Key Takeaways:#

- Beijing’s widening tech crackdown — spanning e-commerce, education, finance, and more — has kept companies on their toes and sparked a $1 trillion stock market selloff in July.

- State media criticisms of China’s red-hot gaming sector represent a source of concern for luxury brands that have been flocking to invest in the space.

- While the official tone on gaming has softened somewhat since, luxury brands must brace for impact if authorities impose stricter regulations on in-game spending, livestreaming, and other activities.

With every fast-rising, lucrative, and youth-driven trend in China, seasoned brands have become accustomed to the risk of government involvement at any time to impose new regulations. The widening tech crackdown that began in late 2020 has seen the seemingly untouchable internet giants Alibaba and Tencent taken down a notch, as authorities aim to quash the anti-competitive practices that created a tech duopoly that potentially threatened Beijing’s power.

For foreign luxury brands, bracing for occasional crackdowns or boycotts is a part of doing business in China, and 2021 has been a particularly tricky year to navigate as the market has taken on even greater importance over the past 18 months. In addition to the ongoing tech crackdown and ever-present possibility of being named and shamed during Consumer Protection Day, brands have had to contend with new challenges such as restrictions on “wealth-flaunting” and the Xinjiang cotton controversy of this past spring, which roped in brands that have long tried to keep politics at arm’s length.

Now, it looks like China’s red-hot gaming industry could be next in the firing line. Last week, shares in Tencent and NetEase slid after the state-run Economic Information Daily, which is affiliated with the official Xinhua news agency, published an article that likened online games to “electronic drugs” and “spiritual opium.” The piece specifically called out Tencent's hit title Honor of Kings (which Burberry had partnered with before Tencent cancelled the deal amid the Xinjiang cotton controversy) as particularly addictive among Chinese youth.

China’s gaming industry has long been subject to strict regulation, with an emphasis on limiting how much (and what) minors can play. Over the past several months market leader Tencent Games has made moves to appease regulators and stave off a stronger crackdown, introducing measures such as the “Midnight Patrol” initiative to stop under-18s from playing into the early morning hours. And while Beijing has softened somewhat in the aftermath of the Economic Information Daily’s article and regulators have yet to move in on gaming as they have on online education, there is ample reason for luxury brands to be concerned about getting caught in the crossfire if Beijing decides to renew its attention to gaming.

Luxury’s current love affair with gaming has been brewing in China for some time. An early highlight was Louis Vuitton’s 2019 partnership with League of Legends, which included in-game skins for players, a real-world capsule collection, and a trophy case for the world championship. Burberry has also invested more heavily in gaming, offering skins, branded games, and most recently partnering with Mythical Games to launch a non-fungible token (NFT) collection for their flagship title, Blankos Block Party.

MAC Cosmetics partnered with Honor of Kings on a series of lipsticks that sold out within 24 hours of their release in early 2019, as did subsequent collaborations on lipsticks and eyeshadows in 2020. Dior and Fendi have worked with local esports players in China to promote capsule collections, and as part of its new “Louis 200” project of digital initiatives, Louis Vuitton launched a WeChat meme package featuring classic design elements for platform users to download.

