While China’s recent Singles’ Day sales may have been all about buying as much as possible as quickly as possible, a new report finds that Chinese shoppers do extensive product research and set a high bar for trust before they make a purchase online, even as their online shopping activity grows.

According to KPMG’s recently released report called “China’s Connected Consumers 2016,” which surveyed the online shopping habits of 2,560 Chinese consumers as part of a global survey of 56 countries, a total of 48.5 percent of Chinese consumers bought a product online at least two to three times a month in the past year. Women’s apparel and food were the most popular categories for online shoppers in China over the past 12 months with 56.7 percent of shoppers having made at least one purchase in each category, followed by electronics, men’s apparel, books/music, and cosmetics, respectively.

The report finds that Chinese shoppers do extensive research before making an online purchase, with 60.8 percent saying they search online for reviews and recommendations—a much higher rate than that of consumers in the United States (39.4 percent).

This online activity goes hand-in-hand with brick-and-mortar shopping—the data finds that consumers often check out items in-store before purchasing online, or vice-versa. “Showrooming,” or looking up items online while in a physical store, is extremely popular, as 69.4 percent of Chinese consumers have done so.

Their omnichannel approach to learning about products also means their final decision to purchase is made from a combination of in-store and online experiences. Their top online trigger for online purchasing is seeing an item in an online shop, which has risen to 42.6 percent in 2016 from 19 percent in 2015. Meanwhile, seeing an item in a physical store came in second, and seeing a friend with the item was third. All of these top three triggers became more prevalent this year.

Convenience is the main reason Chinese consumers prefer to shop online, with 58.6 percent saying they choose this platform for buying products because of the ability to shop 24/7. Price is also an extremely important factor—the ability to compare prices came in second with 52.3 percent listing it, followed by the idea that better prices can be found online at 41.6 percent.

For consumers choosing which online shop to go with, trust is critical—84.2 percent of respondents say that they only buy items that have detailed and transparent product information. In addition, 77.1 percent say service, experience, and atmosphere are the most important considerations for choosing where to shop, while 70.2 percent say they choose shops with the most options for delivery, pickup, and returns. Brand recognition is also a major benefit—70.1 percent say that they trust large global brands more than smaller or local ones.

Since online reviews also play a major role in brand perception in China’s e-commerce market, consumers are highly willing to voice their opinions on purchases online. According to the report, over half of Chinese online shoppers (51.6 percent) make online reviews about their items—a rate far above the global average of 30.7 percent. Most of them (53.8 percent) go through the seller’s website to pots their review, while 38.6 percent will sound off on WeChat and 19.4 percent will do so on Weibo.

In order to build this sense of trust among China’s online shoppers, they want brands to be forthcoming with information—53.6 percent said that educating consumers about products is among the most important ways to build trust, while honesty about negative news is important for 51.5 percent. Protection of customer data is also important, listed by 52.2 percent.

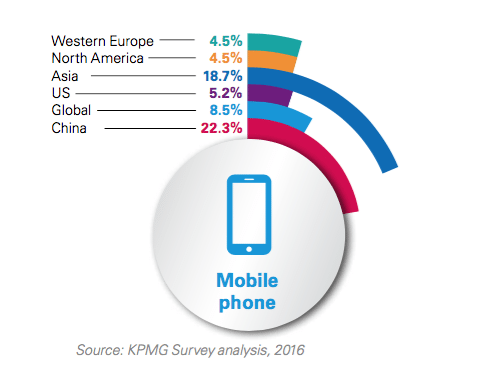

China dominates the world with mobile shopping popularity, while PC shopping is less popular than it on any other continent, according to the report. It finds that 22.3 percent of Chinese consumers prefer mobile shopping, which is ahead of the Asian average of 18.7 percent and far ahead of the global average of 8.5 percent. Meanwhile, 42.8 percent of Chinese consumers say they prefer a laptop or PC to shop, a rate significantly below that of the United States (57.5 percent) or globally (56.9 percent). The survey also found that 90.4 percent of Chinese respondents had bought something over a smartphone in the past year.

Credit cards and Alibaba’s Alipay are by far the most dominant online payment methods, respectively, with 78.8 percent saying they’ve used a credit card to buy online in the last 12 months and 72.2 percent saying they’ve used Alipay. WeChat payment was the third most popular method, used by 34.6 percent of respondents, followed by cash on delivery (22.1 percent).

Once a brand earns a Chinese online shopper's trust, the report finds that it's key to also create loyalty. To keep Chinese shoppers coming back, customer support is the most important factor for gaining loyalty (cited by 51.8 percent of respondents). Meanwhile, promotional loyalty programs are the second most important ways to get repeat visitors with appeal to 43.7 percent of respondents, while 31.6 percent say it’s important for online shops to listen and respond to customer feedback.