It would be an understatement to say that China’s luxury daigou (代购) market, or goods brought into the country to be sold from abroad, is a significant one.

Although their numbers have decreased since 2014, daigou sales are estimated to be worth 43 billion RMB, or the value of about 38 percent of all luxury sales in mainland China, according to Bain & Company’s annual China luxury report. Since these massive numbers mean big sales growth globally, brands can actually receive short-term benefits from daigou sales. As most Chinese consumers are highly aware that foreign luxury goods are significantly more expensive inside mainland China than they are abroad, those unwilling to buy at home but also unable to travel might make a purchase they otherwise wouldn’t have. Meanwhile, wealthy consumers in lower-tier cities have access to a wider variety of items through daigou, and use it to purchase what they ordinarily wouldn’t have access to.

But short-term sales growth can lead to some long-term complications for brands. Based on Jing Daily’s research in its new report, “

China’s Online Gray Market and Counterfeits#

,” below are five ways that the daigou market is causing complications for the global luxury industry:

Lack of brand-driven after-sales service.#

If a consumer orders a daigou luxury item through Taobao, issues that arise with the order have to be directed at the anonymous merchant. Since high-quality customer service is just as important as the quality of the items themselves when it comes to luxury, this key element is being hijacked by individual sellers.

Counterfeit scams.#

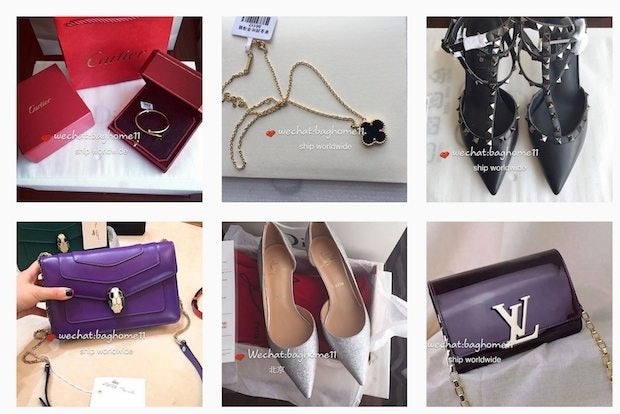

China’s online flood of counterfeits isn’t just going to consumers deliberately on the lookout for fakes. One of the major reasons daigou is incredibly harmful for brands is the fact that sellers are increasingly posting realistic-looking fakes (complete with fake ID cards and receipts), and selling them for the full price. As this practice grows, it can be a disaster for brands that are failing to provide their most enthusiastic customers with a legitimate sale.

Price confusion.#

The availability of a wide variety of prices online for the same item can often be confusing to consumers and cause mistrust in the brand and its value proposition for the price it’s commanding in China.

Rogue store managers.#

Often, store managers abroad will develop relationships with frequent Chinese daigou buyers, communicating with them on WeChat and even helping to ship large quantities of items to China. This results in high sales for the shop (and big commissions), but it’s a sales activity that the boutiques were not originally intended for and that’s happening without the input of the corporate office.

Brand perception.#

All of the aforementioned issues can deteriorate luxury shoppers’ perception of a brand, as they wade through a world of sketchy sellers, see wildly varying prices, and may even have their own in-store shopping experience affected.

As a result, it’s clear that daigou sellers can put a serious dent in the long-term stability of both luxury brands’ image and sales with Chinese consumers. In order to read about each of these issues in more depth, as well as receive key action points for responding to China’s gray market, click here to download our new report.