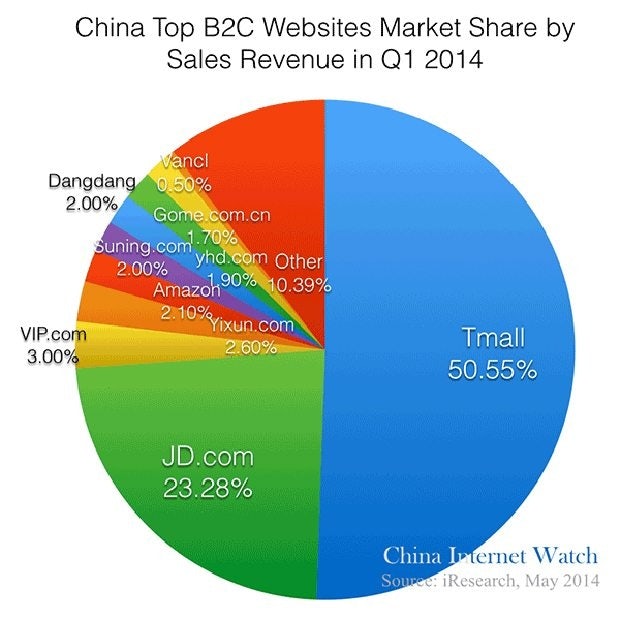

Tmall dominates the B2C scene with slightly more than 50 percent of China's total e-commerce market share. (China Internet Watch)

After a massive amount of online buzz about recent IPO announcements by Chinese e-commerce giants Alibaba and JD.com, China tech blog China Internet Watch has released an infographic laying out exactly how much China market share each of China's B2C (business-to-consumer) e-commerce sites take up. Alibaba’s behemoth Tmall tops the chart by sizable margin with 50.55 percent of market share by revenue, while JD.com comes in second with nearly a quarter (23.28 percent) of the total market. The next three runner-ups, VIP.com, Yixun.com, and Amazon lag far behind, with between 2 and 3 percent each.

According to the blog, China's total online shopping revenue hit 181.92 billion yuan (US$29 billion) in the first quarter of 2014, marking year-on-year growth of 44.6 percent. The B2C sector is rising much faster than C2C (consumer-to-consumer) sites, which grew by 18.3 percent in that time period, according to Chinese research company iResearch.

Alibaba’s Tmall and C2C site Taobao dominate the overall e-commerce market in China, and have investors abuzz right now after the company filed a $1 billion U.S. IPO last Wednesday that is expected to raise a much higher amount when it goes public. Not long after, rival Jingdong Trading Co.’s JD.com filed regulatory papers for a U.S. IPO with plans to raise $1.7 billion as the company does everything it can to try to catch up with its gigantic competitor.