In times of economic uncertainty, luxury consumption is often first to suffer. However, for VistaJet, an international private jet charter company, economic uncertainty has actually helped expand their business in China and garnered more attention from investors. This illustrates the wider impact of a shaky economic outlook but increased demand for both budget and luxury travel goods and services.

In the first half of 2017, passenger departures from China were up 12 percent compared to last year. Global customer retention stood at 91 percent and sales grew by 57 percent. In China, total retention was 100 percent.

The private jet industry has suffered substantially in China because of anti-corruption drives and crackdowns on outbound capital flows initiated by the Chinese central government. Moreover, the current state of the Chinese economy is also concerning. The Chinese economy is still growing substantially, but concerns about the debt to GDP ratio and the health of key firms has darkened China’s economic outlook.

All this means that buying a private jet is a cost that many Chinese HNWIs are shying away from. Chartering a private jet, through VistaJet or through HNA Group’s Deer Jet or Hong Kong Jet, is seen as a safer alternative to have the luxury experience of owning a private jet.

Deer Jet announced this year that it would be expanding its efforts by launching “super-luxury” flights to Tahiti.

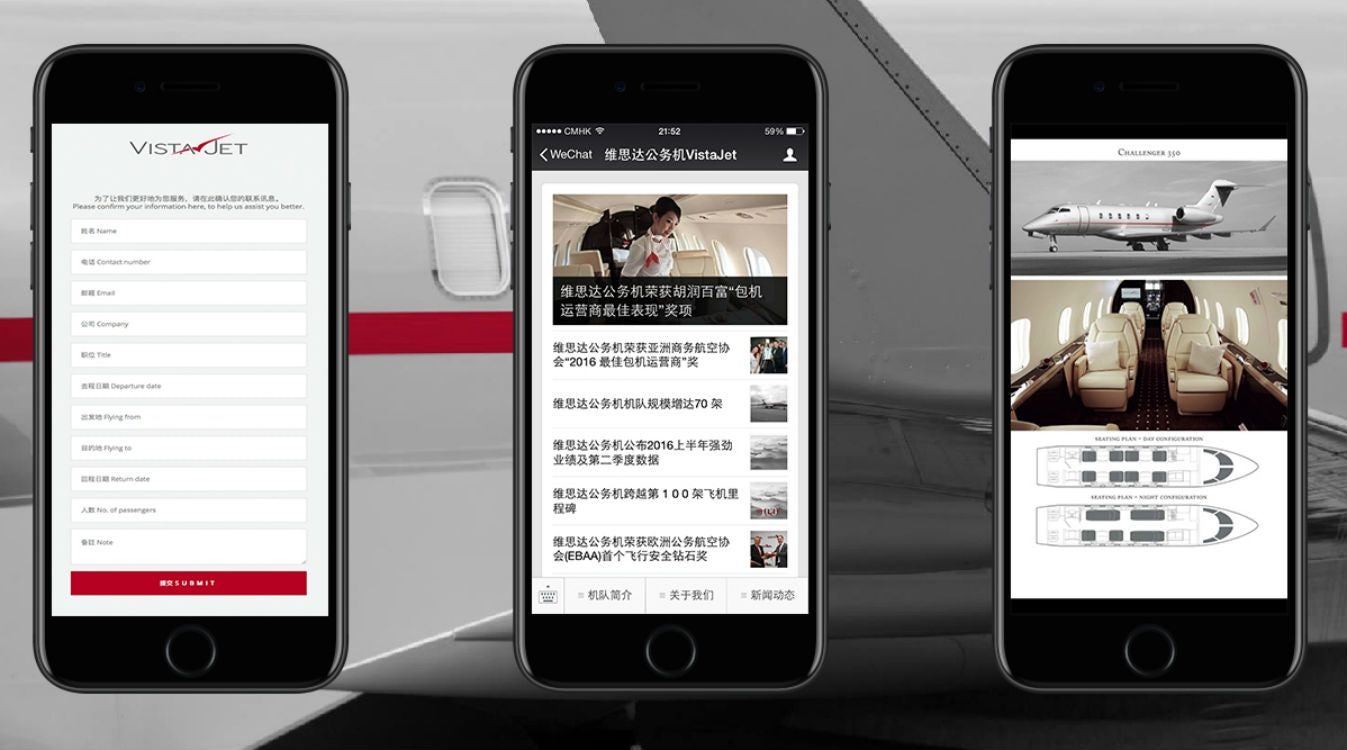

China features prominently in VistaJet’s strategy. In April, VistaJet allowed customers to book flights through WeChat. The company also launched a Chinese language website.

VistaJet’s success in China in 2016 and their continued success this year have helped the company attract significant interest on the part of investors. It was announced today that New York-based Rhône Capital has invested 150 million into VistaJet, increasing VistaJet’s total equity valuation to 2.5 billion.

Overall, VistaJet in China is another illustration that increasing demand for travel and hospitality services by Chinese consumers is both an opportunity and a risk. Many airlines have benefitted substantially from growing outbound Chinese tourism, particularly budget airlines.