There is little doubt that China has taken a leading position in transitioning toward a cashless and digital society. Thanks to the swift development of mobile payment solutions such as Alipay and WeChat Pay over the past two to three years, digital transactions have been made seamless and convenient for Chinese consumers.

In 2016, Chinese consumers processed a total of $3 trillion in transactions through Alipay and WeChat Pay. The evident rise in popularity of mobile payments among the Chinese has already caused a high adoption rate of services by domestic retailers and merchants.

A June 30 report, released to us exclusively by the consulting firm Kapronasia in collaboration with the payment promotion agency CANCAN, indicates that a similar trend is also taking off at an international level.

The study, which is based on a survey of over 1,000 Chinese consumers and more than 60 global merchants, points out that the widespread trend in cashless transactions in China, which coincides with the explosion in outbound tourism, is set to cause a revolutionary change in the way global luxury retailers operate their businesses in the foreseeable future.

Rich Chinese travelers demand mobile payment services overseas#

Factors including "ease of use" and "convenience" have driven Chinese consumers to prioritize mobile payments during overseas shopping, according to the survey, with 67 percent of respondents reporting that they use mobile payments overseas.

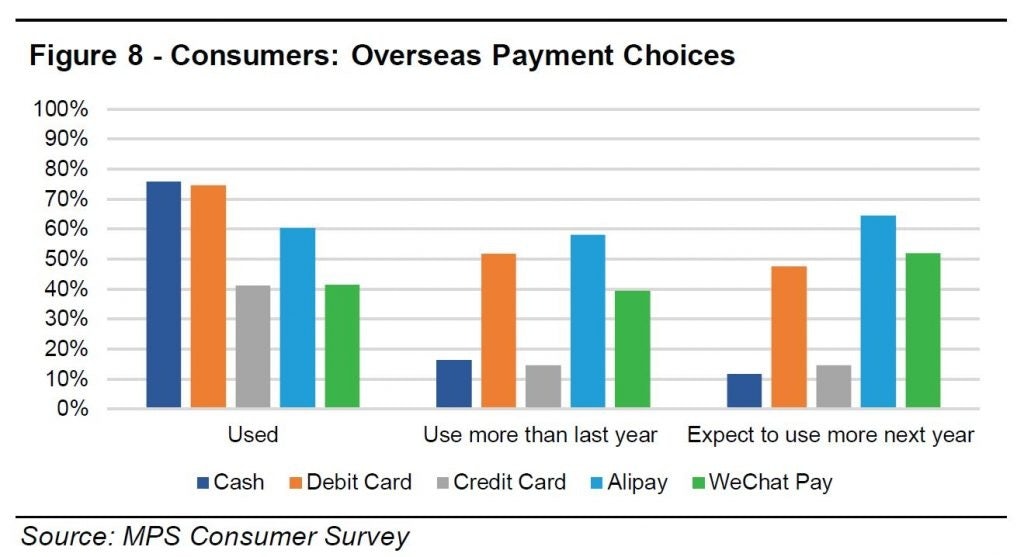

When asked which mobile payment solutions they expect to use more of next year, over half of the respondents said Alipay and WeChat Pay, while a little over 10 percent opted for cash and credit cards, the two payment options that are currently being used most heavily by Chinese consumers when traveling overseas.

It's difficult to meet consumers' expectations for accessible mobile payment options given the current low penetration rate of Alipay and WeChat Pay in the global retail networks. The findings suggest that in 2016, half of the surveyed consumers said that they used mobile payments for about three percent to 30 percent of overseas transactions. Roughly 20 percent of them have never used mobile payment overseas.

In the luxury domain, the adoption rate is even smaller. Luxury department stores Harrods, Selfridges and Galeries Lafayette, which all began offering Alipay early last year, are among the first few merchants to do so. Many luxury brands have started their experimentation within mainland China but have not yet applied the methods outside of Asia.

Plenty of room for growth#

The wide gap between the huge demand by Chinese consumers for mobile payment services and the insufficient supply by international merchants indicates there is plenty of room for growth. The report also noted that applying mobile payment is beneficial for merchants' businesses.

"What we have found from the survey is that Chinese customers tend to close the sale more quickly when they know that they can pay with mobile," said Candice Koo, the Managing Director of CANCAN. "Those transaction times are extremely quick, at under a minute."

"Many Chinese are visiting the shop because they are already interacting with the brand's homepage on the app (in the case of WeChat) or through the company's promotions, also within the app (in the case of Alipay)."

Alipay or WeChat Pay: the domestic rivals extend the battlefield abroad#

For international luxury labels that want to make informed decisions about the usage of Chinese mobile payments for their businesses, it is necessary for them to understand the battle between Alipay (owned by Alibaba Group) and WeChat Pay (backed by Tencent).

The two mobile payment apps both expanded their footprint to the global market in 2015 and invested a great amount of time and money in partnering with local payment processors in major developed markets and establishing relationships with brands and retailers.

Alipay and WeChat Pay each have unique advantages. Alipay is backed by the mature e-commerce system developed by the country's biggest e-commerce company, Alibaba. WeChat Pay, on the other hand, is built within China's top messaging app, WeChat, that has a huge amount of daily active users.

