China’s luxury market grew 20 percent year-on-year in 2018 for the second straight year thanks in part to millennials and women, according to the latest Bain & Company report, “What’s Powering China’s Market for Luxury Goods?”, released on Monday. In 2019, this growth is likely to continue but at a slower rate, indicating that brands should still look to mainland China for continued growth.

Here are the four key takeaways from 2018 and our suggestions on how brands can navigate the market in 2019:

Increasing domestic luxury spending is inevitable#

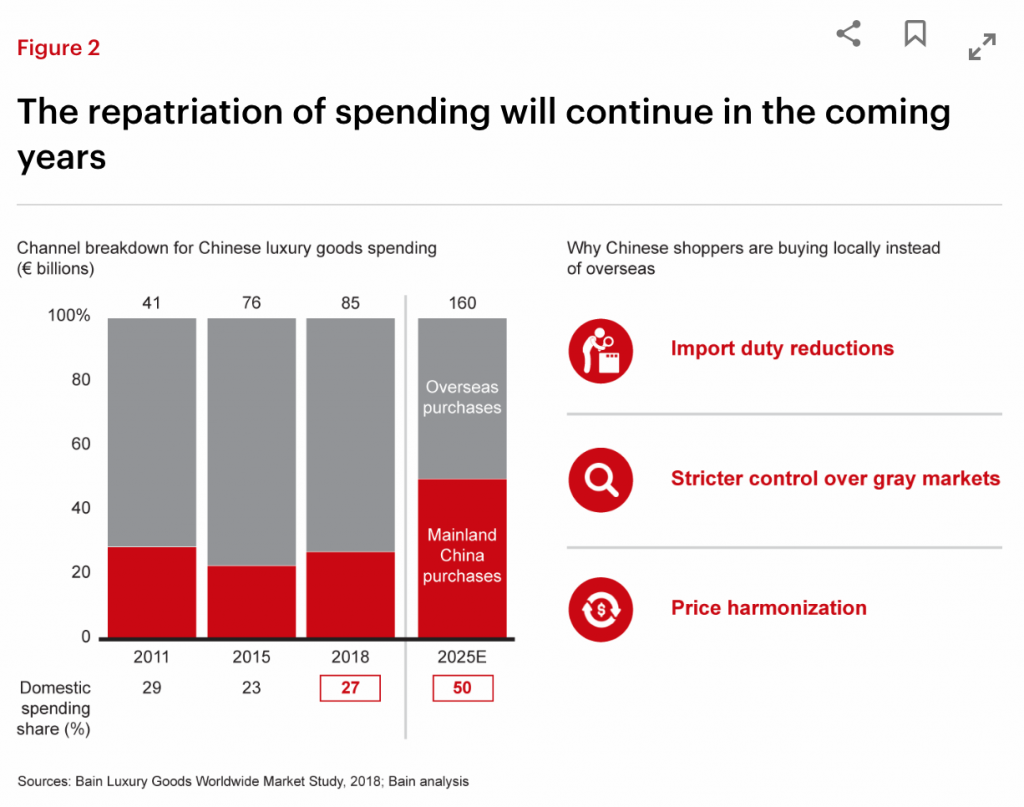

The Chinese government’s effort in boosting domestic consumption is showing — from 2015 to 2018, domestic luxury spending increased from 23 percent to 27 percent of the total spending. This trend will continue due to the government’s evolving policies, such as reducing import duties, stricter controls over daigou (shoppers who purchase goods overseas to sell in China to avoid import taxes). In addition, brands have narrowed their price gap between local and overseas markets in response to government initiatives since last year.

Bain predicts that by 2025, the disparity between luxury shopping abroad and in China will even out.

We believe that to prevent a sales slip, brands may need to shift their focus to China’s domestic market. The strategy to achieve this could mean continuing to narrow the price gap, allocating more budget to this market, and even granting more decision-making power to the local Chinese team when it comes to marketing.

