As Chinese tourism booms, the global luxury travel industry has been especially interested in understanding the evolving demands of China’s high-end travelers—whose tastes have been rapidly changing thanks to a combination of factors including travel experience levels, generational differences, and the massive influence of social media and online research. This segment is a key topic of discussion at the inaugural New York Times Luxury Travel Conference that started today in Singapore and takes place through December 2, gathering a wide range of experts to discuss the trends shaping the industry with a particular focus on Asia.

Ahead of the conference (which includes Jing Daily as a media partner), we checked in with panelist Paul Hicks, who is the CEO of GHC Asia, a communications agency with offices in Hong Kong, Shanghai, Beijing, Chengdu, and Singapore that works with luxury travel and tourism-focused retail clients including St. Regis, Raffles, Visit Finland, London Luxury Quarter, and McArthurGlen. In a Q&A via email, he discussed the latest evolutions and trends he’s been seeing in China’s luxury travel industry, including the importance of social sharing, the influence of KOLs, the travel habits of Chinese millennials, and more.

As Chinese travelers are increasingly looking for new experiences, what role does public relations play in getting them to pay attention to the brand?#

PR has a very important role to play in helping to educate Chinese travelers about the many exciting travel experiences around the world and the different brands that can help them experience it. We have found that media in China are very receptive to good content from PR agencies like us if they know we are a source of good and reliable stories. Would-be travelers in China still tend to be less experienced as travelers and so have a genuine hunger for knowledge. Compared to Western travelers ,they will do a lot of research in advance of their trips, and often know exactly what they want to see and what they want to buy before they go. Once Chinese consumers have made their travel decisions, they research the destination/experiences/shopping online, but their travel ideas and inspirations are usually coming from print media and key tastemakers.

When it comes to resonating with an audience of Chinese luxury consumers, is social media or traditional media more important now?#

Social media is becoming more and more important all over the world, but nowhere is this trend more dominant than in China. The younger generation in China don’t “go” online, they live online. Most of the key print titles in China have also had to develop a strong online presence, build apps, and some have their own video channels and are experimenting with virtual reality and augmented reality. Even strong names like The Bund, The Beijing Times, and Travel+ have or are about to close down their print version in China and focus solely on their online platforms and apps. It may sound alarming in a Western context, but their influence in the travel space remains as strong, and they still have the same editorial team; they are just providing content in a medium more tailored to the constantly on-the-go smartphone-based lifestyles of their audience. This is a relatively easy one for PR agencies to get their heads around. We still engage with them on the same “storytelling” terms; the results just come out in a different medium. More challenging for us is the ever-changing landscape of social media KOLs, where followings and influence can be strong, but where the rules of engagement invariably blur the traditional lines between paid and earned media.

What types of stories are most inspiring to Chinese luxury travelers?#

GHC Asia recently organized a roundtable discussion on behalf of The Ritz-Carlton chaired by famed broadcaster and United Nations Goodwill Ambassador James Chau at which we asked some of China’s top travel editors and influencers that very question. The results are not really that surprising: Chinese luxury travelers, like most others, are looking for truly unique experiences that they can share with their friends and family through social media. One editor told us about staying in an underwater hotel room in Dubai as a unique and mesmerizing experience, which while extremely expensive, was totally worth it for being so totally removed from his normal day-to-day life.

What are the differences in ways luxury travel brands are communicating with Chinese millennials in comparison to the older generations?#

A friend of mine in Hong Kong, a young lady from a good family in her late twenties, would often joke to me about an upcoming PFT trip to an exotic luxury location: PFT stood for “Parent-Funded Travel,” an annual family reunion trip paid for by the parents so the family could spend quality time together. What is interesting and unique about China, is that it is the younger generation of 20- and 30-somethings who are often for the first time in their families affluent enough to travel, and it is their desire and aspiration to share the joys of international travel with their parents who have never before left China. This is something that international hotel and travel brands should pay attention to as it is phenomenon largely unique to China—but quite powerful.

In terms of communicating to millennials, what many travel brands, like the fashion brands are doing, is using KOLs who resonate with the younger generation as guest managers of their content channels. This way, they still build their own following, but they are also able to “borrow” the influence of these KOLS. Live-streaming is also quite a phenomenon unique to China, still mostly for the very young generation with lots of time on their hands, but I predict this will be used a lot more by brands in future and is certainly something we are recommending our travel clients to consider for the China market. But it is not yet regulated by the government, so there may be changes in the rules of engagement.

How has the communications industry responded to the massive rise of online travel review sites in China?#

As always with a massive proliferation of new channels, you can really only do so much—and just focus on the key sites that dominate most of the market.

