How do Chinese women really feel about that next big luxury collection out on the market? Exane, a France-based investment company, has attempted to answer this question with a quantitative analysis of the Chinese shopper’s true desires when it comes to purchasing luxury brands.

The primary findings aren’t news per se, at least according to most market reports. They reveal that luxury stalwarts like Chanel, Dior, and Hermès are what Chinese shoppers think about most when they go to sleep at night—it’s not surprising, then, that Apple looked to Hermès' timeless leather designs for its latest wearable tech collaboration that attracted droves of China's fashion-savvy.

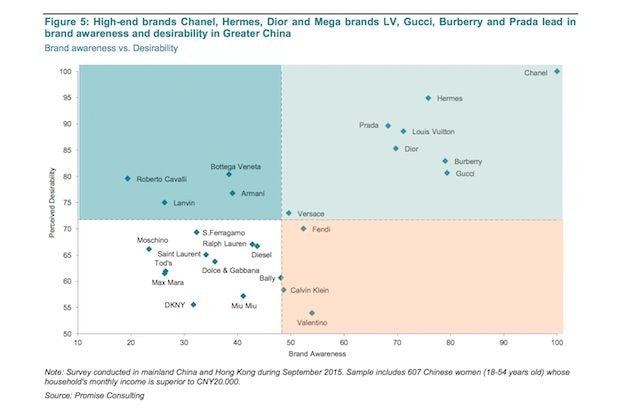

More revealing, however, are Exane's findings as to which brands are notorious in China, but have yet to prove to consumers that they're worth an investment.

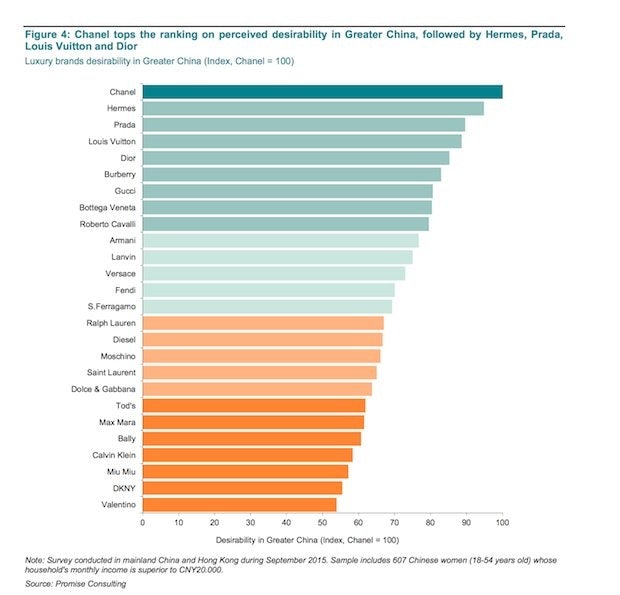

Exane teamed up with marketing survey specialists Promise Consulting to release its report titled “Measuring Brand Exclusivity and Desirability – China,” which calculates the difference between how much consumers desire a brand versus how exclusive they view the brand to come up with a measurement of either a desirability surplus or deficit. They did this by surveying 607 Chinese women between 18 and 54 years old whose monthly income is higher than RMB20,000 (US$3,124). They were each asked to rank around 30 brands in terms of most exclusive or high-end to least exclusive, plus most desirable to least desirable.

The report found that brands like Bottega Veneta, Ferragamo, and Prada were frontrunners with favorable desirability ratings despite what market consensus would suggest. Meanwhile, brands like Gucci and Burberry, while still ranking quite high overall in terms of how much consumers are aware of the brands, are not as desirable as one would think. Exane came up with a significant desirability deficit for both of them, with Burberry doing better in Hong Kong compared to mainland China and Gucci doing worse.

Burberry’s status in China does come with baggage. While most luxury labels generally remained wary of taking their products into China’s e-commerce sites because of the fake goods, Burberry was the first to take a chance by opening a store on Alibaba’s Tmall last year to start creating a sense of legitimacy around its brand on the site. Gucci has also been working on rebuilding its name, not just in China, but among its clients around the world.

As Chinese consumer trends decide the fate of the major luxury players, those brands that play off of the growing middle class’s newfound desire for originality through store placement and brand strategy are going to excel, if this report is anything to go by. Hermès, for example, did well by choosing to position itself in Shanghai’s former French Concession, a move that told consumers it was offering “refined luxury,” according to Philippe Jourdan, CEO of Promise Consulting.

“Hermès’ brand image and the conception of its products echo the evolving attitude of Chinese clients, who are searching for products that are less visible, branded more discreetly, reflect an authentic savoir-faire and upper quality,” Jourdan said in a statement.