This post originally appeared on WALKTHECHAT, our content partner.

Today, we study the top-100 best-selling KOL campaigns on Douyin (Chinese version of Tik Tok) during the last 30 days.

Our goal: helping you understand how to really sell on Douyin.

Note: the period studied ranges from the 17th of June to the 17th of July 2020. The study focuses on top-100 best-selling campaigns. All data comes from Newrank’s Xindou platform.

Campaigns analysis#

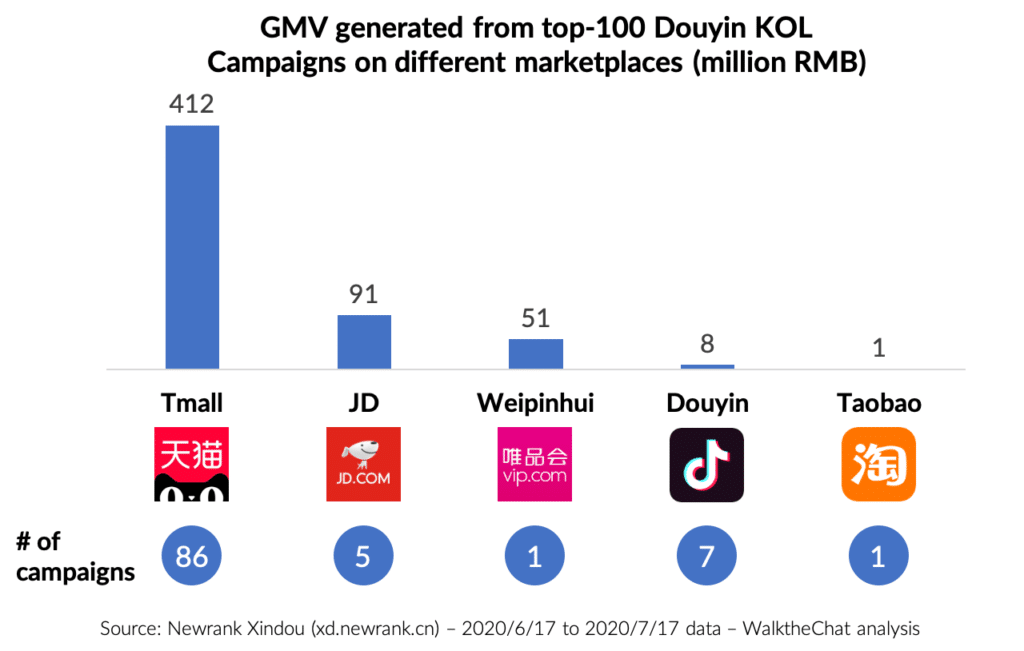

Over 30 days, the 100 best-selling Douyin KOL campaigns generated a combined Gross Merchandise Volume (GMV) of 563 million RMB.

73% of this GMV was generated through sales on the Tmall platform.

Tmall also leads in terms of the number of campaigns directing users to the platform: 86 out of 100 campaigns.

However, this doesn’t mean that Tmall is the “best” platform to promote on Douyin. Large brands with large KOL budgets are more likely to use Tmall as their primary sales channels. They will be eager to drive sales to the platform to improve their reviews and organic rankings on the Tmall ecosystem.

