Explosive Growth In High-Earner Demographic Projected For Coming Decade#

A luxury mall in Shanghai. (after_alex/Flickr)

Consulting firm McKinsey & Company has just released a report on the explosive growth of China's middle class and its effect on the country's consumption patterns, and the numbers are remarkable--by 2022, more than 75 percent of China’s urban population will be making a middle-class income with purchasing power parity similar to the average incomes of Brazil and Italy.

While the report's discussion spans middle class incomes ranging from 60,000 renminbi ($9,000) to 229,000 renminbi ($34,000), there are several key takeaways regarding luxury that can be gleaned from its findings. The changes discussed in the report regarding the income, age, and geographic demographics of this rising class are likely to dramatically alter the luxury landscape in the coming years.

First, the study finds that a substantial amount of luxury industry growth will be driven by the massive population expected to enter the upper middle class, which consists of people making 106,000 ($16,000) to 229,000 renminbi. The report states:

Along with affluent and ultrawealthy consumers, upper-middle-class ones are stimulating rapid growth in luxury-goods consumption, which has surged at rates of 16 to 20 percent per annum for the past four years. By 2015, barring unforeseen events, more than one-third of the money spent around the world on high-end bags, shoes, watches, jewelry, and ready-to-wear clothing will come from Chinese consumers in the domestic market or outside the mainland.

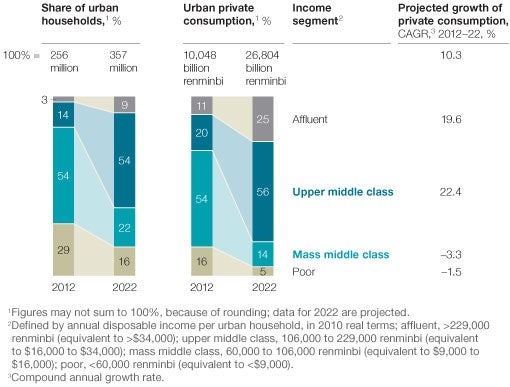

This trend is seen in the chart below, which shows that upper middle class consumers will transition from 20 percent of total urban private consumption in 2012 to to 56 percent in the next decade. Affluent Chinese will take up a substantially higher rate as well, moving from 11 to 25 percent.

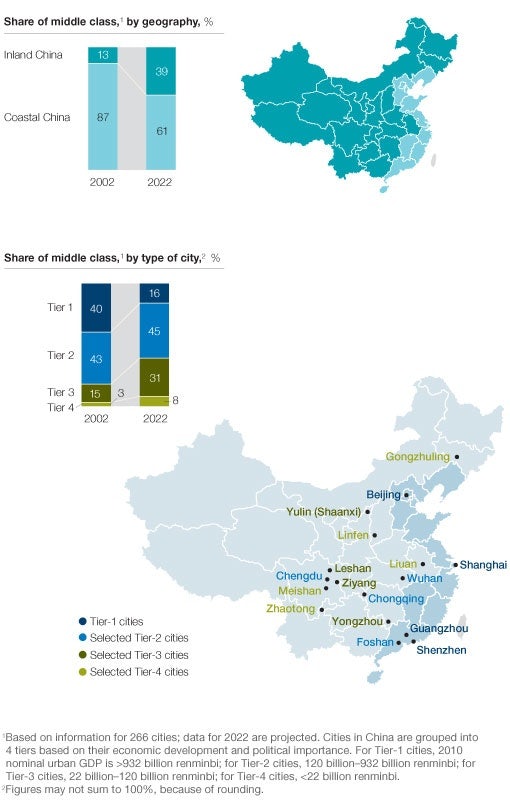

Geographically, second-, third-, and fourth-tier cities are all expected to rise in income and take up a higher percentage of China's overall middle class by 2022. The importance of China's second tier is highlighted in the chart below, which shows that it will make up 39 percent of the middle class by 2022.

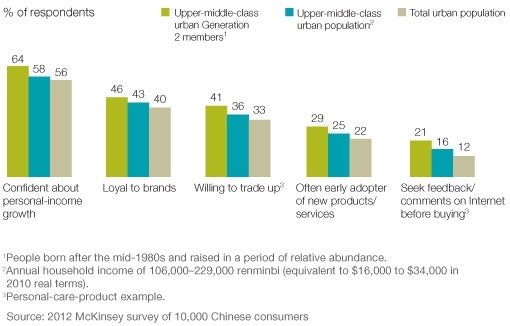

The study also cites key cultural shifts taking place among different demographics of middle-class Chinese consumers. China's younger middle class members have been shown to be more likely to "seek emotional satisfaction through better taste or higher status," are "loyal to the brands they trust," and "prefer niche over mass brands." In addition, they are "confident, independent minded, and determined to display that independence through their consumption."

All of these trends bode well for luxury brands targeting both the upper-middle-class and affluent income ranges, and will likely cause many companies to realign their strategies. While affluent customers will continue to drive growth in ultra-luxe categories, the rise of upper-middle-class consumers has already had an influence on the growth of more "accessible" sectors such as beauty, fast fashion, and mid-luxe lifestyle brands. In addition, the rise of lower tiers will be an increasingly critical factor in profit growth numbers, but brands must remain cognizant of differences in consumption patterns between these cities and the upper tier. Meanwhile, as China's affluent population already skews younger than that of other countries, the rising new generation of consumers will continue to push companies to respond to the new demands of this demographic.