Key Takeaways:#

American businesses are left in limbo as they lack government support from Washington and are under siege in China.

Aside from adapting to changing consumer demands, the multinational enterprises that stayed in China had to deal with an increasingly hostile business environment.

- Instead of solely focusing on Chinese reforms, foreign brands should pay more attention to their challenges in the Chinese economy.

Beijing has come under fire for its policy shifts over recent months, with its new approach towards “Big Tech” and its harsh education and gaming reforms dumbfounding the international business community. Some global players have adjusted to the changing environment, while others didn’t respond well to the new challenges. As such, those businesses were forced to scale back their China operations or even move out of the country altogether.

Some US multinational enterprises (MNEs) have started looking for alternate sourcing sites in emerging markets, specifically Asia-Pacific and Latin America, while others moved factory production completely out of China. This shift, however, was provoked by the ongoing trade war and rising labor costs in China, and having less to do with policy changes.

Already in 2019, CNBCnoted “an eight-fold rise in average blue-collar wages since 2004” has pushed toy-makers, shoe manufacturers, and apparel producers to look for alternatives to Chinese manufacturing. Just to put things into perspective, the average hourly wages for China's manufacturing workers sit at 4.12, according to Barclays research, versus 1.59 in India.

However, CNBC and The Wall Street Journal also highlight the complexity of replacing China with emerging Asia-Pacific economies, as labor shortages, product quality problems, and a lack of specialized supply chains complicate the process.

In 2019, quality issues were on the rise in the South Asian manufacturing sector. According to Qima, India and Pakistan registered inspection failure rates of over 33 and 37 percent, respectively. Meanwhile, over 40 percent of all inspected goods in Cambodia during Q2 2019 were rated outside the acceptable quality level.

The MNEs that stayed in China not only were forced to adapt to changing consumer demands but also to an increasingly hostile business environment. Therefore, they had to lobby their governments for better trade and working relations with China. So far, European companies seem to have gotten a better deal than their American counterparts. And the signing of the EU-China Comprehensive Agreement on Investment (CAI) shows that the European Union is ready to strengthen economic ties with China even though Washington has embraced a tougher stance against the country.

As Corporate Europe Observatory reports, China has used its multinational corporations like Tencent, think tanks, and academic institutions to boost its image with the European Union and promote its flagship program, The Belt and Road Initiative.

Meanwhile, American businesses seem to have been left in limbo as they lack government support and are under siege in China. However, the situation isn’t as doomed as it seems.

Most of Beijing’s policies shifts have been blown out of proportion in Western media, falling into the category of “politics of blaming.” Rather than focusing extensively on China’s reforms, foreign brands should pay closer attention to challenges currently facing the Chinese economy: rising debt, a slowing economy, higher unemployment, and stagnant job creation for young workers.

The Chinese Communist Party (CCP) understands the possible blowback if the economic situation continues to deteriorate. Consequently, it aims to bolster its image through popular policies because Chinese consumers necessarily will demand greater transparency from tech platforms, brands, and idols.

In fact, the overwhelming majority of global consumers demand their governments protect their interests and rights. But too often, Western corporate lobbyists bully democratic government.

“America faces a crisis of corporate capture of democratic government, where the economic power of corporations has been translated into political power with disastrous effects for people’s lives,” says Liz Kennedy, director of democracy and government reform at the Center for American Progress.

Look at it like this: Amazon, Facebook, and Google’s power grab in the US goes unchecked despite consumer demands for limits to their power. Conversely, China’s new policies pose threats to big tech, not consumers.

So what is the endgame of China’s new approach to “Big Tech” and idol economy? Greater control. Not only are happier workers more productive, but they are also easier to control. Countries where ordinary citizens are dissatisfied with democracies fuel rebellions and street uprisings. That leads to economic and political instability.

Meanwhile, Beijing also understands that China is at a crossroads. The CCP faces the risk of losing power because some tech giants (Alibaba, Meituan, and Didi), business executives (Jack Ma), and idols have grown ambitions of becoming extremely powerful. So, to keep a country of 1.4 billion people under control, you cannot have any figure more powerful or charismatic than Xi Jinping or a private company that threatens the status quo of the CCP.

But similar rhetoric is even present in the US, where Republicans rally against big tech companies and business leaders who amassed too much power and became immune from public accountability, such as Mark Zuckerberg and Jeff Bezos.

