After months of planning, advertising and hype by brands and retailers, China’s annual shopping event Singles’ Day, or 11/11, took place on Sunday and the holiday’s inventor Alibaba Group had another record-breaking year.

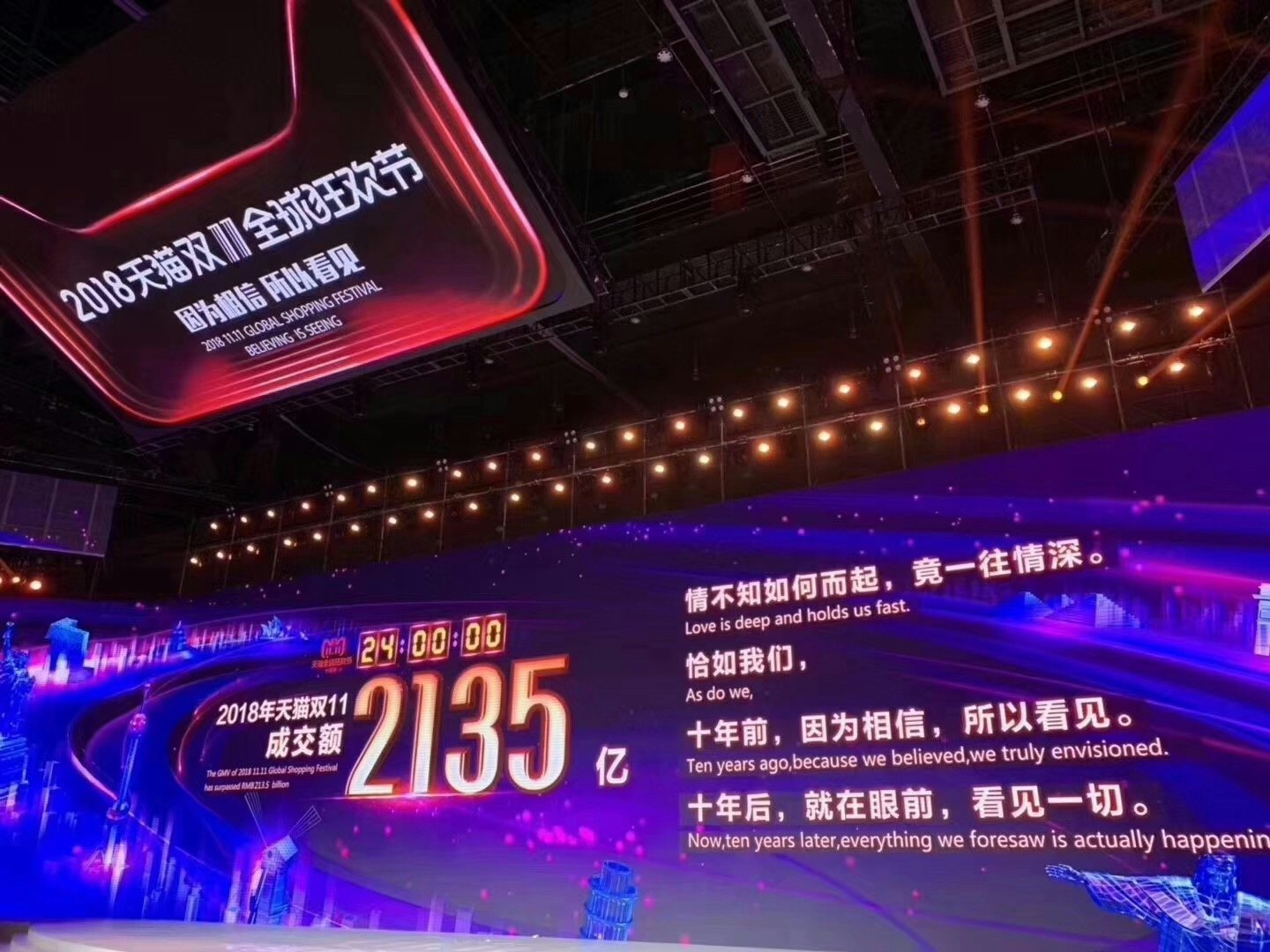

Marking the 10th anniversary, Alibaba reported the sales over the last 24 hours reached $30.8 billion (RMB 2,135 billion) in gross merchandise volume, up from last year’s $25.3 billion (RMB1, 682 billion) record. At the same time, it was the first time that delivery orders that were placed exceeded a stunning one billion.

At a gala in Shanghai, Alibaba flashed the climbing sales figure on a flashing tote board more normally associated with charity telethons. To put the gross merchandise value figure into perspective, Business Insider said $30.8 billion in sales nearly tripled every company’s, including Amazon’s, Black Friday and Cyber Monday sales combined in 2017. The comparison isn’t quite equal, as 11/11 shoppers can make online orders weeks ahead of time that isn’t processed until Single’s Day, but the pace of buying still soothed some market-watchers who consider 11/11 as a bellwether for the Chinese economy.

Alibaba’s major e-commerce rival JD.com also scored around $23 billion (RMB 159.8 billion) during the Singles’ Day, according to the company’s spokesperson.

Economic concerns#

Singles’ Day serves as an important metric to gauge the health of China’s economy. The country’s growth has shown signs of a slowdown in recent months as China entered the trade war with the United States and its credit/debt issues are critical.

Despite the record-breaking sales, The New York Times called this year’s event “a party held with icebergs in sight from the deck”. The pace of sales growth actually slowed, with a 27 percent climb this year compared to 39 percent in last year and 32 percent in 2016.

And as for whether the blockbuster total will reverse a slide in Alibaba shares, Tech Crunch noted “The slowdown [in rate of 11/11 sales growth] came on the heels of Alibaba’s weakest revenue growth since seven quarters ago and a cut in its annual revenue forecast — though revenues are still increasing at a healthy rate of 54 percent year-over-year.”

Chinese publications also put a question mark on the record-breaking sales figures reported by Alibaba, noting the growth was widely predicted, even expected. Tang Xiaotang from Local Retail Observer wrote: “it is politically incorrect to doubt Alibaba would be able to break its sales from last year.”