Digital media consumption is no doubt on the rise in China, but a new report by Ipsos suggests that marketers may not want to give up on traditional media channels just yet when it comes to targeting the region's wealthiest consumers.

For its annual "Affluent Asia” report, Ipsos surveyed more than 19,000 wealthy consumers from 10 countries across Asia, including Hong Kong, Singapore, Malaysia, Thailand, Taiwan, Indonesia, India, the Philippines, South Korea, and Australia, to learn more about their international media consumption habits. This year Ipsos also conducted pilot research into affluent mainland Chinese consumers' media consumption habits, and the findings suggest that while the reach is similar between the two survey groups, in mainland China, digital formats are overtaking traditional ones in some categories.

According to the survey, Asia-Pacific consumers spent more than two hours in an average day watching television, compared to 1.86 hours using websites and 1.7 hours using apps. Reading newspapers and magazines were delegated under an hour each.

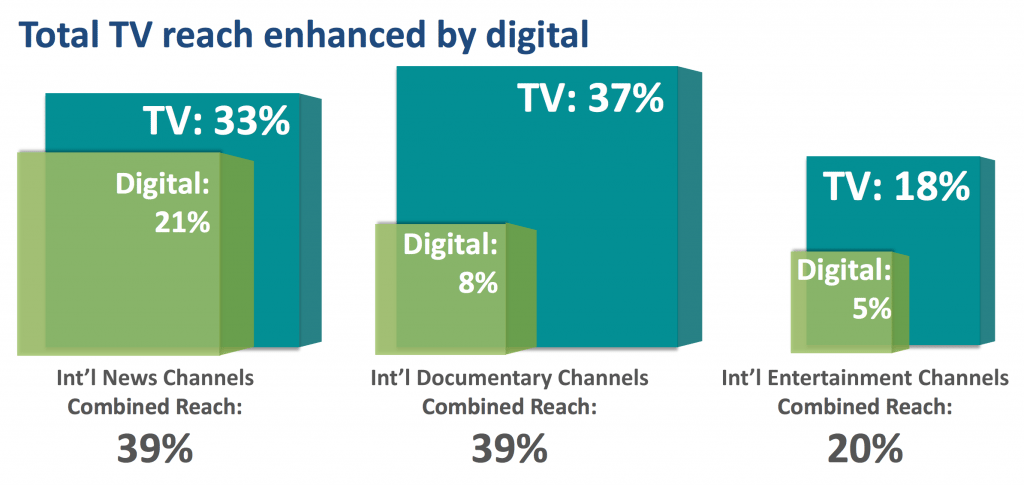

But while television is a top habit for Asia-Pacific consumers, the research suggested that digital content enhanced news and entertainment channels' engagement. For example, while international entertainment channels reached 18 percent of consumers between Q3 2015 and Q2 2016, a 5 percent digital engagement rate boosted these entertainment platforms to a combined reach of 20 percent (in this study, combined reach refers to nett of past seven days of TV viewership and past 30 days of digital reach).

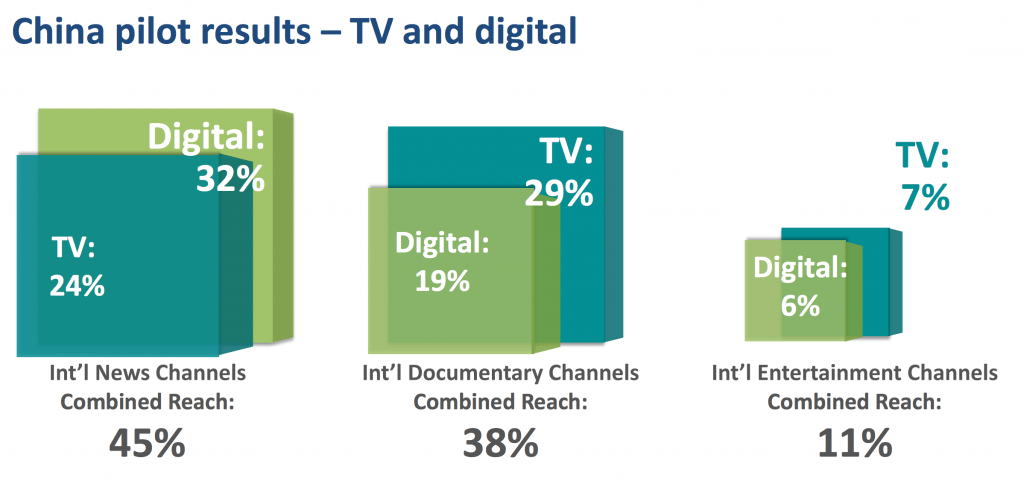

For mainland Chinese consumers in a pilot survey of more than 540 affluent consumers in the top 20 percent of the population by income in Beijing, Shanghai, and Guangzhou, TV played a smaller role in international entertainment channels than APAC as a whole, reaching 7 percent of consumers while digital reached 6 percent.

When it comes to international news media however, the percentage of engagement is different between all of Asia and China. For the APAC countries surveyed, international news channels had a combined reach of 39 percent, with 33 percent for TV and 21 percent for digital. In mainland China, though, more consumers are relying on digital avenues for international news consumption, at 32 percent, compared to 24 percent using TV. When combined, digital and TV sources have a a reach of 45 percent.

Print consumption across media categories in China has yet to be taken over by digital consumption when it comes to international publications, but the gap is narrow. International dailies have a combined reach of 22 percent of those surveyed, with digital content playing a big role in boosting reach. Digital reach for these publications is 12 percent on average and print reach is 14 percent (in this case, combined reach refers to nett of average issue readership and past 30 days of digital reach). In contrast, international monthlies see a 23 percent reach in print, compared to 11 percent engagement digitally.

So what does this mean for marketers? While the report doesn't offer concrete suggestions, the survey data does provide a clue as to how brands might want to consider divvying up their content to achieve the optimum readership in Asia. For China, while television engagement is still dominant in some categories of media consumption, brands and marketers also can't forget about the increasing number of mobile users in the country and the swelling significance of WeChat as a digital media consumption tool. Ultimately, while navigating the media sphere in China can be tough, it still holds true that diversifying platforms and mediums might prove beneficial for brands.