It has been a while since the Chinese beauty market saw an influx of domestic beauty brands. For a long time, premium labels that offer higher quality and prices from countries like France, the U.S., Japan, and South Korea didn't see them as a real threat. That, however, is changing quickly. It seems as if the C-beauty era has arrived.

According to a May 21 report co-released by consultancy Kantar Group and Chinese tech company Tencent Holdings, Chinese-born beauty players are having a breakout moment in 2019. They are climbing the value chain, moving from producing low-cost items to high-end goods. Because of this, they're now seeing their client base increasingly overlap with those of international luxury beauty brands.

The Kantar x Tencent survey indicates that three out of four Chinese consumer respondents purchased beauty products from a Chinese brand in the past six months, and for 50 percent of them, it was their first-time purchasing C-beauty items. Meanwhile, the report also states that over 40 percent of consumers are willing to choose C-beauty products in the future, and nearly 90 percent of them will consider a repeat purchase.

The transformation of how C-beauty companies are perceived among Chinese consumers is happening at an unprecedented speed, and it's not just because of price advantages. The report writes that those who considered price as the primary reason why they chose C-beauty brands dropped from 48 percent in 2007 to 26 percent in 2018. Instead, today’s Chinese consumers find that C-beauty brands stand for a mix of good qualities that they seek in their beauty consumption: innovative Chinese style, a high price-to-quality return, trust, and original homegrown ingredients. Powered by localized marketing campaigns and innovative storytelling, it's clear why C-beauty brands are rising rapidly.

The allure of Chinese style#

C-beauty is the latest fad for a group of Chinese shoppers who are trend-seeking and innovation-driven. The report identifies them as a group of consumers who enjoy C-beauty brands for their Chinese origin, history, cultural elements, and aesthetics, even though they have the purchasing power to buy luxury beauty products. They are mostly female, between the ages of 15 - 25 years old, and live in first-tier cities. They are drawn to creative marketing campaigns by C-beauty brands that are based on their childhood memories. For example, the Shanghai-based food company White Rabbit, known for decades for their creamy candies, ventured into the beauty sector by unveiling skincare and perfume products last year and created a sensation among young Chinese consumers that thought fondly about the brand from their youth.

High price-to-quality ratio#

Consumers who are budget-conscious and care about investment return see C-beauty as a cheaper alternative to some international, big-name beauty brands. In fact, many C-beauty brands claim their products can offer the same skincare or makeup effects as international brands at one-third the cost. Meanwhile, C-beauty brands collaborate with top-tier Chinese celebrities and a great number of key opinion leaders (KOLs) on key social media channels including Weibo, Little Red Book, and WeChat, which adds to their credibility and reinforces their branding among Chinese consumers.

Chemical-free, natural herbal ingredients#

Some C-beauty brands are tapping into the power of traditional Chinese medicine to win over the support of consumers. For instance, the Shanghai skincare brand Inoherb is famous for incorporating Rhodiola Rosea, a plant that was used by ancient Chinese to make skincare goods, into its formula. According to the report, there are respondents who believe C-beauty fits the skin conditions affecting Chinese people the best, while foreign brands are seen as using chemical ingredients that damage their skin.

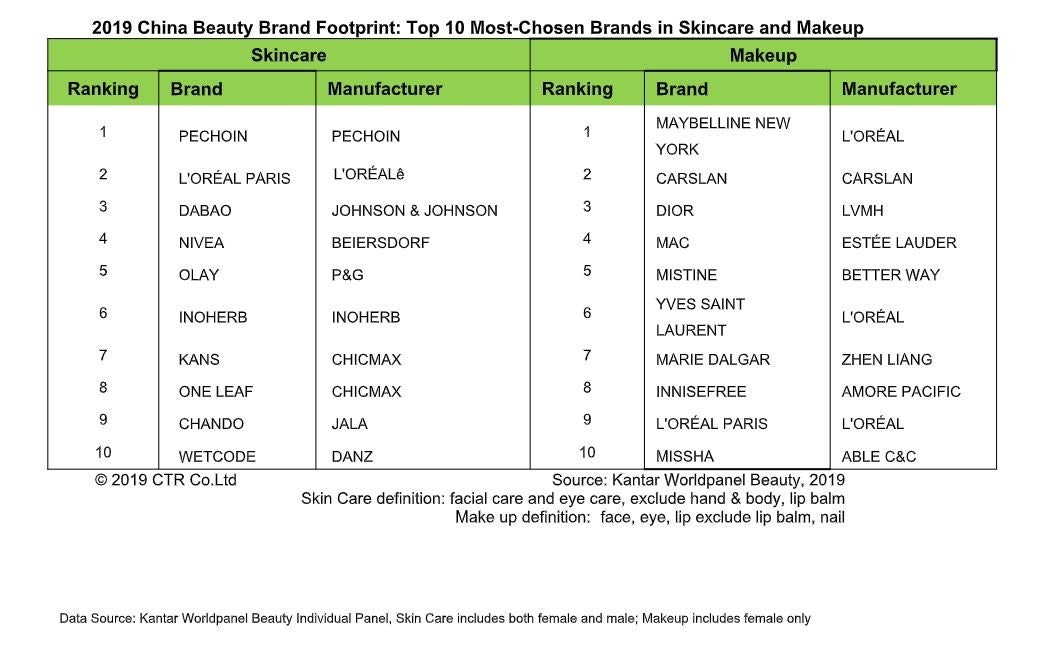

C-beauty brands are moving toward playing a larger role in the Chinese beauty market. Though the status of international luxury brands in the field is still stable — as evidenced by the latest rankings of the most-chosen beauty brands of 2018, which prominently featured big-name players like Dior, Estee Lauder, and L’Oréal — the momentum of C-beauty must be noted and monitored.