Large-Scale Contemporary Art Proving Target For Chinese Collectors#

Coming in the wake of the recent record-setting $375 million contemporary art auction at Sotheby's in New York, the upcoming Christie's contemporary Asian art evening and day sales in Hong Kong should see strong bidding buoyed by a more optimistic buyer market, greater scarcity of top Chinese pieces, and the relatively lower prices for blue-chip Chinese and Asian art.

Though few lots at the recent contemporary art auction in New York, with the exception of a Lichtenstein sculpture, went to Chinese bidders, this doesn't mean the success of last week's Sotheby's sale will have no effect on China or on the prices for Chinese art. In recent years, we’ve watched as prices for top works of Chinese traditional, modern and contemporary art have rebounded from the global financial crisis, sending artists like Zhang Daqian and Qi Baishi to the list of the world’s top five in terms of sales volume at auction last year. In recent years, Chinese buyers have essentially been “redrawing the maps,” with Artprice recently announcing that the volume of fine art sales at public auctions in mainland China accounted for 41 percent of the global market in 2011, making it — as Jing Daily wrote earlier this year — the largest art market in the world.

So what, exactly, does the record-breaking Sotheby's New York sale have to do with China? It illustrates, as have other sales in mainland China and Hong Kong in recent years, that the boundaries of prices for artwork will continue to rise, driven by the bidding habits of motivated buyers and collectors. Many of the new Chinese collectors of Asian and, to a smaller extent, Western art are looking to diversify assets amid fluctuating inflation at home, a trend that should continue in the years ahead. Over the past year in particular, we’ve watched as Chinese collectors and investors have sent prices for Chinese modernist painters through the roof, pushing domestic Chinese auction houses further up the global rankings — where two, Beijing Poly and China Guardian, now trail only Christie’s in Sotheby’s in sales turnover. In record time, both auction houses have dominated the Chinese contemporary and traditional art segments, with China Guardian taking in US$606 million at its autumn auctions in Beijing last November alone and nearly $60 million in its first-ever Hong Kong auction last month.

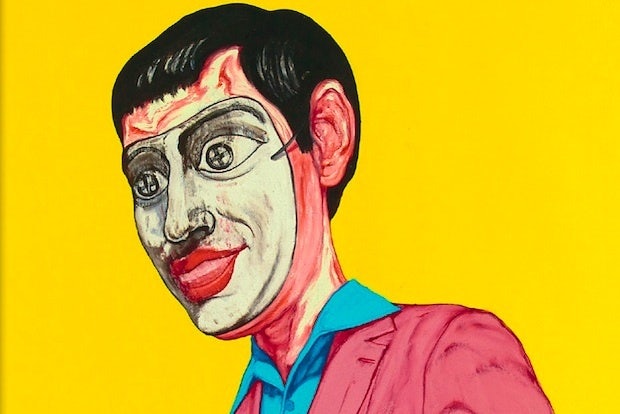

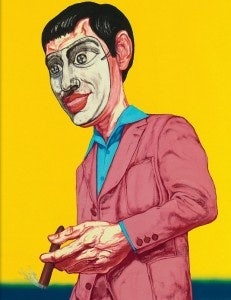

Last week's auction also showed that collectors once again have a strong desire for very large-scale pieces. The most high-profile piece sold in New York, a Mark Rothko that ultimately went for a jaw-dropping $75 million, was 9½ feet tall. Next week at Christie's, large-scale pieces are also likely to get the attention of serious bidders. We expect Chinese collectors to home in on one in particular, a massive Zeng Fanzhi's "Mask Series" (1999) that measures 217.5 x 327.5 cm (over seven feet by nearly 11 feet). Estimated at US$2.6 million - 3.2 million, the size and rarity of this piece could make it a prime target for one of China's more seasoned bidders.

Aside from baseline prices for modernist Chinese painters like Zhang Daqian and Qi Baishi, Chinese buyers have pushed the boundaries of pricing in the contemporary art market as well, leading prices for the best works by top Chinese contemporary artists to pre-global economic crisis levels. As top Western contemporary artists like Warhol, Rothko, Still, Lichtenstein, Bacon and Basquiat all sit firmly in the US$5-50 million range at auction, as time goes by we should see auction prices for multi-million-dollar living contemporary Chinese artists like Zhang Xiaogang (whose works broke the $10 million mark in 2011), Zeng Fanzhi (who reached $9.7 million in 2008), and others continue to climb in tandem with the broader global auction market and gradually close the gap with their Western counterparts. Within a few years, it would not be unexpected that prices for top works by first-generation blue-chip Chinese contemporary painters like Zhang, Zeng and Fang Lijun could average between $5-10 million, which would -- to seasoned Chinese collectors -- not be considered very expensive for contemporary masters.

In only a few short years, the particular motivations and highly pragmatic bidding habits of Chinese collectors have reshaped the market, with artists sometimes unknown outside of China selling for millions on a consistent basis. Last year, works by Huang Binhong (1865-1955) sold for a combined total of US$86.79 million, more than double his 2010 total of $41.8 million, the renowned artist Zao Wou-Ki nearly doubling his 2010 total with sales of $90 million, and works by Wu Guanzhong (1919-2010) making a whopping $212.62 million, over 2010 revenue of $72.77 million. Given the right motivation, for Chinese collectors, clearly the sky — rather than a pre-sale estimate — is the limit.