Baidu’s Ernie chatbot has moved out in front of the six AI models released to the public by Chinese tech companies last week after the Chinese government cleared them for consumers to use.

It became the most-downloaded free app on Apple’s app store on August 31, amassing over one million users on the first day it was available. However, Bloomberg ranked the bots according to their ability to complete everyday tasks, placing Meituan’s Zhipu ahead.

Tencent, ByteDance, Meituan, SenseTime and Baichuan also released chatbots featuring the same conversational UI as OpenAI’s ChatGPT. Users can download the apps freely.

With companies the world over, including Kering, Zegna and Zalando, betting big on AI to propel luxury consumption, brands will need to get to grips with these new AI tools, all potential candidates to be the next super app, especially as ChatGPT is blocked in China.

Quest for supremacy#

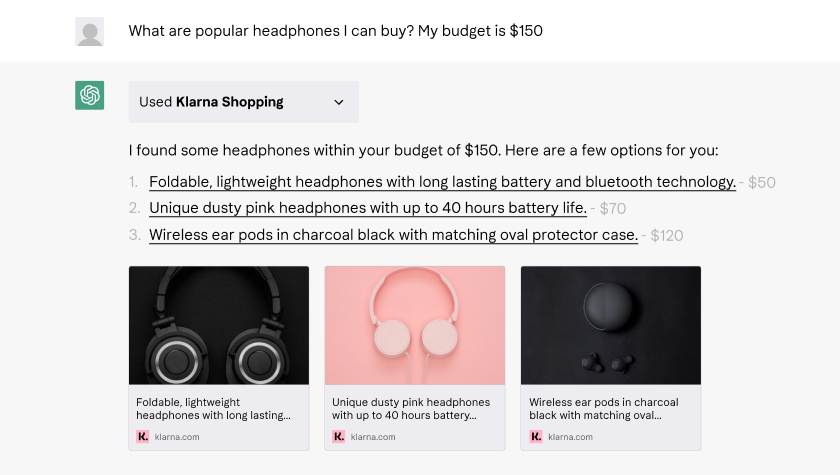

In the West, brands have mostly been using OpenAI’s ChatGPT. For instance, buy-now-pay-later business Klarna and grocery delivery Instacart have both made ChatGPT plugins available to facilitate shopping. Similar services will likely follow in China.

China strictly regulates AI services and products, and AI models are subject to a licensing regime. Though comparative latecomers to the AI party, the newly released chatbots fuel the debate on whether the US or China will lead the world on key technology.

In some areas, including super apps, China is winning. Tencent’s WeChat Pay has 1.1 billion active users and boasts convenient integration across the entire WeChat ecosystem, whereas Apple Pay has about 500 million users globally.

Super apps are one-stop-shop applications that provide services like food delivery, payments, e-commerce, social media and more, all in one.

Tencent’s WeChat is seen as the best example of a super app. WeChat boasts 80 percent market penetration in China, including 900 million active users for its payment system. Instagram’s market share in the US is 51 percent. Apple Pay, one of the most popular digital wallets outside of China, has about 500 million active users globally.

Alibaba’s Taobao and Tmall go far beyond Amazon’s scope, featuring everything from livestreaming to entertainment feeds and mini-games on their apps.

China thrives on tech implementation and adoption. Video game illustrators in China are being replaced by the technology, for example. Virtual influencers are another area where generative AI is likely to make a splash.