Takeaways:#

- Around half of Deloitte’s Chinese respondents said they were likely to delay large purchases, according to Deloitte’s Global State of the Consumer Tracker.

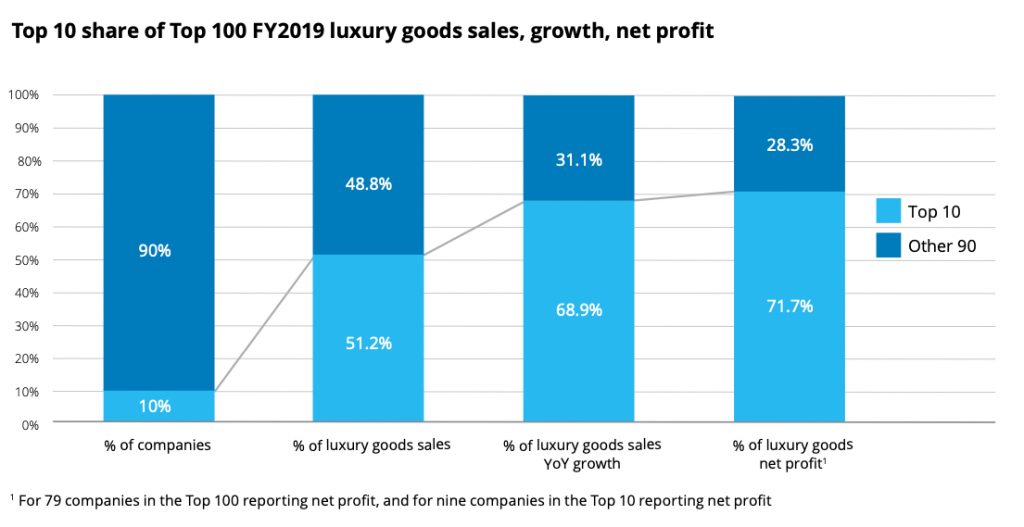

- For the first time, the top-ten luxury companies contributed more than half of the top 100’s total luxury sales over the 2019 fiscal year, according to Deloitte.

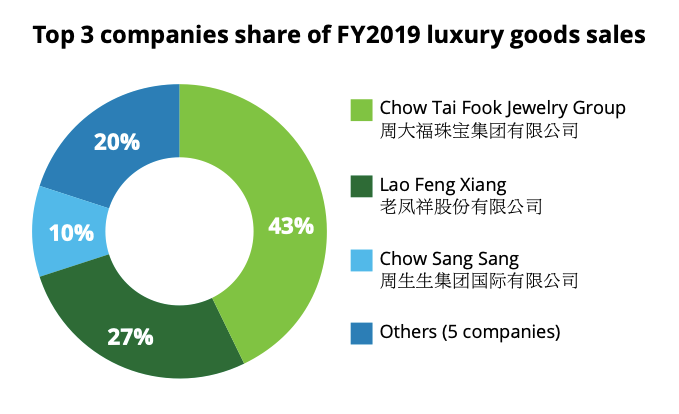

- Among the top-100 global luxury companies by sales over the 2019 fiscal year, the majority of eight companies based in China were jewelry makers, including Chow Tai Fook (8th), Lao Feng Xiang (16th), and Chow Sang Sang (30th).

Deloitte recently released the seventh edition of its Global Powers of Luxury Goods report, which includes the most important trends in “a new age for fashion and luxury” and the top-100 largest luxury goods companies globally.

“Tradition and responsiveness, two elements that have always characterized luxury companies, will both be required to face great challenges in the post-COVID environment,” said Patrizia Arienti, the EMEA Fashion & Luxury leader at Deloitte Global, in the report. “We see the pandemic acting as a divider between the old way of doing business and the new scenario that is taking shape, characterized by changing consumer behavior,” she added.

Here, Jing Daily captures three key findings in the global consultancy’s report from the 2019 fiscal year for companies to review and consider.

Global consumers’ have uneven reactions to the pandemic#

Across the 19 countries surveyed, 30 percent of the correspondents say they have concerns about making future payments, Deloitte said. According to the company’s Global State of the Consumer Tracker — a longitudinal study that explores the consumer mindset in the wake of COVID-19 — 63 percent of respondents in India and 47 percent of those in China were the most likely to delay large purchases. In comparison, respondents in the Netherlands, South Korea, Japan, and Germany felt the most secure about their finances and health.

Among all the countries in the survey, only consumers in China, where lockdown measures were eased before the rest of the world, seem more inclined to increase their spending on discretionary goods — and 26 percent of those purchases would be for apparel and clothing.

Legacy brands embrace resale To encourage the circular economy#

From the second-hand e-tailer Plum (红布林) to the used luxury livestreaming platform Feiyu (妃鱼) China has seen a boom in the luxury resale goods market. But this trend is a worldwide one, says Deloitte. Moreover, brands can rest assured that spending on used luxury does, in fact, augment the demand in the primary market, as affluent millennial and Gen-Z consumers are purchasing in both the primary and second-hand markets.

The second-hand market is forecasted to increase at a compound annual growth rate of 15.5 percent, from $16.2 billion in 2018 to $68.5 billion in 2026. Therefore, to help encourage the circular economy, legacy brands are embracing resellers. As such, luxury retailers and brands are both entering the growing resale market. In 2018, Richemont and Farfetch acquired the resale platforms Watchfinder and Stadium Goods, respectively.

Jewelry groups continue to represent China in the top-100 list#

For the first time, the top-10 luxury companies contributed more than half of the top 100’s total luxury sales over the 2019 fiscal year, according to Deloitte. Half the top-10 companies achieved double-digit year-on-year sales growth (only Swatch Group reported a fall in sales.)

Among the top-100 global luxury companies by sales over the same period, the majority of those eight based in China are jewelry makers, including Chow Tai Fook (8th), Lao Feng Xiang (16th), and Chow Sang Sang (30th). Trinity Limited, which owns menswear brands such as Cerruti 1881 and Kent & Curwen, is a new entry at 98th. It’s also the only top-100 Chinese company outside of the jewelry category.