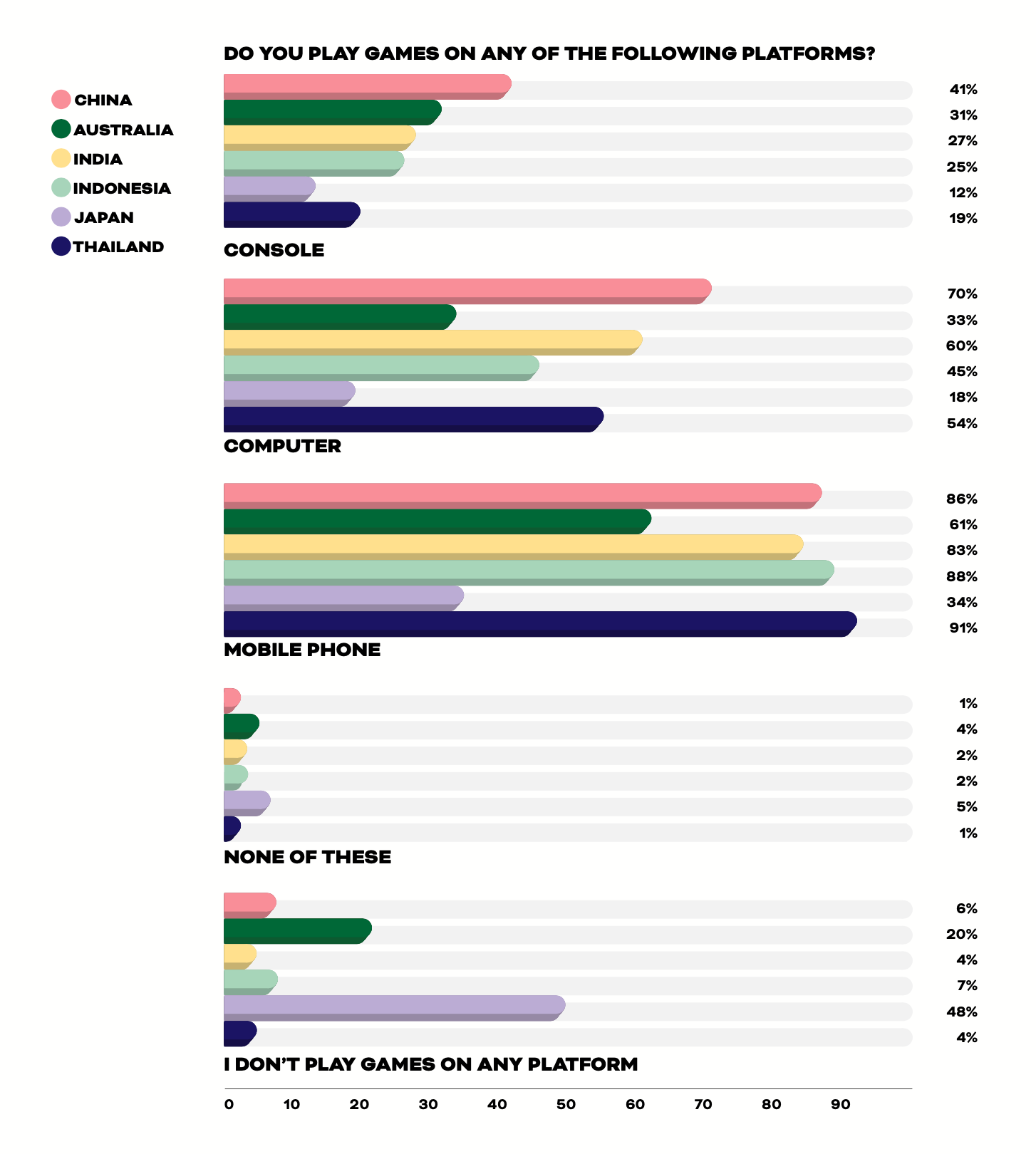

While many luxury brands are implementing broader global strategies to tap the world’s three billion player-strong market (estimated to be worth nearly $176 billion), China is key, both for immediate sales and potential revenue. The number of players in China hit 667 million in the first half of 2021, with revenue of $23.28 billion during that period, up 7.89 percent year-on-year. And by 2025, China’s total gaming market is set to reach $55 billion with 781 million players. That’s a lot of potential customers for limited-edition capsule collections or in-game skins.