The gap between winners and losers continues to grow#

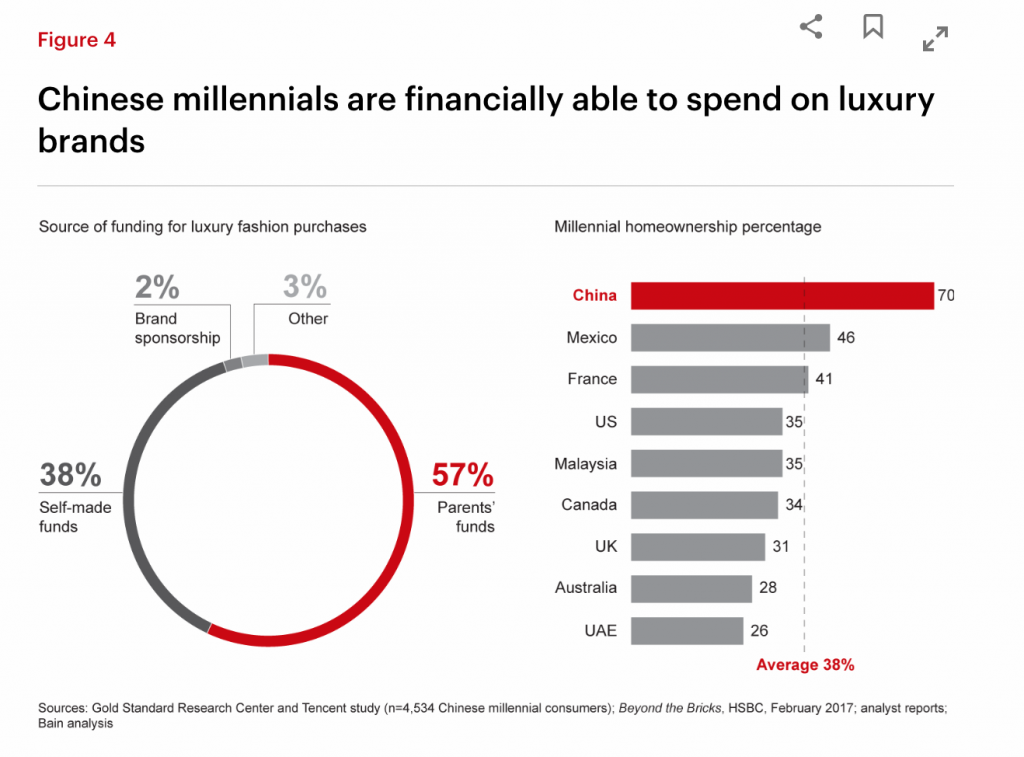

Major market changes can separate winners from losers quickly. Bain reported that this year the division is especially obvious. They wrote: “For every brand that grew by more than 25 percent in 2018, there were two brands that grew by less than 10 percent.” The winners quickly adapted market changes — their efforts include innovation on digital channels and influencer marketing; frequent product launches and refreshing images that also won over millennials.

Be warned, smaller players! It may be a rough road ahead amid increasing competition as bigger and more established fashion houses can put on extravagant campaigns in China and are willing to invest in the country, thereby “offset[ting] the increasing cost of doing business in China.”

The cosmetics sector was a big winner in 2018#

While the sales of online luxury goods are increasing, the cosmetics industry is the only sector that grew in terms of online penetration in 2018. The report concludes that it’s a traditional female category, “while watches, a predominantly male category, grew by less than 10%”.

We think it might have to do with the slowdown in China’s economy. While lipsticks have a lower price point, more millennial women have also learned to spend rationally, meaning they may opt to invest in skincare instead of other product categories like handbags.