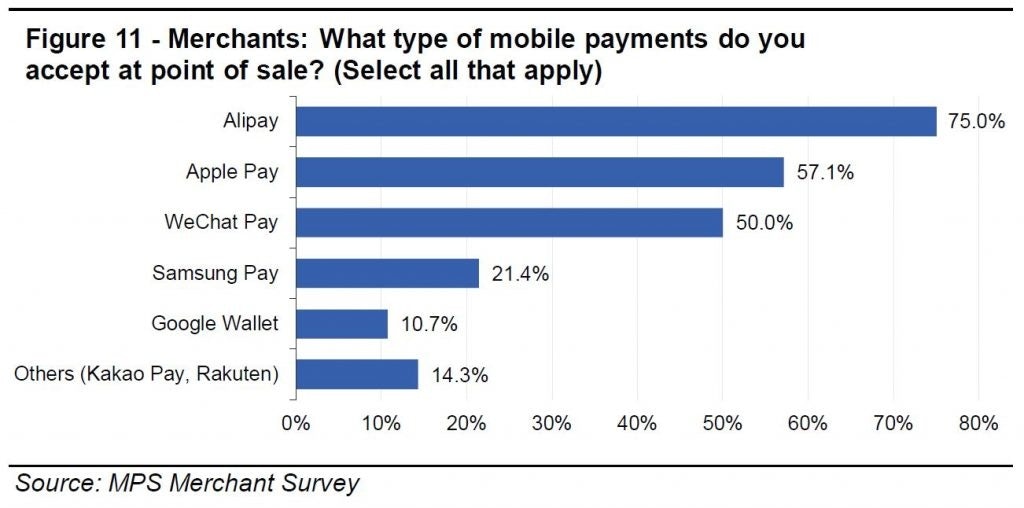

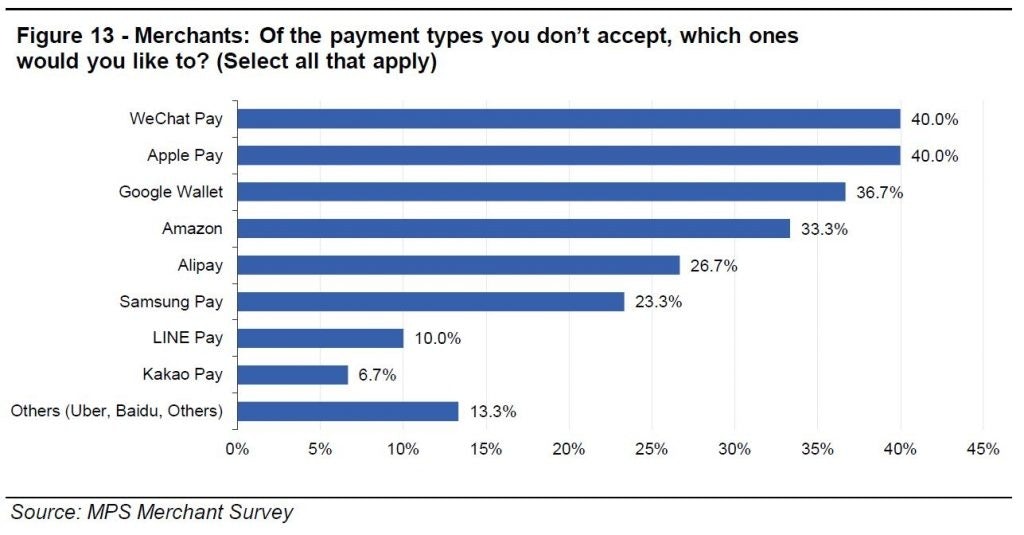

According to the survey, it seems that Alipay currently leads the competition by accounting for three-fourths of the overseas presence among the surveyed merchants. However, the image below reveals that international merchants have also recognized the importance of WeChat Pay for their Chinese consumers, with 40 percent of them marking the option as the payment type that they want to accept in the future.

"Mobile payments will certainly have an impact on our business this year," said a travel retailer speaking on the condition of anonymity. "We also think that our negotiation power with the mobile payment suppliers will increase thanks to more competitors entering the field."

Will the Chinese government's capital controls curb the expansion of mobile payment?#

Luxury brands also need to understand that the Chinese government's regulatory power can be a road bump when it comes to the international expansion of Chinese mobile payment. The capabilities of major providers have frequently been curtailed by the regulatory moves of the Chinese government.

For example, in 2015, the People's Bank of China (PBoC) issued an order to set a 5,000-yuan cap on purchases made through an online payment provider during a single day, according to a report by Quartz. Meanwhile, the QR code-enabled payments are limited to 200 yuan per day.

While the above rules currently apply only domestically, it remains unclear how they will impact overseas payment.

With respect to conducting transactions overseas and moving money abroad, the restrictions set by the Chinese government are more likely to tighten than loosen as the country has been plagued by capital outflows and slowing economic growth in recent years.

"Tencent's side seems to have more concerns about the merchants," said Jenny Chen, the Marketing Manager at the WeChat Agency WalktheChat.

"When WeChat approves a merchant for cross-border WeChat payment, they request a lot of information from the company, and have a strict underwriting process to make sure the merchant is not engaging in money laundering."

Zennon Kapron, the director of Kapronasia, had a more optimistic take on capital controls. "The limits are relatively high," said Kapron, "and shouldn't affect the spending of most consumers."