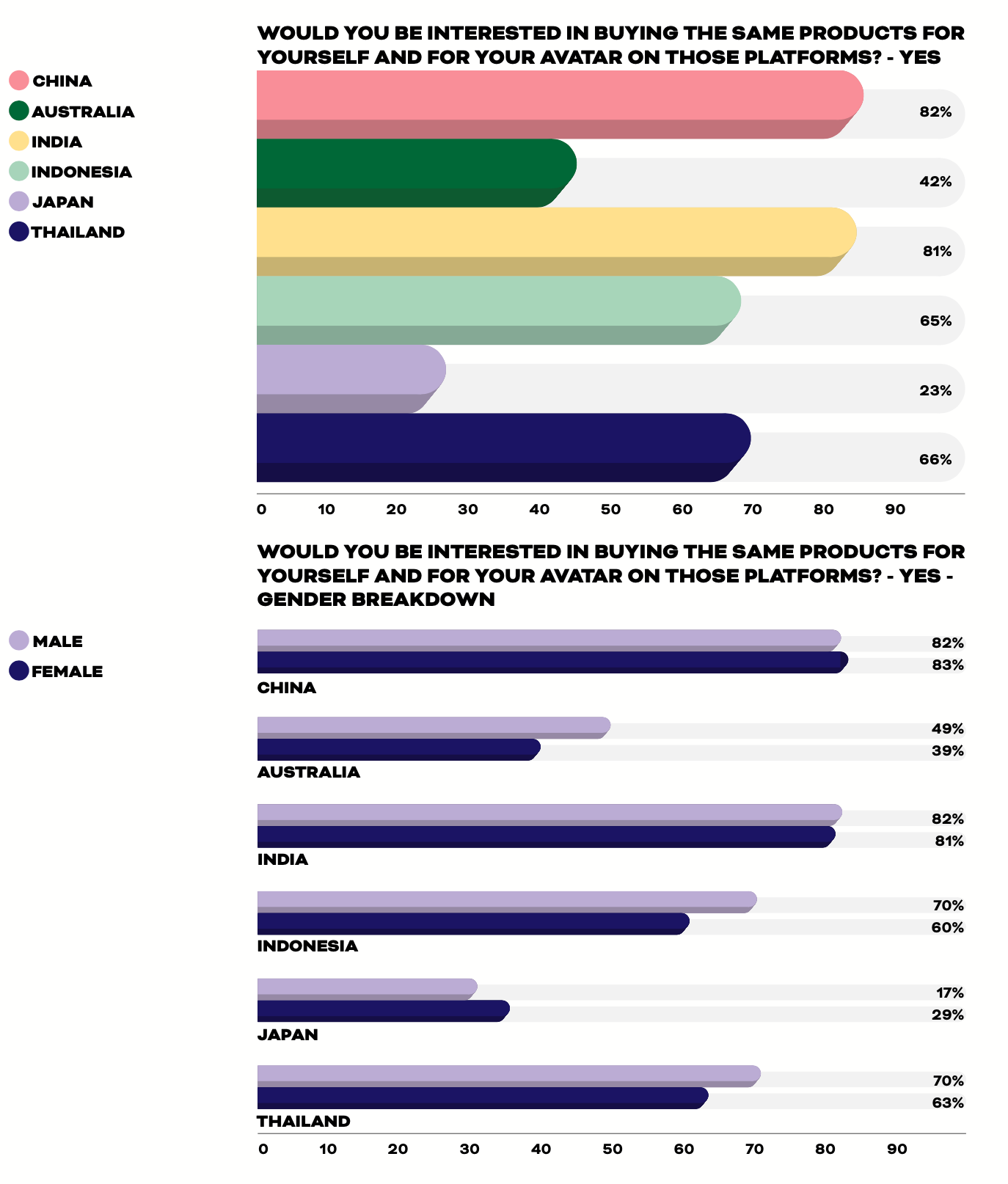

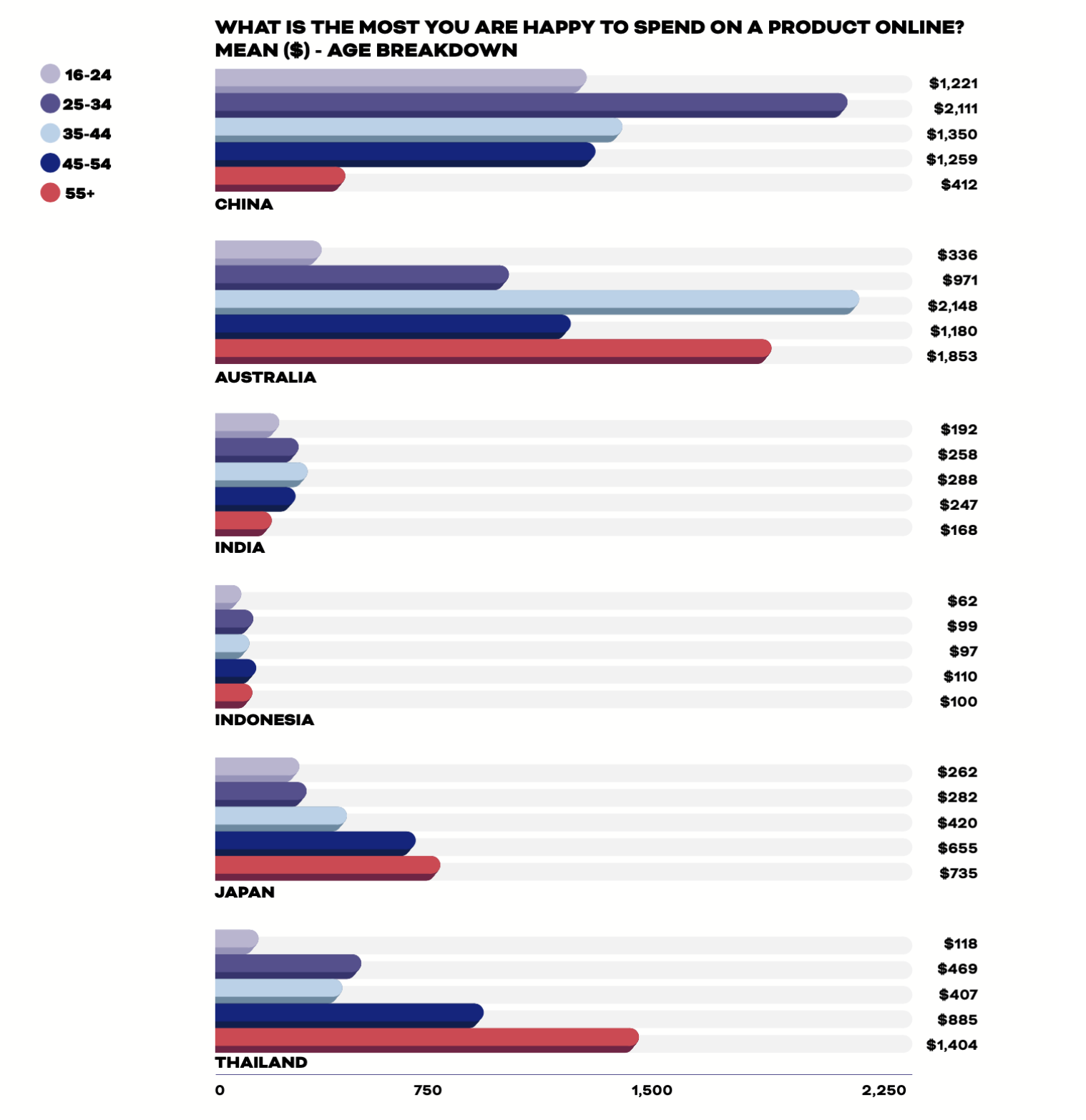

China is the largest gaming market in the world, and its players, which skew young and female, overlap with critical demographics for luxury. As noted in the recent Transcendental Retail: APAC report by Jing Daily and Wunderman Thompson Intelligence, 82 percent of Chinese survey respondents said they are interested in buying matching products for themselves and their avatars on gaming platforms. Young Chinese are also more willing to spend significantly more on online purchases, with consumers in the 25 to 34 age group reporting a mean of $2,111, according to the report, which could translate to more in-game sales.

In the case of a serious gaming crackdown — especially in concert with more restrictions on displays of wealth — luxury brands could see their significant investments in gaming go to waste. As Jing Daily recently noted, while Beijing’s recent salvos probably won’t have much short-term effect on luxury brands, “future regulations could have a larger impact on game spending, livestreaming, and other online user activities, spoiling the fun and another possible revenue stream.”