creating, building, and protecting brands across channels, markets, and sectors.