A few months after iconic Parisian fashion boutique Colette closed its door at 213 Rue Saint-Honoré, a new store named “Colette: Forever” quietly opened in downtown Shanghai. The store has nothing to do with the original, run by Colette Roussaux and her daughter Sarah Lerfeli.

According to Chinese media, the owner of this Shanghai store, who claims to be a loyal fan of the original Colette, views the new opening as a tribute. He disagrees with the criticism that his actions have infringed upon the intellectual property rights of Colette.

“I like it, so I am allowed to create one just like it” is a standard mentality among Chinese entrepreneurs. The phenomenon is in part a result of the opening up of the Chinese economy, when the country transformed into the world’s factory, supplying major fashion labels around the world. If Chinese manufacturers already know how to make the stuff, then why not fetch a higher price by selling it directly to consumers?

Copycat Fashion Design by Traditional Manufacturers#

Richard Ellings, the Director of the Commission on the Theft of American Intellectual Property, once claimed that the best way to avoid theft by Chinese companies is for fashion brands to opt out of manufacturing in China.

In recent years, the dramatic rise of labor costs in China has caused an increasing number of international brands to move their production lines to cheaper countries in Southeast Asia and Africa. The loss of international orders has forced traditional manufacturers to explore new business models in order to remain competitive.

Some of them decided to establish their own fashion brands to sell the items they produce. However, because most lack professional training and experience in fashion design, many choose to make goods that appropriate the designs of established brand-name products.

These brands are often known as shanzhai, or "mountain village" brands, a term that became popular after a boom in copycat tech companies that set up in Guangzhou in the early 2000s.

Zhejiang Bagpipe Clothing Co. Limited, based in Wenzhou, is a prime example. The company was founded in 1999 under the name Wenzhou Fengdi Clothing Manufacturing Company. But now it has rebranded itself as a Scottish company with operations in mainland China. Its eponymous brand, Bagpipe, produces a full ready-to-wear collection including clothes, shoes, and accessories. However, a close look at their products shows brazen thefts from big-name brands including Gucci, Chloe, Valextra, and Prada.

“These products are selling very well,” Yiran Han, a sales associate at a Bagpipe store in Quzhou, Zhejiang Province, told Jing Daily. “Many consumers know they look like designer handbags but such a low price point makes them less concerned about that.”

Creative Copying#

Companies like Zhejiang Bagpipe may cause serious losses to international fashion and luxury brands, either through lost sales or diminished excitement about the original brand. This is a particular concern now, as more and more foreign brands are entering the Chinese market to sell to Chinese consumers directly.

Some commentators say that IP-theft will gradually disappear as the Chinese government looks to enforce laws that support domestic brands, as well as foreign ones. This is part of President Xi Jinping’s “Chinese Dream”, which considers creativity and innovation crucial to rebuilding national pride and gaining greater cultural power globally.

Sara Liao, a Chinese scholar from The Chinese University of Hong Kong who focuses on studying the copycat phenomenon in China, however, disagrees. She argues that “while the Chinese Dream is a top-down project to implement structural and systematic channels for innovation, it also tries to co-opt shanzhai culture to utilize the bottom-up practice of creativity to foster innovation nationwide.”

The huge commercial success of Taobao brands like Zhang Dayi, which frequently copy the designs of big-name brands, to some extent, supports Liao’s observation. Through making good use of new digital technology and social media, these brands have built up a solid customer base across China, and their product pricing and brand positioning have both edged higher as their businesses received more recognition from Chinese consumers. The state also seems to have turned a blind eye to their practices in recent years, giving them a jump start as they evolve towards doing their own thing.

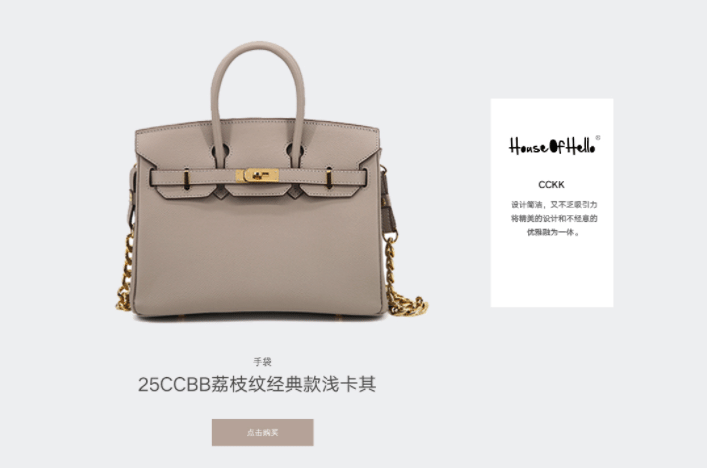

There are also brands that deploy smart marketing strategies to justify their plagiarism. House of Hello, a Hong Kong-based fashion label, built its entire business on copying the designs of big-name brands. It costs 2,599 RMB (412) to purchase a House of Hello handbag that is almost 99 percent the same as Hermes’ Birkin bag. Creative Designer Tina Lee positions the brand as an affordable luxury for every lady who wants to lead an elegant life, arguing that her design represents a disruption to the traditional high fashion industry, rather than a theft.

What Luxury Brands Can Do#

In recent years, luxury brands have made renewed efforts to counter the rampant counterfeiting in the Chinese market. However, they have struggled to make headway in a culture where copying is acceptable behavior for most Chinese consumers.

“The vast majority of foreign luxury goods designers do not make use of any of the provisions of the Chinese IP laws,” said Steve Dickinson, an attorney with Harris Bricken who helps foreign companies enter the Chinese market. “They simply whine.”