Key Takeaways#

:

- Singles' Day is a good time to reflect on the key emerging clientele for luxury: the single Chinese women.

- While COVID-19 is inflicting more pain on women in labor market, there is light at the end of the tunnel.

- A combination of societal change and “womenomics” should see female shoppers boosting sales of many consumer subsectors over the next decade.

So this week was 11.11 again. In the West, there was Remembrance Day or Veterans Day, a time to respectfully honor those who served in the military. In mainland China, however, it’s become better known for a different kind of battle, one for consumers’ wallets. Story has it that 11.11 was invented at Nanjing University in 1993 — and dubbed “singles day” as the four 1s represent single individuals — as an opportunity for unmarried individuals to treat themselves to gifts. From there, the idea continued to gain traction, spreading via social media, to become the largest physical retail and online shopping day in the world. And now, as Alibaba and other online platforms continue to shatter previous sale records each year, the shopping festival has moved on from targeting only the single shopper. But for now, at least for the luxury market, the most important shopper is by far the single female consumer.

In most countries, reports and surveys show that women already influence the majority of spending decisions and while the COVID-19 crisis is inflicting more pain on women in the West, leading some in the media to use terrible terms such as “shecession,” I remain very optimistic that over the next decade, the luxury industry will be swept by incremental female spending, most notably coming out of China.

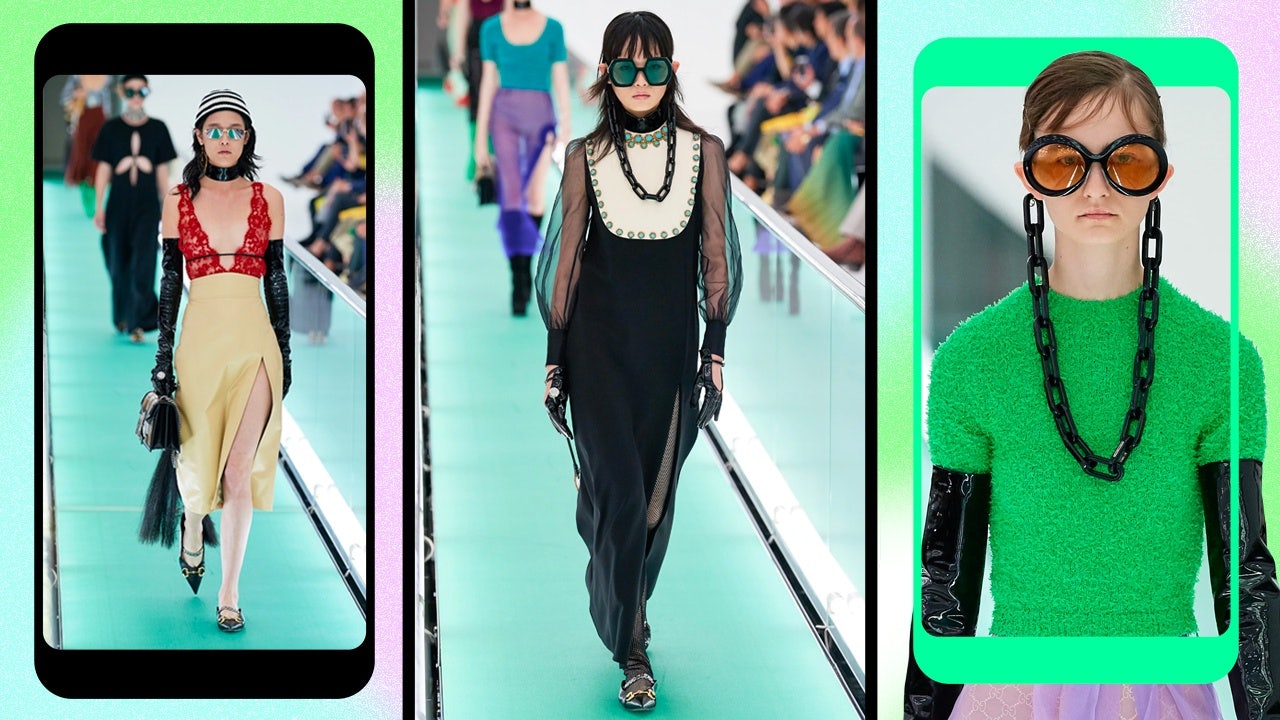

First, female employment rates that were going up pre-COVID-19 should resume their trajectory once the world stabilizes, notably in countries facing demographic headwinds: Japan or Germany today, China starting in the mid-twenties. So-called “womenomics,” a Japanese political experiment should become a global reality. Pre crisis, the gender pay gap had narrowed as well. More importantly, family structures are changing with women getting married later (if at all) and having children later (if at all) and that is freeing up a lot of spending for the core consumer of luxury: the Chinese single lady. Self-purchasing and impulse buying are taking over gifting and purchases by women for themselves is huge. This is visible in the jewelry segment, where the traditional diamond bridal segment is lagging other subsegments. You no longer have to wait on him to get his act together and purchase that 2 carat ring, you can take your destiny into your own hands!

Womenomics will go a long way to correcting economic injustice, but less quantitative factors are also at work. The culture is changing. Whether it is a globally active movement like Me Too or local women’s groups, there is clearly a growing collective conscience that should gradually give women a greater voice in all parts of society and ultimately correct economic injustices. And then there are facts that are just starting to sink in. Women managed countries have more efficiently addressed the COVID-19 crisis and last week’s other glass ceiling smashed: women can reach the highest levels of office, even in the US. As Twitter feeds picked up on this: “Rosa (Parks) sat so Ruby (Bridges) could walk so Kamala (Harris) could run”

A combination of financial means and societal change will lead to female purchases (not just decision making for the household but actual spending) that will move the needle dramatically for many subsectors. Obviously, the female driven sectors: jewelry, cosmetics, handbags. But also ones that have been seen, wrongly, as catering to men. In spirits, the US has seen the emergence of brands by women for women with the help for example of the Women’s Cocktail Collective, with inspirational brands such as gin liqueur Pomp & Whimsy or Oaxaca distilled Yola Mezcal starting to move the needle. Back in China, it’s the young female employees that are moving the needle for the luxury market, usually first-time purchasers looking to fit in socially and professionally. Mao Zedong proclaimed that “women hold up half the sky.” For luxury, it will be a lot more than that.

Erwan Rambourg has been a top-ranked analyst covering the luxury and sporting goods sectors. After eight years as a Marketing Manager in the luxury industry, notably for LVMH and Richemont, he is now a Managing Director and Global Head of Consumer & Retail equity research. He is also the author of Future Luxe: What’s Ahead for the Business of Luxury (2020) and The Bling Dynasty: Why the Reign of Chinese Luxury Shoppers Has Only Just Begun (2014).