Luxury watch brands like Tag Heuer have been increasing their digital presence in China in recent months, and the timing couldn't be better—Chinese consumers are now visiting luxury watch websites more than ever before.

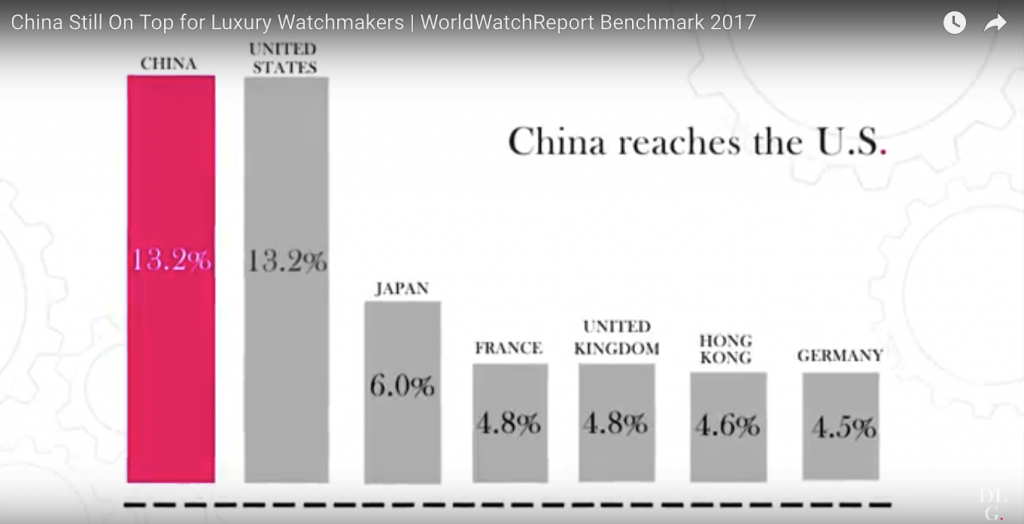

Visits to luxury watch websites from China are expected to surpass web traffic from the currently leading U.S. market this year, according to the results of the latest WorldWatchReport™ Benchmark by Digital Luxury Group (DLG). The report presents insights into the changing preferences and behaviors of consumers, offering clues as to how the Swiss luxury watch industry can save itself in China.

The industry experienced another year of dramatic losses and a 9.9 percent drop in global exports, led by a lag in shipments to Hong Kong and mainland China.

Based on data on 85 million web visits collected from Google analytics results of 62 watch brands in 2016, DLG reported that web traffic from China grew 39 percent year-on-year, beating the 9 percent average in 20 global markets during the same period. China's rapid growth has already put it on par with the United States at 13.2 percent. The performance is even more remarkable given that the traffic from WeChat, China’s uncontested social media giant, was not included in the report.

The global luxury watch industry used to benefit from China's gift-giving culture, where high-profile individuals in business and political circles purchased costly watches to showcase their social status or to nurture relationships. However, President Xi Jingping's nationwide anti-graft campaign brought the downfall of ostentatious displays of luxury, bringing ongoing challenges to the luxury watch industry in China.

Despite these obstacles, brands are beginning to consider how they can change their course by taking advantage of the emerging market of millennial consumers who have different goals and behaviors from their predecessors.

The rise in web traffic from China suggests there is a huge group of digitally savvy consumers with a strong interest in luxury watches. Thus, strengthening their digital elements, from distribution channels to marketing campaigns, has become necessary for luxury watch makers seeking to serve to the potential needs of these consumers.

“Most brands are nevertheless still stuck in the old world multi-brand wholesale model,” wrote Luca Solca, the head of luxury goods at investment bank Exane BNP Paribas, in a recent report commenting on this year’s Baselworld Watch and Jewelry Show. “Very few incumbents have started to scratch the digital surface to distribute products; many more are using digital marketing tools to build their brands and monitor their effectiveness.”

There have been several recent examples of prestige watch brands moving to provide Chinese customers with smoother and more seamless digital experiences. Brands such as Bulgari and Jaeger LeCoultre have tapped China's social media users and leveraged the power of Chinese online influencers to roll out marketing campaigns to attract young customers.

As the general sentiment of the industry is that 2017 is off to a brighter start, it's likely consumers will find that more luxury watch brands are enhancing their digital capacity this year in China.

The full DLG report and consolidated benchmark indicators are available here.