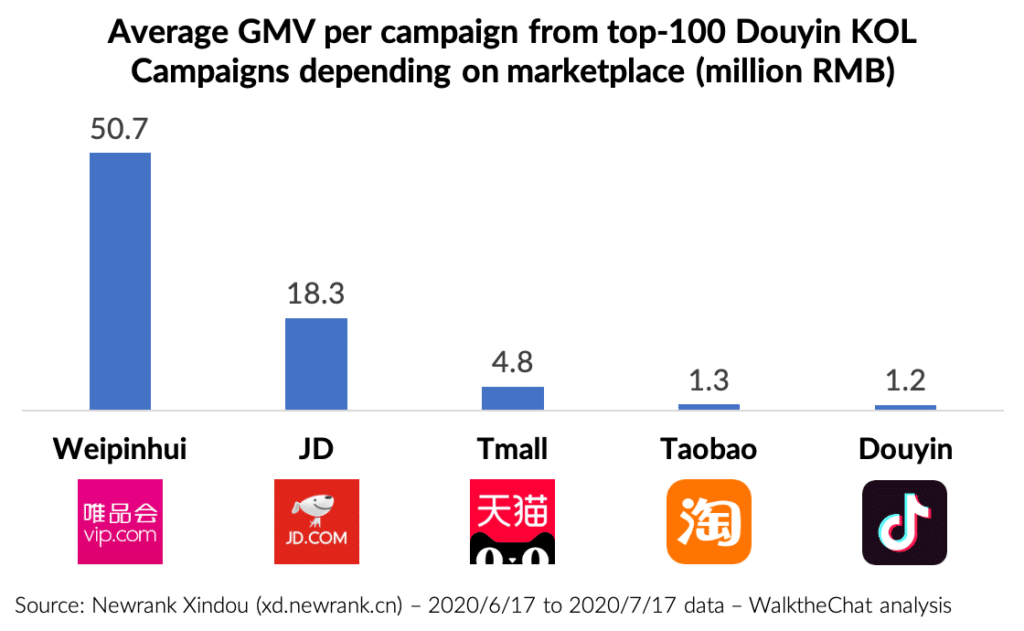

In fact, looking at the GMV per campaign paints a very different picture. Tmall ranks at a late 3rd position and Weipinhui leads the way with campaigns 10 times bigger than the average Tmall Douyin promotion.

JD.com also performs extremely well, with an average GMV per campaign 4 times higher than Tmall.

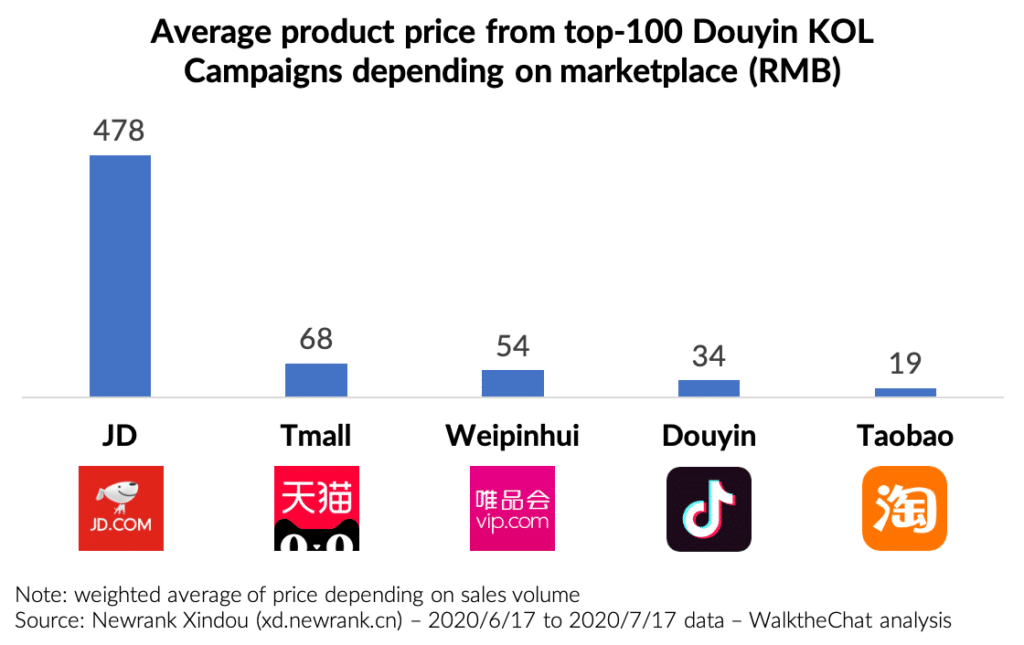

Tmall isn’t the platform with the highest-priced items either. The average product sold on JD on these top-100 campaigns was 478 RMB, against only 68 RMB on average for Tmall campaigns.

Native Douyin and Taobao stores perform poorly on all of the above metrics. Douyin and Taobao stores are usually operated by individuals and smaller companies. They don’t have the marketing budgets of companies operating Tmall or JD.com stores.

