Earlier this June, Alibaba’s mid-year shopping festival, Tmall 618, saw record breaking sales for both domestic and foreign brands, many of whom surpassed benchmarks set by 2018 Singles’ Day. And with 2019 Singles’ Day just around the corner, the tech giant has set the bar even higher for this November’s shopping frenzy.

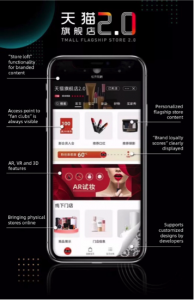

According to Alibaba, the platform will “offer new features and tools that enable brands to further engage with their customers through rich, interactive content and an omnichannel experience.” The new features have been dubbed, “Tmall Flagship Store 2.0.” One of the standout features includes AR-powered virtual makeup tools, with beauty brands like Tom Ford Beauty, MAC, and Giorgio Armani Beauty preparing to upgrade their stores with this new technology.

AR makeup tools is no longer a novelty in the beauty market. Earlier this summer, YouTube launched an AR filter and introduced their AR Beauty Try-On function. Beauty brands like MAC Cosmetics have collaborated with popular YouTubers to promote their products as paid sponsorships. Last year, L'Oréal fully acquired the Canadian AR Beauty Company Modiface, in the hope of applying the company’s AR and AI tools to their 34 brands, including Lancôme, Giorgio Armani, and Urban Decay.

As a rising trend, AR makeup technology is making its presence in the Chinese beauty market as well. One of China’s leading e-commerce players, JD.com, launched its self-developed AR makeup functionality in 2017. Elsewhere, the AR magic mirror developed by local AR technology corporation Paxi has been introduced to China’s biggest beauty product retail chain, the A.S. Watson Group Ltd.

The potential of AR technology in the Chinese beauty market, however, has yet to be fully realized. Led by big e-commerce players like Alibaba, Chinese e-commerce is on track to transform this technology into a “new retail era,” where online and offline merchants learn from each other and provide a brand new shopping experience for consumers.

As a Nielsen report points out, offline shoppers will use the Internet to compare prices, while online consumers will visit the physical store to know more about products. As a part of the new retail strategy, AR makeup aims to provide an offline try-on experience with online shoppers and further stimulates their online shopping impulse, which could be important for the e-commerce platform, Tmall, and their brand flagship stores.

According to a JPMorgan study released in October, “China is now the second-largest beauty player in the world, with online sales now representing a quarter of the market, as brands have been able to reach customers outside the most developed Chinese cities.” A large base of Chinese online shoppers, however, want a “real” shopping experience that can compete with the physical store experience, and Tmall’s Flagship Store 2.0 is positioned to meet their needs.

This is not the first time Tmall has used AR technology to promote its creative retail modes. As early as February 2018, Tmall partnered with the mall operator Intime to launch a “Smart Ladies’ Room” in Hangzhou’s West Lake Intime shopping mall. They offered a pair of “magic mirrors,” an AR-powered digital screen that “lets shoppers virtually try on and purchase cosmetics.” Alibaba has also launched a magic mirror in its Maybelline Tmall pop-up store, as well as the Korean cosmetics Innisfree store before, to test the AR makeup tool market.

After more than one year of testing the market, Tmall has prepared to apply their AR makeup techniques to a wide range of online stores. Given Taobao and Tmall’s giant influence in Chinese e-commerce landscape, it is likely that Alibaba will release the untapped potential of AR technology in the Chinese beauty market. Here’s what beauty brands should focus on to grasp this lucrative opportunity.

AR makeup tool offers customers many more options than to simply try on makeup in a fun and innovative way. Without the concern of hygiene issues or the tedious process of removing layers of makeup, customers can quickly and easily try on as many different products as the wish. The AR technology can also save them the trouble of traveling to bricks-and-mortar stores and expands their room for choice. For brands, AR makeup tools saves them the cost of hiring a large team of sales assistants, because customers can enjoy the self-service try-on process. The aim is to improve a consumer’s overall shopping experience, which will hopefully further increase the transaction conversion rate, and help bring about increased profits for merchants.

Another reason why AR technology is especially important to the Chinese beauty market is the rising spending power in Chinese low-tier cities and suburbs. According to Invesco, the consumption growth in low-tier cities is catching up with first-tier cities, and low-tier urban residents are increasingly pursuing high-end products and looking for novel shopping experiences. For beauty brands that have not yet entered these low-tier cities, Tmall’s AR-powered online store can help them getting closer to this underserved and growing consumer base. Thanks to the AR makeup technology, customers who have limited or no access to these brands can now try on their products and see what works for them. Moreover, it’s also a smart strategy for Western brands to test the local market before launching a physical store.

Before devoting themselves to Tmall 2.0 stores, however, brands need to be prepared. As Jiang Fan, the president of Tmall and Taobao, said the upgraded stores “would allow for an even more cutting-edge and seamless shopping experience,” which makes the boundary between online and offline shopping more blurred. Also, according to McKinsey’s “China Luxury Report 2019,” for online purchases young consumers — millennials and Gen-Z’s — “are demanding superior experiences through personalization and easy try-on.” Therefore, brands need to transform their traditional digital marketing modes into a more “personalized” strategy. With the help of the AR makeup tool, beauty brands may be able to provide individualized service on online stores as good as offline stores. For example, AT makeup technology can offer too many choices. But instead of leaving customers in the sea of different-color lipsticks or eye shadows, brands can offer some personal makeup recommendations as well as promote their products.

It may take some time for Chinese beauty customers to fall in love with the virtual experience of AR makeup tools, but the potential is promising, as long as Tmall and global beauty brands can provide potential customers with a “real” and convenient shopping experience this emerging technology promises.