Chinese millennials are getting more adventurous when it comes to wine—and they're drinking more of it, according to a new survey by market research company Wine Intelligence. Import volume rose 37 percent last year as 48 million consumers in China's “urban upper-middle class” are now indulging at least twice a year. That's a 25 percent increase from 2014's 38 million consumers drinking wine. Out of those surveyed, nearly half were under 30 years old.

The "China Landscapes 2016" report surveyed about 1,000 Chinese upper-middle class drinkers in March. Wine Intelligence defines China's urban upper-middle class as people ages 18 to 54 years old with an income of at least 6,000 RMB ($900) a month (in Beijing—less for those in lower tier cities). These middle-class drinkers are fueling China's wine industry thanks to the fact more of them have disposable income to devote to buying wine. Plus, the growth in wine being sold via e-commerce channels has made a wider variety of wines available. While 61 percent of those surveyed bought their wine at specialty shops, the next-biggest source for wine purchases was online at 49 percent, surpassing hypermarkets and department stores for the first time.

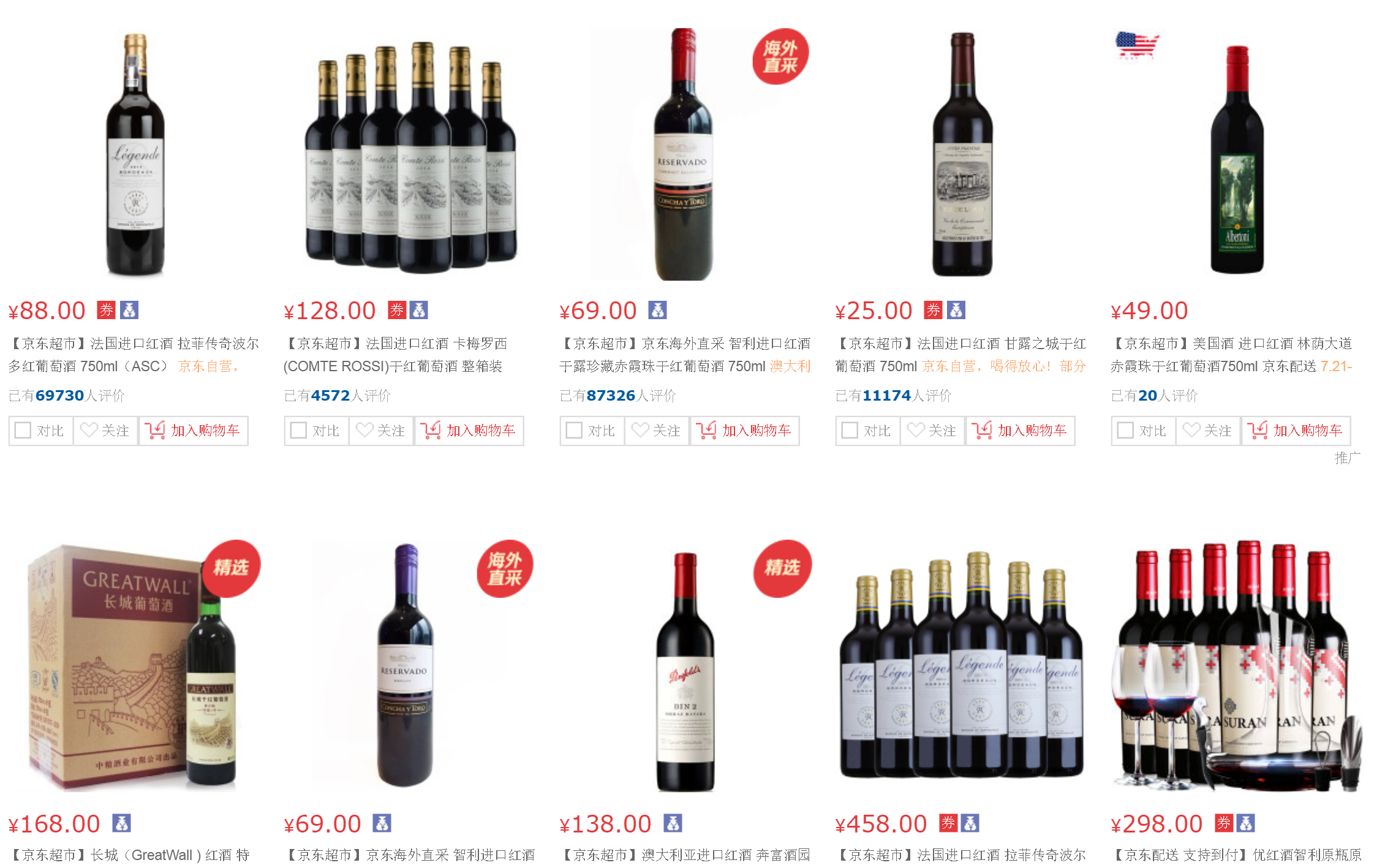

Most consumers in the e-tail sector bought their wines from JD.com and Tmall. These e-commerce giants have seen their clientele numbers go up as both companies have made moves to provide better opportunities for wine sales on their platforms. In May, JD.com partnered with Australian winemaker Penfolds to meet consumer demand for wine after JD's wine sales doubled in 2015.

Drinking wine twice a year may not seem like that often, but this latest data shows that about 35 percent of those surveyed were indulging at least once a week, which Wine Intelligence says is a “notable” increase from last year. While fewer of them are spending less than 100 RMB ($15) for a bottle of wine, the growth of those spending more has slowed, in part due to the crackdown on gift-giving as part of President Xi Jinping's anti-corruption campaign. While wines in the premium sector continue to take the heat, this has provided an opportunity for more affordable wines from a variety of regions to target curious Chinese consumers.

While younger consumers are no doubt more adventurous in their choices, the types of wine people buy is also largely dependent on where they're from. Shanghai and Beijing consumers are more likely to try different styles and brands, whereas those from lower-tier cities are more apt to stick to what they know, especially classic styles or what a sommelier recommends.

Wine Intelligence says that based on these findings, it's now incredibly crucial for brands to engage with their consumers and know which channels to target. “Even though overall consumption will continue to boom over the medium term, targeting the wrong consumer segment, selling via the wrong retail channel, or being underrepresented in the fast-growing online channels, is a formula for slow growth,” the report said.