Key Takeaways#

- In 2019, the overall spending of consumers from tier-3 cities and below represented 44 percent of China’s total luxury sales.

- Around 45 percent of middle-class consumers in tier-2 and tier-3 cities in China are interested in purchasing luxury goods versus 37 percent in tier-1 cities.

- Luxury brands hate trimming their prices, but incentive marketing is a reasonable strategy for lower-tier cities.

In 2017, Morgan Stanley estimated that lower-tier cities in China might become “engines for spending” that could fuel economic growth. “While investors perceive larger cities as offering the most important consumer base, we believe that lower-tier cities will be bigger, wealthier, and more eager to spend and could contribute two-thirds of incremental growth in national private consumption toward 2030,” said Robin Xing, Morgan Stanley’s chief China economist.

And in regards to luxury spending, these emerging luxury consumers now produce a major share of consumption. For one, the Deloitte-SECOO CIIE Blue Paper 2019 emphasizes the importance of lower-tier cities. According to Secoo platform data between September 2018 and September 2019, tier-3 cities and below led in annual purchase frequency with 27 of the top 30 cities (approximately 90 percent). These lower-tier cities are also ahead in the repeat buying category (29 of the top 30 cities are 3rd-tier cities or below) and also lead in the three-purchases-or-more category (30 out of 30 top cities).

Overall spending by consumers from tier-3-and-under cities represented a whopping 44 percent of China’s total luxury sales in 2019. As such, the media platform Created in China recently highlighted why tier-4 and tier-5 cities are driving luxury consumption growth, while Luxe Digital documented how 45 percent of middle-class consumers in tier-2 and tier-3 cities are interested in purchasing luxury goods (versus 37 percent in tier-1 cities).

Considering the incredible potential of this market, let’s take a look at some successful marketing strategies that will reach these affluent consumers:

It’s all about the experiences

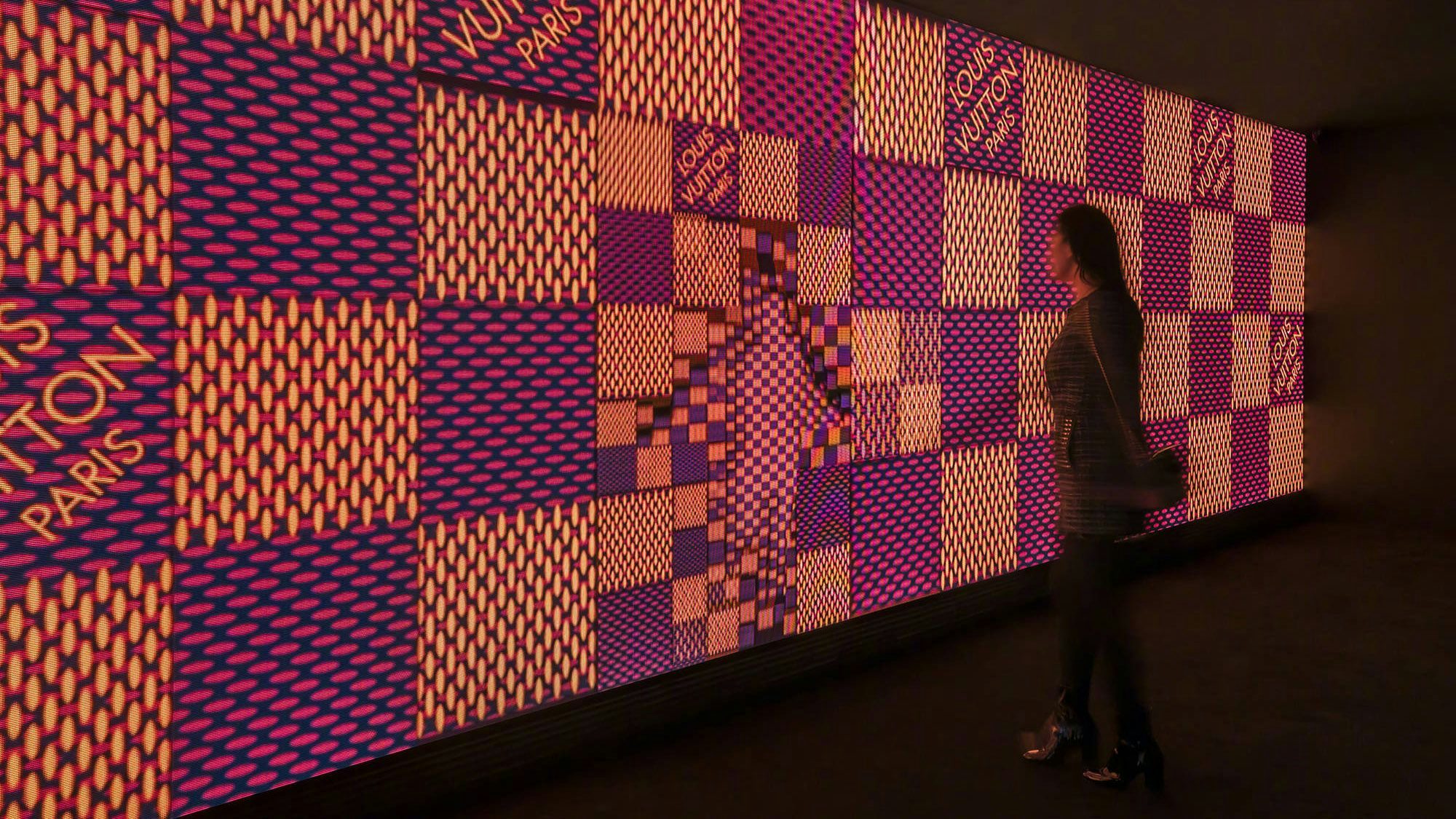

Experiential marketing is trending globally. But in lower-tier cities, this trend is still scarcely visible. Luxury shoppers in places like Beijing, Wuhan, Hangzhou, and Hong Kong are engaging in sophisticated forms of “retailtainment.” Interactive displays, voice-activated and AR-enabled mirrors, and smart dressing rooms are just a few of the new technologies used to create unique interactive experiences.

Apart from that route, luxury brands also sponsor and co-create artistic experiences that engage consumers and build an immersive environment. But art exhibitions, gallery openings, and museum events are largely missing from lower-tier cities. Therefore, smart luxury brands would be wise to counterbalance that arts deficit through services exclusively available in lower-tier cities.

Considering how luxury brands already have an abundance of structured data at their disposal, they have the leverage to come up with personalized solutions via customized products and in-store services. Moreover, luxury brands should consider expanding their already unique features. For example, Burberry could grow its network of “social retail stores,” while Tiffany & Co, Louis Vuitton, and Gucci could open more eateries and chic cafés.

Additionally, a hybridization with fashion and music represents a unique opportunity because it transforms a physical store into a music venue, allowing smart luxury brands to envision multisensory experiences like concerts and pop-up events. Livestreaming sessions moderated by local KOLs or gaming competitions also have potential since they bring the brand closer to younger demographics.

As always, Louis Vuitton is ahead of the curve here, having understood the massive potential of esports. The French luxury brand has partnered with Riot Games to design the Trophy Travel Case, which holds its championship Summoner’s Cup.

Incentive marketing

Luxury brands hate trimming their prices or being associated with discounts, but incentive marketing is a reasonable strategy in lower-tier cities. In fact, there’s one particular feature that’s specific to lower-tier cities: community group buying.

“Neighborhood communities tend to be more prevalent in lower-tier cities, as multiple generations live under one roof and within close proximity to each other,” says Feifei Xu, Prophet’s former associate partner. “Pinduoduo uses this to its advantage, and its growth is built around offering huge economic incentives [deeper discounts and sweeter deals if users buy in groups and share purchases through messaging apps] This encourages users to promote the platform to their friends, families, and neighbors.”

But Pinduoduo’s model shouldn’t be brushed off as antagonistic to everything luxury should represent. Group-buying events create a sense of community that brings people together. And Gen Zers are all about community-building and creating borderless tribes of like-minded individuals.

The “mini-me” mania

China’s matching mother/daughter style is not a groundbreaking trend. But, surprisingly, luxury brands have yet to see the marketing potential in the “mini-me” trend that’s now sweeping through lower-tier cities. “Fertility rates tend to be higher in lower-tier cities, as the relaxation of the one-child policy and affordable cost of living are increasing the willingness of people to have larger families, giving lower-tier cities the needed momentum to expand their consumer bases,” says Invesco Investment Insights. Economic growth is also faster in lower-tier cities, according to Invesco.

These affluent consumers have the time, means, and right attitudes, so brands must attempt to understand and respond to their needs. Beauty brands can offer experiences that pamper “mommy and me,” while retailers can promote trunk shows and special events that feature “mommy & me” designer collections.

Likewise, heritage brands can expand their VIP perks and incorporate additional personalized gifts for their “mini luxury customers.” Dior already features collections of stuffed animals, and Louis Vuitton has beautiful music boxes.

For years, upscale hotels have organized luxurious play dates and kid-friendly events, spoiling a generation of privileged “Little Emperors.” Heritage brands could learn from them by taking advantage of this unique opportunity.