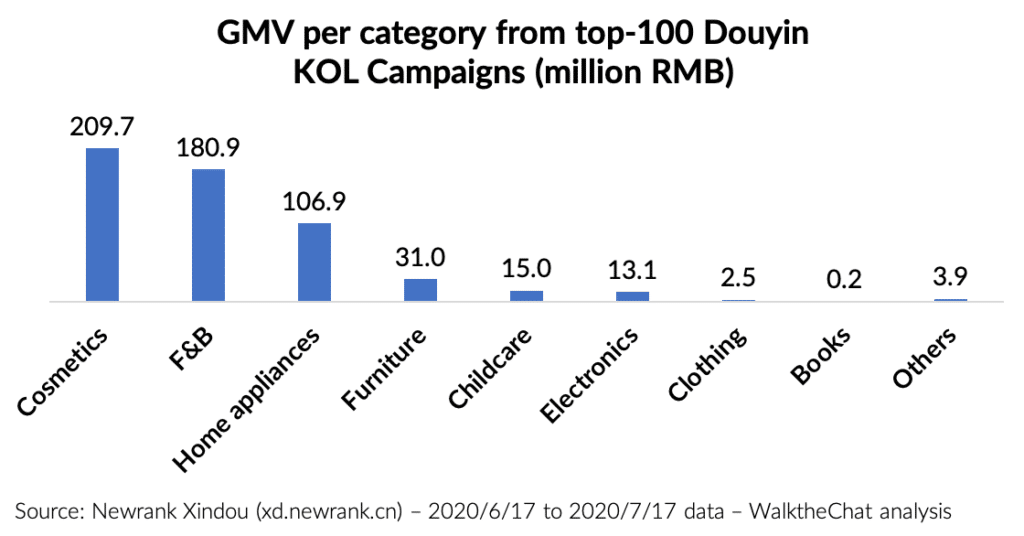

In terms of categories, Cosmetics and F&B dominate the best-performing KOL campaigns. Although many small KOL campaigns sell clothing through their account, this category is barely represented among top-selling campaigns (only 0.4% of total GMV)

Is Douyin moving upmarket?#

Looking at these campaigns, it is striking that Douyin campaigns are moving toward some more expensive items.

Some of these pricier products include consumer electronics or home appliances, priced above the typical 0-300 RMB range of Douyin products.

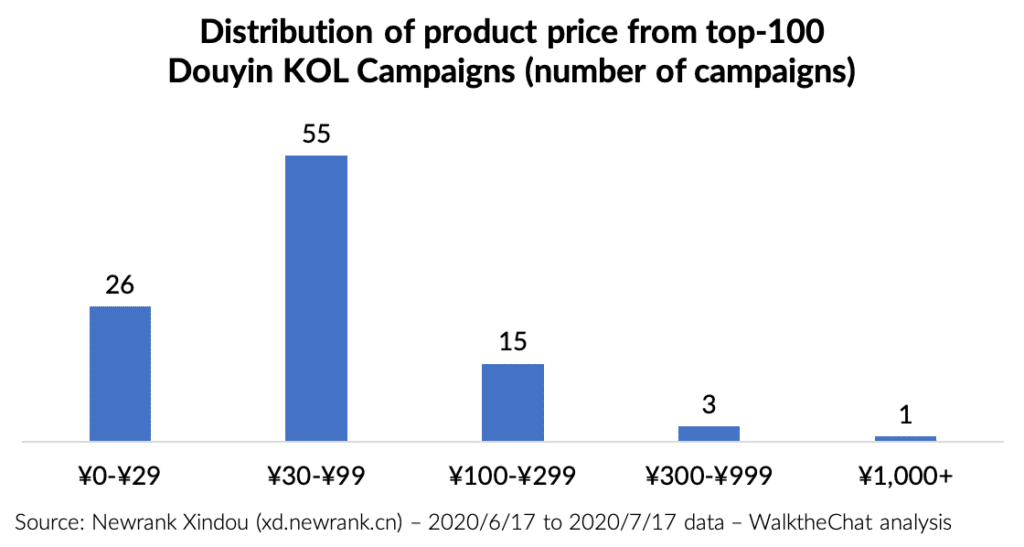

However, this move toward more expensive products is still at an early stage. In fact, only 4 of the top 100 Douyin campaigns studied promoted products above 300 RMB. 81 of them promoted products cheaper than 100 RMB.

Conclusion#

The analysis of best-performing Douyin campaigns provides interesting insights into Douyin marketing:

- Douyin is still focused on the sales on cheap items (below 300 RMB and even 100 RMB)

- However, some successful campaigns for more expensive products (above 300 RMB and even 1,000 RMB) are starting to emerge. These campaigns are more likely to drive traffic to premium platforms such as JD.com

- Platforms such as JD.com and Weipinhui lead to better performance than Tmall campaigns on average

- Taobao and Douyin Native platforms performed worst, most likely because they are operated by smaller brands or individuals

- Cosmetics & F&B were the best-performing categories, while fashion represented only 0.4% of total GMV of the campaigns we studied

In conclusion, careful experimentation for the promotion of products in the 300-2,000 RMB range is becoming an option on Douyin. Brands with Tmall, JD.com or Weipinhui stores, and operating in the beauty or F&B sector, are most likely to encounter success with this approach.