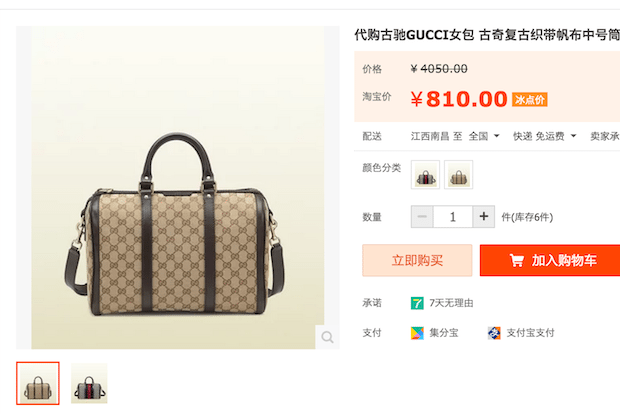

A "Gucci" bag of questionable origin for sale on Taobao.

Although a growing number of luxury brands have officially joined Alibaba-owned Tmall to fight China’s vast gray market, some have a chiller attitude toward the e-commerce giant. This week, one major luxury player, Paris-based Kering, filed a lawsuit against the Chinese e-commerce group, claiming that Alibaba “encourages and profits from” the sale of fakes on its platforms.

In a lawsuit filed last week in New York, Kering—owner of such brands as Yves Saint Laurent, Gucci, and China’s very own Qeelin—alleged that Alibaba is “complicit in the sale of fake handbags, watches and other items on its marketplace sites in a manner that constitutes ‘racketeering.’”

Kering’s lawsuit centers around sales of counterfeit Balenciaga and Bottega Veneta products on Alibaba marketplaces, which Kering says continue to proliferate despite assurances from the Chinese e-commerce giant that it would be more diligent in addressing sales of fakes across its online ecosystem, which encompasses sales platforms like Taobao and Tmall, as well as payment processor Alipay (which has moved to make inroads in the U.S. market over the past year).

These legal moves beg the question whether Kering—always the trendsetter—may just be the first major luxury conglomerate to take measures against Alibaba at a time when the company needs to improve its image worldwide. In the run-up to its historic IPO last year, Alibaba sought to burnish its image and ink deals with high-profile Western brands and retailers, successfully wooing the likes of Burberry, Calvin Klein, and Estée Lauder to start Tmall stores.

Alibaba has frequently made efforts to prove that it's taking serious steps to fight fakes, claiming that it has spent more than $160 million on doing so since 2013. In May 2014, it announced that it had streamlined the process by which it removes counterfeit items, while it has previously announced additions to thousands of staff members it says it has employed to fight fakes. This week, it just announced new QR code technology to fight sales of fake goods on its sites.

It’s been an uphill battle for the e-tailer to turn around its image, however, as fakes can still be readily found on the sites. Kering has had its watchful legal eye on Alibaba for quite some time now—it previously filed a similar lawsuit in July 2014, but managed to reach an agreement with Alibaba that caused it to withdraw its suit in August.

The lawsuit is just one example of how brands are trying to combat the proliferation of fakes in China, which has long been a major headache for the industry. Main Kering competitor LVMH signed an agreement with Alibaba in 2013 stating that the e-tailer would help cut down on fakes, while brands like Burberry that have joined Tmall have been able to leverage their position to request more stringent action on fakes.

If Kering is able to see success with this method, we might see more brands opt to take legal action in the future. This is especially possible given the fact that few brands have taken Burberry’s “if you can’t beat them, join them” approach by officially setting up on Tmall—despite the fact that the number of gray market goods did go down significantly once its account was launched.

Without making concrete progress, Alibaba leaves itself open not only to more lawsuits, but to greater gains by its competitor JD.com—which has been wooing major Western brands and retailers itself recently. Last week, JD scored arguably its biggest “get” of all time, with the news that LVMH-owned Sephora would join the platform,which closely followed a similar deal with Luxottica.

No matter what ultimately happens with the lawsuit in New York, it’s clear that Alibaba needs to redouble its efforts to eradicate fakes, to the extent that it can be done—which is no small task across such a vast e-commerce ecosystem.