Domestic duty-free sales in the Asia Pacific region are forecast to reach 81 billion by 2027, with the vast bulk of them coming from China, according to a new report from market research provider Euromonitor International. The figure is almost half of the 168 billion that will be generated by the entire global duty-free market by 2027.

China will dominate the Asia Pacific region, accounting for 87 percent of the total within a few years, while Australia, South Korea, and India top the list of the highest-spending destinations per arrival when it comes to inbound duty-free shopping. Preliminary research from Euromonitor suggests that India’s inbound tourism spending hit 12 billion in 2022 and is expected to reach an estimated 28 billion in 2023.

While China and India have similar sized populations — with India recently overtaking China as the world’s most populous country — Chinese consumers have a far greater propensity to search out luxury brands and ultimately spend more in duty-free.

Prudence Lai, senior analyst at Euromonitor International, tells Jing Daily: “China is a key source market in Asia Pacific. However, as the Chinese government plans to use duty-free as a vehicle to boost domestic consumption, Hainan will not be the only duty-free destination in the country going forward. Diversifying the customer base by attracting domestic consumption and alternative source markets in the region will be key.”

China’s moves to repatriate luxury spending have been in place for many years now and Hainan is the best known, and most successful, example. The province came into its own during the Covid-19 crisis, being one of the few places where Chinese nationals could go on duty-free shopping sprees while international travel was banned.

It hasn’t all been rosy though, as mainland city lockdowns negatively affected the island in 2022. According to the Hainan Provincial Bureau of International Economic Development, total duty-free store sales amounted to 48.7 billion RMB (7.2 billion) last year, well below the 2021 figure which exceeded 60 billion RMB (about 8.9 billion).

"City destinations such as Shanghai, Guangdong, and Guangzhou in China are seeing duty-free outlets grow rapidly [as] many Chinese visitors opt for domestic shopping destinations rather than global hubs such as Paris, London, and New York."

Back on track#

However, this year's performance looks more promising. The province’s duty-free shops achieved 16.9 billion RMB (2.35 billion) in the first quarter, a year-on-year increase of 14.6 percent, according to Haikou Customs. Sales from offshore duty-free shops in the province are expected to exceed 80 billion yuan (11 billion) this year.

But there are other options besides Hainan. “City destinations such as Shanghai, Guangdong, and Guangzhou in China are seeing duty-free outlets grow rapidly [as] many Chinese visitors opt for domestic shopping destinations rather than global hubs such as Paris, London, and New York,” says Lai.

These duty-free shops can only be operated through government licenses and, so far, only Chinese companies like China Duty Free Group and Wangfujing Group have been granted them.

At Dutch beauty house Rituals, global travel retail director Melvin Broekaart says: “The Chinese are long-term thinkers and they are going to do what it takes to keep spending at home.”

Tao Zhang, managing director at L’Oréal Travel Retail Asia Pacific, adds: “There is higher awareness of Hainan and the policy stimulus. The onus is therefore on duty-free operators outside China to create really memorable, differentiated experiences for Chinese consumers to shop there.”

McKinsey’s 2023 "China Consumer Report" has also made Western brands take a good look in the mirror as homegrown competitors begin to take more of the limelight, and that may apply to the duty-free channel before long.

“There once was a time when consumers paid a premium for foreign brands; those days are over," the report states "Chinese companies today offer excellent products that are competitive or sometimes even superior to their foreign peers. So, while it’s not a new phenomenon, the preference for local brands has accelerated, and national pride is not the only driving factor." The report adds that on top of making "bolder" investments, domestic firms in China are faster at reacting to trends and catering to consumer needs.

A shopping mindset#

More widely across the Asia Pacific region, some 22 percent of respondents in Euromonitor’s 2022 "Voice of the Consumer" lifestyle survey said that they pick their travel destinations based on the quality of shopping there, a percentage that is higher than the global average.

Price is also a key consideration. While VAT rates in Asia are typically around 10 percent, they go as low as 5 percent in Taiwan and up to 18 percent in India. Hong Kong is an exception, with no VAT or sales tax at all and therefore a draw for mainland Chinese travelers who, when at home, have to pay up to 13 percent depending on the product category.

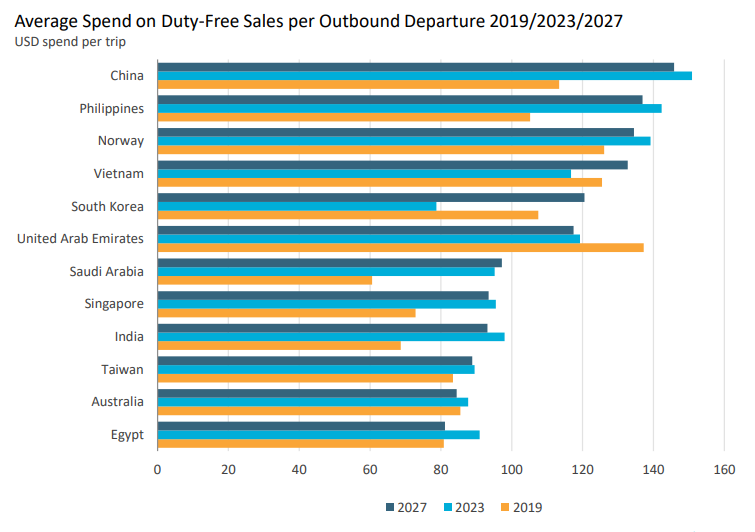

Also worth noting is that among high-spending nations, China will rise to the top this year in terms of duty-free sales per outbound departure, surpassing Vietnam, Norway and the United Arab Emirates.

Global duty-free sales will return to pre-pandemic levels by 2025, with overall spending in the channel set to reach 168 billion in 2027 — 15 percent above pre-pandemic levels across both domestic and international spending, according to Euromonitor.