Burberry's Spring/Summer 2016 show for menswear. (Courtesy Photo)

This week, Burberry became the latest luxury brand to report less-than-stellar sales figures in the Greater China region, blaming the usual suspects: lower foot-traffic from mainland Chinese shoppers in Hong Kong (worsened by the lingering effects of last year’s political demonstrations), the ongoing anti-corruption crackdown on the mainland, greater animosity between locals and mainlanders…nothing new there.

Although some articles jumped on Burberry’s sales figures of evidence that the China luxury market is in serious decline, a deeper glance at Burberry’s performance so far in 2015 indicates that it’s really not all that bad—and the brand is taking more action than most of its competitors to improve its position in the second half of the year.

According to Burberry, sales in Hong Kong in the three months to the end of June “decelerated further to a double-digit percentage decline.” While this is cause for concern, given the brand estimates that Hong Kong and Macau account for around 10 percent of its total revenues, Burberry’s Hong Kong stores remain profitable. Lest anyone thinks that Chinese consumers are “over” the brand, Burberry pointed out that sales rose (albeit not by much) in mainland China, and Asia—minus Hong Kong—remains buoyant, with Japan and Australia particular bright spots. It should be pointed out that these are two luxury markets powered in no small part by Chinese tourist-shoppers and, in Australia’s case, affluent students, immigrants, and part-time residents.

The onus is now on Burberry to explain what it plans to do to boost sales in China and Hong Kong, rather than just continue courting globetrotting Chinese shoppers. Although the brand looks to be taking the most obvious course of action—reducing legacy stores in mainland China (to 10 from 13) and total stores there to 63, negotiating lower rents in Hong Kong, and cutting prices in both Hong Kong and the mainland—it’s the fourth lever Burberry intends to pull which is perhaps the most intriguing. In its earnings report, Burberry mentioned plans to redirect marketing to target local Hong Kong consumers.

According to finance director Carol Fairweather, this could mean shaking up the product mix in Hong Kong, via “lighter fabrics and smaller bags.” This might not sound incredibly exciting, but localizing for the Hong Kong market might actually do more to encourage sales (to mainlanders as well as locals) than anything else.

The reasons for this are pretty simple: lighter materials play well in the hot, humid city—as well as across the border in nearby Guangdong Province—and jaded shoppers need to see something new and different that they can’t find elsewhere. Absent that novelty, what’s stopping them from shopping online or in South Korea? Convenience? If they want convenience, they can buy online. The prices in Hong Kong certainly don’t have much of an advantage. Additionally, small accessories do well among shoppers buying gifts for friends and family (particularly ones that can be hidden from any potential overzealous customs officials in Shenzhen).

As Jing Daily has previously pointed out, the same boring excuses for poor Hong Kong sales are played out. Brands have had plenty of time to retool strategies. Quite simply, people are buying less stuff in Hong Kong because it’s essentially the same stuff they were buying a few years ago. In the search for something new, Chinese shoppers are choosing Korea, Japan, Australia, and the United States over the crowded sameness of Hong Kong stores.

That said, Burberry has an opportunity to once again be a market leader in Hong Kong (and China). If the question is: “Can Burberry turn it around in Hong Kong?” The answer is: absolutely.

Although it might take the remainder of the year (or longer), Burberry has a chance to get back on track in Hong Kong, given it undertakes a simplification strategy that sees it:

Put the aforementioned lighter-weight fabrics front and center#

, promoting them as “tailored for Hong Kong,” and designed with the city’s weather and lifestyle in mind. The trenches and scarves will still be there, but shouldn’t be the star attractions—leave that to the Regent Street flagship.

Get in front of younger local consumers#

. Middle-aged mainlanders come and go, but young Hong Kongers are an excellent captive audience. Burberry has an opportunity to more aggressively market its lower-priced Brit line to this group, leveraging the brand’s relationships with the celebrities that younger consumers care about.

Rethink its digital strategy#

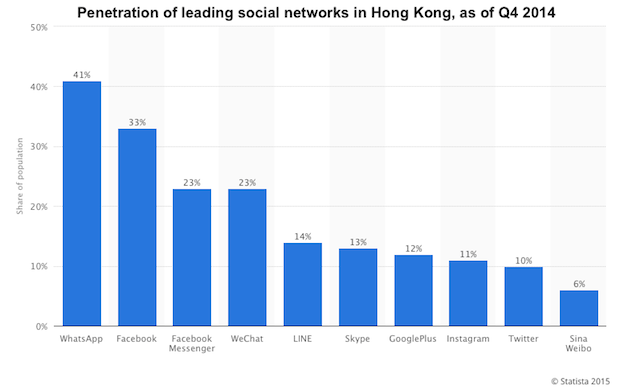

, putting greater emphasis on localized traditional-Chinese-language efforts on WhatsApp, Line, Facebook, and other social networks popular in the city, and working with high-impact, younger local influencers to spread the word about new lines.

Heavily publicize its greater emphasis on locals#

, speaking to their pride in Hong Kong and addressing any possible feelings of being overlooked by brands by brands in recent years. (This local-pride strategy has worked very well for homegrown companies like G.O.D.)

To distill this down even further, Burberry simply needs to speak more explicitly to Hong Kong’s ego. For the past half-decade (at least), the local Hong Kong consumer has remained an afterthought among brands hungry to unload inventory to hordes of mainland day-trippers. Reiterating its commitment to the market and to the local consumer is a good way to build goodwill and encourage people to give Burberry another look.

The best part about this strategy is that it won’t dissuade the still-important mainland Chinese shopper. The vast majority of these visitors already have a shopping list in hand, and if they’ve got Burberry on that list, they probably won’t be aware of—or care the least bit—about Burberry’s local marketing strategy.

Avery Booker is a partner at China Luxury Advisors.