Can you give an example of a successful case study for one of your luxury travel clients in the China market?#

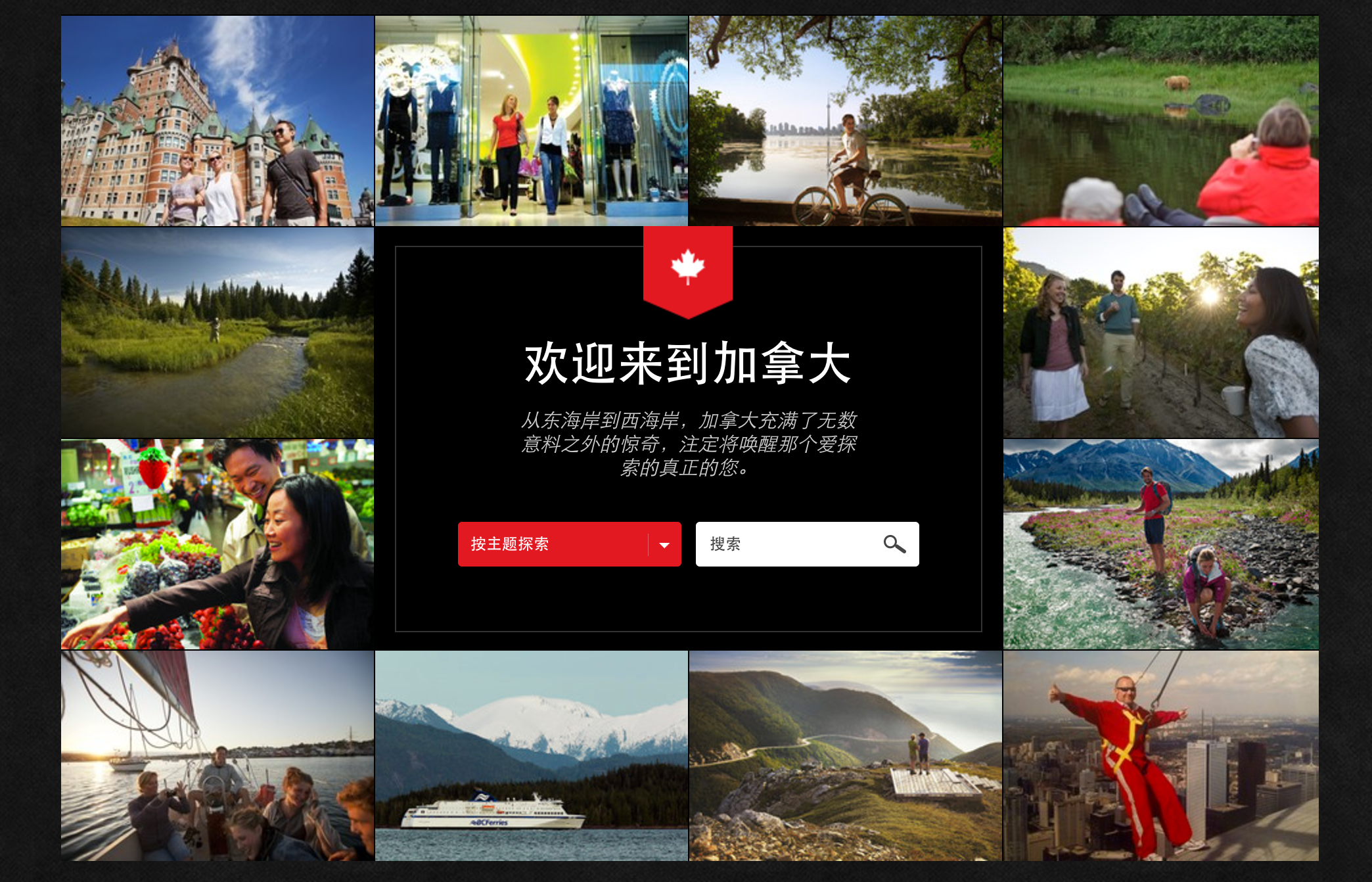

One that I think was very successful was a Destination Canada initiative to produce a “reality TV show” about traveling to Canada. Families were invited to audition to be “presenters” of the show and create their own ideal dream trip to Canada. The winners were then flown to Canada to record their travel itineraries, which were broadcast on TV. Thanks to a tie-in with an OTA, viewers could then also book the same itinerary they had watched if they found it interesting. It was a great combination of PR, broadcasting, social media, and O2O marketing all rolled into one. We worked closely with Destination Canada and digital media specialists Dragontrail to promote this campaign on multiple platforms.

How do you keep up with evolving luxury tastes in the travel market?#

We are the PR partner in China for the International Luxury Travel Market (ILTM) and as part of that, there is an invaluable pre-event summit which presents the latest global insights into the luxury travel industry. The event also brings together the top names in the travel industry with those at the frontline of booking travel for luxury travelers. So it’s a great time to ask people what trends they are seeing. Other than that, I read lots of travel industry news reports and spend a lot of time asking hoteliers and travel media what new trends and tastes they are observing.