WeChat awakening#

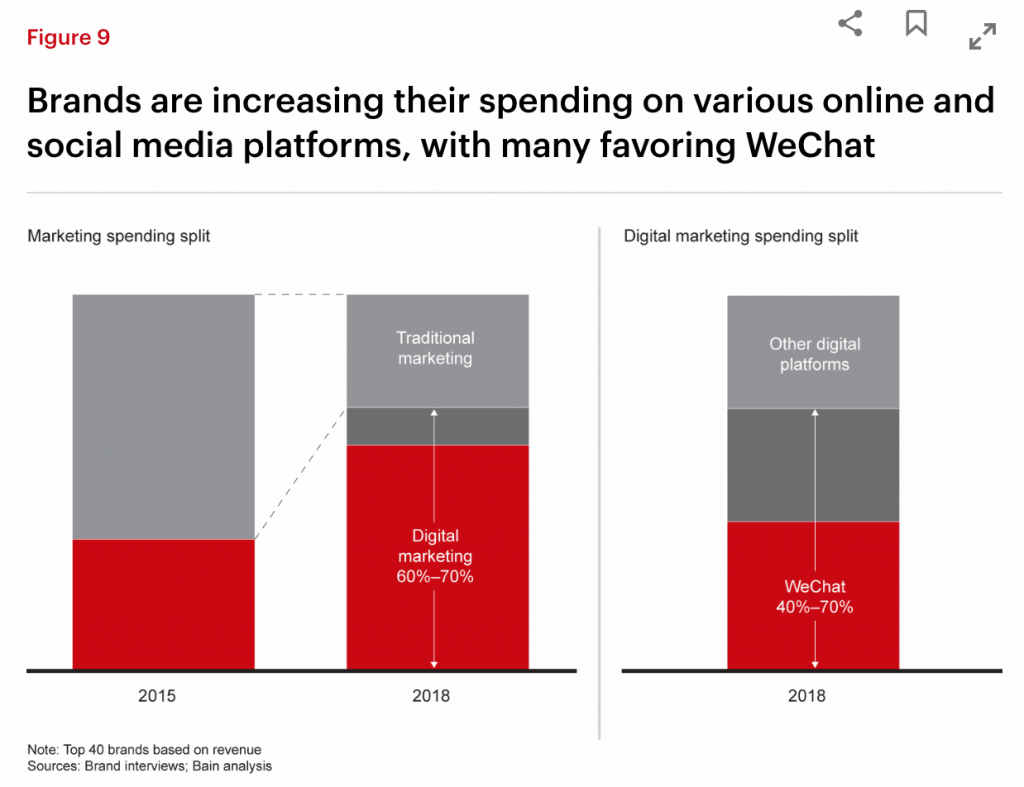

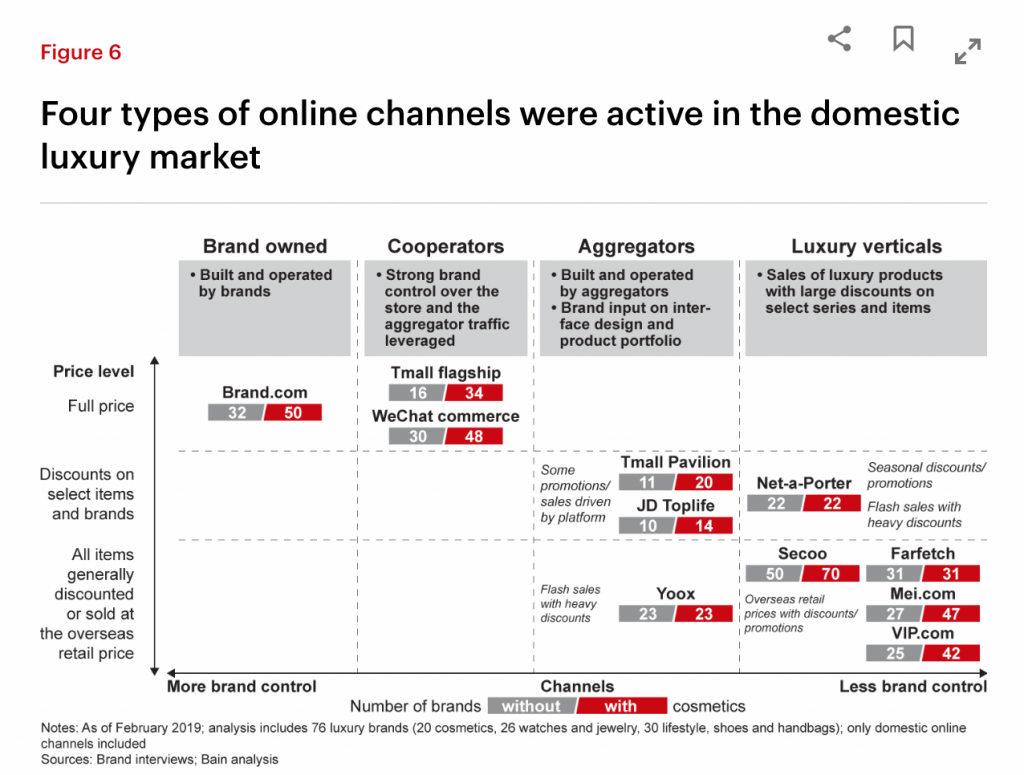

Out of all digital channels, WeChat was a prioritized tool for brands to reach consumers — the top 40 luxury brands allocated 40-70 percent of their digital marketing budgets on WeChat. This tool has become an important link between the online and offline worlds, and brands rely heavily on its service-oriented functions, such as customer service, WeChat-commerce, and membership management.

We suggest brands on WeChat to stay away from “one-off” solutions and instead create an ecosystem (such as official account, payment system, e-commerce shop) for long-lasting benefits.