Takeaways:#

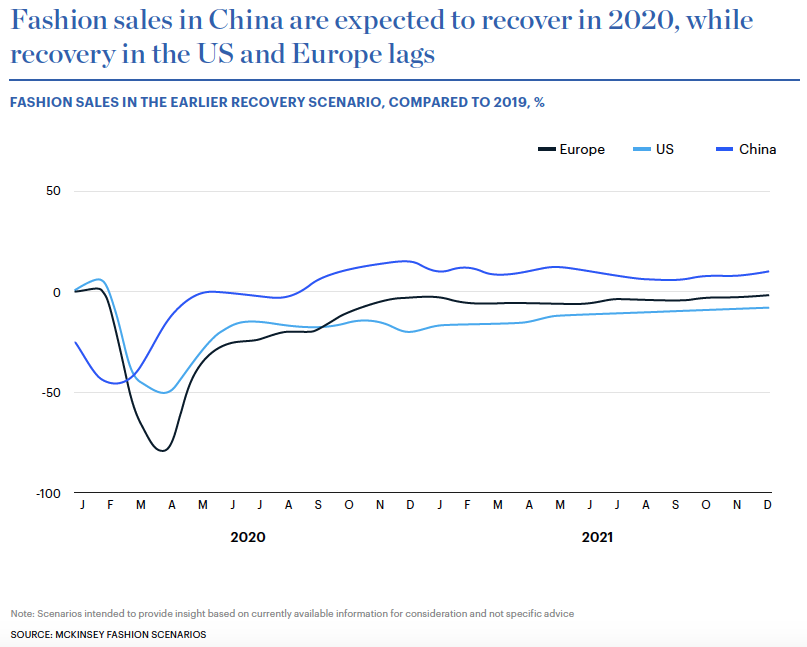

- The new State of Fashion 2021 report is based on two McKinsey fashion scenarios: a more optimistic “Earlier Recovery” scenario predicts that global fashion sales will decline by between 0 and 5 percent in 2021 compared to 2019, and a “Later Recovery” scenario would see sales growth decline by 10 to 15 percent next year compared with 2019.

- Despite a positive outlook brought by the repatriation of luxury spending to China, brands should not make hasty decisions about the market but to plan a strategic approach for the long-term.

- Permanent brick-and-mortar stores, or even long-term leases, are likely to be replaced by flexible pop-ups and other new store formats.

In a year in which everything changed, the global fashion industry is expecting an uneven recovery with Europe being the worst-hit region, followed by the US, while China will likely be less impacted, McKinsey & Company and The Business of Fashion (BoF) stated in the new State of Fashion 2021 report released on December 2.

Shedding light on three key sections this year — the global economy, consumer shifts, and the fashion system — the joint report gives a closer look at the external shockwaves brought on by the COVID-19 pandemic and how the industry is expected to reflect and react. McKinsey & Co. and The Business of Fashion embarked on the partnership in 2016 to put out a yearly report on the global fashion industry, which includes results from fashion executives survey, data-driven analysis and in-depth interviews.

Here, Jing Daily breaks down the four trends that are germane to the China market, which, like the rest of the report’s findings, are based on two McKinsey Fashion Scenarios: A more optimistic “Earlier Recovery” scenario predicts that global fashion sales will decline by between 0 and 5 percent in 2021 compared to 2019, and a “Later Recovery” scenario would see sales growth decline by 10 to 15 percent next year compared with 2019.

A Digital Sprint from Livestreaming to E-Commerce#

It’s no surprise that brands worldwide have pivoted to digital to reach customers during the COVID-19 pandemic. In China, though, the trend is most apparent in the rise of livestreaming commerce. The trend started as early as 2016 with the launch of Alibaba’s Taobao Live and was substantially boosted during the national lockdown earlier this year. Namely, the number of sellers on Taobao Live grew by 719 percent in February alone, according to the report.

When facing a Wi-Fi generation in China with a distinctive online environment built by platforms such as WeChat, Weibo, and Tmall, luxury would have to deploy stand-alone strategies to target the ever-growing picky consumers.

“We’re shifting to more of a customer to business (C2B) model. This means that we closely observe their behaviors, interests, likes, scrolling, attention, interest, purchasing and loyalty,” Mike Hu, Alibaba Group Vice President and General Manager of Tmall Luxury, Fashion and FMCG said in the report. “Over the next two years, we hope to increase the number of luxury brand flagship stores on Tmall by more than 100 percent annually.”

Travel Interruptions Elsewhere Has Brought Repatriation to China#

The travel retail sector remains severely disrupted and destination shopping suffered throughout 2020. International tourism is expected to remain subdued in 2021, while shoppers will continue to experience further travel interruptions, the report concludes, while the China market is witnessing repatriation of luxury spending due to this.

Citing plans from Hong Kong-based DFS Group to outlet player Value Retail to invest in China, the report indicates an ever-positive outlook in the China market. Mauro Maggioni, Asia-Pacific CEO of Golden Goose, agrees, saying: “Mainland China has become the place where all the purchase power is trapped.” However, despite a positive outlook in China, report authors also suggest that brands should not make hasty decisions about the market but to plan a strategic approach for the long-term.

From Consumers to Corporations: Less is More#

After demonstrating that more products and collections do not necessarily yield better financial results, COVID-19 highlighted the need for a shift in the profitability mindset, according to the report. The past Shanghai Fashion Week in October addressed great importance to sustainable fashion: ranging from sustainable designer products to the debut of the Green Carpet Fashion Awards in China, as well as sustainability-themed forums and reports. While extending optimism in younger consumers worldwide, who were born into the sharing economy, the report notes that a collective effort is required to achieve the circularity of the fashion economy, in which fashion companies, customers and all participants in the value chain collaborate.

Measuring Retail’s Return of Investment in New Ways#

New store formats will continue to emerge in 2021, as well as the inevitable closing of physical stores in the rest of the world, the report says. It points at examples such as Harrods’ up-and-coming outpost in China called “The Residence” in the format of a private members’ club and French footwear brand Veja’s “services” concept store in Bordeaux with a shoe-repair corner. Permanent brick-and-mortar stores, or even long-term leases, are likely to be replaced by flexible pop-ups such as Shanghai’s one-year-old TX Huaihai, the report states.

The founder of the youth-focused concept mall, Dickson Szeto, is in the process of opening half a dozen more TX properties around China. The malls will feature a rotation of brand pop-ups changing every three months in a bid to keep up with young consumers’ desire for newness. “If I give a brand three years of space, I am taking a risk, but they are also taking a risk, so pop-ups are the best model for both parties,” Szeto explained in the report.