“Moutai has become China’s Louis Vuitton"#

There are fewer than 20 bottles of 1958 Moutai in existence

The emergence of Chinese collectors as a major force in the wine auction market may be pushing prices for top Bordeaux and Burgundy vintages higher and higher, but in China, their appetite for new investments has caused prices for high-end baijiu -- traditional Chinese distilled spirits -- to skyrocket. As Jing Daily wrote this February, the baijiu auction market is booming in mainland China, with rare vintages regularly selling for hundreds of thousands of dollars amid frenzied bidding. As Liu Yuan, general secretary of the National Association for Liquor and Spirits Circulation, recently said, this partly boils down to the pedigree, price and long history of the top baijiu brands, particularly Maotai. Said Liu, “Moutai has become China’s Louis Vuitton…Given the limited output and steep price, it’s a good way for officials to curry favor and for the rich to show off their wealth.”

As we pointed out this summer, baijiu's boom-times show no sign of stopping any time soon. At a Xiling auction house sale last December in Hangzhou, a bottle of 1958 Maotai sold for 1.4 million yuan (US$229,453), while China Guardian sold another bottle from 1958 for 910,000 yuan (US$143,410) just a few days later. With domestic Chinese auction houses scouring the country for rare vintage bottles over the past 18 months, we've seen prices trend even higher in 2011. At a Beijing Poly auction this past June, an extremely rare 1930s vintage from the distiller Nai Mao (赖茅), the company that eventually evolved into Maotai, sold for a whopping 2.6 million yuan (US$409,152) in a sale at which more than 1,000 bottles of of baijiu met with intense bidding. In addition to the Ya’s 2.6 million yuan Nai Mao, highlights of the auction included a bottle of 1967 Maotai that sold for 253,000 yuan (US$39,136), a 1966 Maotai that went for 701,500 yuan (US$108,514 ), and a rare bottle of 1960 Five Star Maotai (五星茅台) that sold for 1.3 million yuan (US$204,576).

So are the sky-high prices for baijiu at auction sustainable, or is this another case of speculators pumping up the market? This week, China's Public Finance Net (大众理财网) looks at the growing popularity of baijiu as an investment vehicle for China's elite. Translation by Jing Daily team.

This year, China's inflation situation has become even more severe. Stock market volatility, financial turmoil, restrictions on the property market and rising gold and silver prices have also hit investor confidence, and a lack of investment channels makes many wealthy individuals look at different options. In addition to works of art, lately more investors have turned to collecting baijiu.

From an industry standpoint, the prevailing belief is that whether we're talking about art or wine, investing in traditional Chinese collectibles has become a "theme" in the domestic auction market. As the baijiu auction market has begun to take shape, public awareness of baijiu, particularly in terms of top-quality products, has risen. Considering most people in China already have a solid foundational knowledge about baijiu, this will have a positive impact on the market. Still, buyers need to do their homework before buying and collecting vintage bottles, in order to keep their bidding habits rational.

High-end baijiu has a sort of memorable resonance [in China], and for collectors, especially those expecting inflation to continue growing, the value of their investment will become even more obvious. Compared to the last few years, more and more investors have started to focus on high-end and rare baijiu as a financial vehicle, making the trend highly visible. But an important thing to note is that there is currently a deficiency in China in terms of storage facilities and a need exists for top-quality alcohol storage. Otherwise, the value of these collectors' investments could drop like a stone.

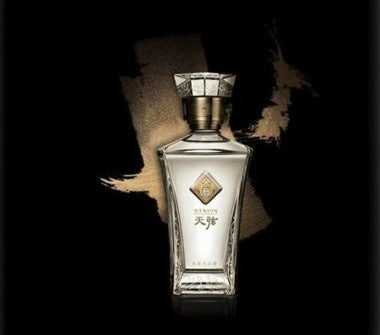

LVMH-owned Wenjun will introduce its Tian Xian line to Hong Kong this month

The market for rare baijiu may be booming, but as in China's similarly booming wine market, counterfeits are rife. As collector Zhang Zongjie (张总结) told Southeast Net (Chinese) this week, "Currently in the auction market, I'd say eight or nine out of every ten bottles of Maotai are fake." Whether Zhang's estimate is simply anecdotal or on target, clearly collectors are still eager to bid on vintage lots at auction. Next month, Xiamen Dingjia Auction House (厦门定佳拍卖行) will hold an auction of more than 30 vintage bottles from the 1950s and '60s, which the company solicited from private collections around the country. According to the company, Xiamen has produced more than 20 collectors over the past two years, making that city one of the most active vintage baijiu auction markets in China.

In other baijiu news, the LVMH-owned distiller Wenjun announced this week that it is set to enter the Hong Kong market, beginning with its flagship Wenjun and small-batch Tian Xian lines, which range in price from 790-1,280 yuan (US$124-202) per 750 mL bottle.