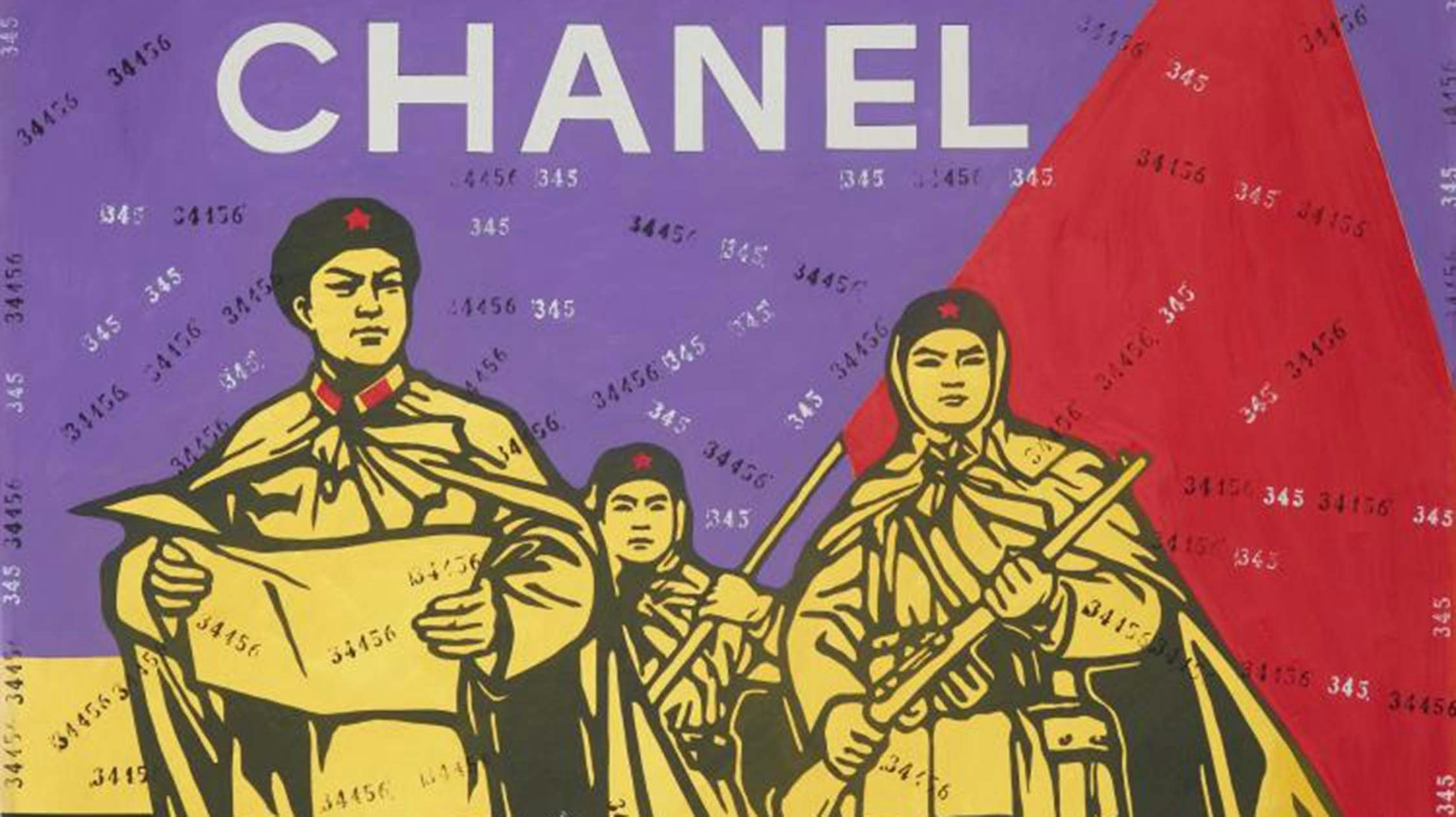

In the end, taking back power from private companies means censoring Western entertainment and reviving the communist ideologies. Beijing saw firsthand the influence Western values have had on their youth, and they want to rectify that. Chinese cultural values, like those in Japan and Korea, emphasize collectivism, unlike individualistic Western values.

Luxury brands won’t find it too challenging to adjust to these unique circumstances. The impact on their operations will be minimal as long as they avoid controversies and scandals and embrace a more “harmonious” approach similar to the one championed by Elon Musk.